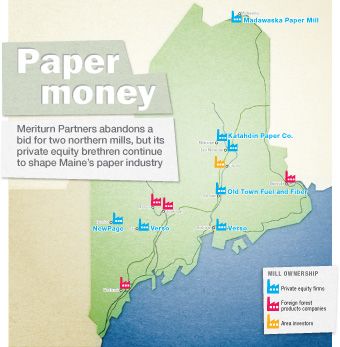

Paper money | Private equity firms own six of Maine's major paper mills, for better or for worse

The recently abandoned sale of two northern Maine paper mills to a California private equity firm brought the state’s paper industry to the brink a defining moment. Had the sale of Brookfield Asset Management’s Millinocket and East Millinocket paper mills to Meriturn Partners materialized, Maine would have marked a thoroughly modern development in the ownership of one of its most traditional industries.

Private equity firms began eyeing the state’s struggling mills in the late 1990s, but the Katahdin sale would have been the first time a mill passed from the hands of one private equity firm to those of another. On both sides of last month’s ultimately failed transaction, the parties lacked a primary interest in the forest products industry. Maine pulp and paper companies have operated under a kaleidoscope of ownership structures in previous years, with fluctuating industrial interests yielding to various types of financial investors, but prior owners could claim a chief stake in timber and pulp and paper interests. The four private equity firms that now possess six of Maine’s 10 major paper mills, however, can’t make that claim.

“Overall it’s been positive,” says John Williams, president of the Maine Pulp and Paper Association, of private equity investment in Maine’s mills. “Companies have backed the facilities and in many cases put money into them, and that’s been the key to keeping them competitive.”

Up north, Brookfield and the towns are now in talks with another, undisclosed potential suitor for the shuttered Katahdin Paper Co. mills, but a new deal is hardly imminent. Toronto-based Brookfield, which bought the mills in 2003 for $103 million, has given the state until July 31 to find a buyer for the mills before it dismantles them, following Meriturn’s failed bid for $48 million in property tax breaks. Meanwhile, 450 jobs hang in the balance at the East Millinocket mill, idled since April 1, while the Millinocket mill stretches into its third year of closure.

Duane Lugdon, a United Steelworkers Union representative, has mixed opinions about the private equity firms overseeing the state’s mills. “Some of them couldn’t care less about their employees or the surrounding communities, like we see with Brookfield,” he says. A minority, including Patriarch Partners, owner of Old Town Fuel & Fiber, have demonstrated a commitment to industrial manufacturing and to Maine’s people, he says. But “the majority of private equity firms are speculators,” Lugdon says. “Speculators obviously look to buy low and sell high.”

Still, hope remains that a deal will be reached to save northern Maine’s paper-making heritage. On its website, East Millinocket proudly proclaims itself, “The town that paper made.”

Rescues and returns

Private equity firms have risen to greater prominence in recent years, snatching up such iconic brands as Burger King, Hertz and Linens N’ Things. They’ve also developed a reputation, some say unwarranted, for swooping in and buying distressed companies, laying people off, burdening the companies with debt and then selling them after extracting maximum profits and doing little to improve operations.

Private equity interest in Maine’s paper assets emerged in the late 1990s, after smaller, “boutique” paper companies acquired mills from their larger counterparts on the cheap, says Jacquelyn McNutt, president of business consulting firm Degrees of Excellence and former executive director of The Center for Paper Business and Industry Studies in Atlanta. But high workers’ compensation rates and burdensome state taxes on capital investments, along with a reeling paper market, maxed out their balance sheets and led those smaller companies to consider shutting the mills down, she says.

“Private equity rode into this morass and started funding steps to invest,” says McNutt, a former executive with Great Northern Nekoosa, onetime owner of the East Millinocket and Millinocket mills. Public corporations were stymied by their shareholders — institutional investors in particular — that were primarily concerned about short-term returns, she says. “[Private equity] took these assets off the public stock-trading goals,” McNutt says. “They allowed the management team to get a better grip on what investments were required.”

Private equity firms made no bones about their plans to improve the mills’ operations and then flip them, or their aversion to the historic costs associated with mill unions. “Although the private equity end game is detrimental to a really healthy long-term business platform in Maine… if it hadn’t been for the private equity moves at the time they made them in Maine, the whole system would have collapsed like a deck of cards,” McNutt says.

The firms will have to earn healthy returns to stay solvent in such a highly leveraged environment, says Lloyd Irland, a forestry consultant who once served as director of the Bureau of Parks and Lands and as state economist. “I would put private equity in the positive column, from what I know,” he says, adding that the investments have kept some mills from sliding into obsolescence. “If the markets get worse, when will the patience of these private equity firms run out?”

Firms looking to unload their Maine paper holdings will find few paper companies willing to take on such high-cost assets in a tight credit market, McNutt says. “The companies that got rid of them want them back like they want a triple enema,” she says. Public companies looking to integrate mill assets with new product lines, such as biofuels, might represent the next wave of buyers, McNutt predicts.

Disciplined effects

The nature of the potential new suitor for the Katahdin mills remains a mystery, though Ludgon says it’s not another private equity firm. “We’re convinced we can do it in Millinocket and East Millinocket,” he says. “We just need a partner who’s willing to do the right things.”

Jeff Dunton, president and CEO of Twin Rivers Paper, which operates the East Millinocket mill, and a former executive at Fraser Papers and MeadWestvaco, says private equity investment has been positive for Maine’s mills. Brookfield Asset Management holds a 51% interest in Twin Rivers. “I think private equity has brought a level of financial discipline to the mills the paper companies never had,” he says.

Private equity firms may crack the whip financially, but it comes at a local expense, according to Lugdon. “The discipline they invoke is through taking away wages or benefits, that’s how they reduce costs,” he says, rather than through technological advances. “They look for tax deals from the communities that are untenable; they hold them over a barrel.”

Brookfield responded to a request for comment on its ownership of the mills in the form of several PowerPoint slides. The company cites annual payroll of $11 million, which generates approximately $30 million in economic benefit; $35 million in annual purchases of goods and services from the region (excluding power and oil); and annual municipal taxes of $4.5 million (partly offset by state programs). The slides also reference Katahdin’s development of new paper grades to offset erosion in demand for directory paper, and Brookfield’s commitment to honor an agreement to provide power to the mills even if the paper business is sold.

Cerberus Capital Management of New York, which acquired the Rumford mill in 2005 through a $2.3 billion buyout of MeadWestvaco, does little to combat private equity’s opportunistic reputation, at least in the choice of its moniker. Named for the three-headed mythical dog that guarded the gates of Hades, Cerberus has failed to invest in the NewPage mill, blaming its poor performance on market influences, Lugdon says.

NewPage announced in March it would sell the Rumford cogeneration energy assets for $61 million to ReEnergy Holdings, which will operate the facility to provide electricity and thermal energy to the mill, while the mill’s pulp and papermaking process will supply ReEnergy with biomass fuel.

NewPage is scrambling to restructure its rising debt, as distressed investors angle for equity grabs, according to BusinessWeek. Among those investors is another mythically named private equity firm, Apollo Global Management of New York, a major holder of NewPage’s $800 million in second-lien bonds.

Apollo also has a presence in Maine, but the firm seems to have earned a more positive reputation in the industry. It took ownership of the mills in Jay and Bucksport upon acquiring International Paper’s coated paper division in 2006 for $1.37 billion, renaming it Verso. At the time, no one knew what to expect of newcomer Apollo, says Bill Cohen, Verso’s spokesman. “We just didn’t know what it was like,” he says. “Everyone’s first natural reaction is, ‘Oh my god, they’re going to tear us apart.’”

But the company has brought innovation and financial restraint to the mills, Cohen says. Verso has since gone public and is now embarking on a $40 million project to upgrade the Bucksport mill’s biomass boiler and install a new steam turbine. Construction began last winter, and will resume in June, with plans to complete the project by the end of the year. “They’ve allowed us to make this investment,” Cohen says of Apollo. “At the same time, the expectation for performance is there.”

The expectation used to be not if the paper machines would cease operating, but when, he says. “When an asset ran its life, it got shut down,” Cohen says. Then the mill’s leadership began to ask, “Why don’t we figure out what else we can do with these machines that can be profitable?” Cohen says. “Would that have happened in the old days? Probably not.”

Apollo kept the mills’ management team intact. Across-the-board gutting of existing management hasn’t occurred in Maine, says Williams of the Pulp and Paper Association. “They are firms that aren’t paper companies, so they need the expertise that’s already established,” he says. At Lincoln Paper and Tissue, the management has welcomed a minority private equity investment.

Private equity seems to have made its most glowing impression in Old Town, however. The former Georgia-Pacific mill there closed in 2006, putting 450 people out of work. Today, it operates as Old Town Fuel & Fiber, employing about 200 under the ownership of glamorous billionaire Lynn Tilton of Patriarch Partners.

Tilton has developed a reputation in Maine for working with unions and bringing innovation to the mill, which still produces pulp but has retooled toward converting wood waste into renewable biofuels. Patriarch plans to invest $76 million into the mill this year. Old Town City Manager Peggy Daigle says Tilton’s actions “indicate a longevity and a desire to be here.”

As long as a mill owner treats the employees well, pays its taxes and operates according to its permits, “Do I care who the investors are?” Daigle says. “I’m not sure I do.”

This story has been updated to correct Jacquelyn McNutt's title.

Jackie Farwell, Mainebiz senior writer, can be reached at jfarwell@mainebiz.biz.

Read more

Madison paper mill value plunges by $150M

Old Town mill suspends operations 'indefinitely,' lays off 180

Ex-investor of Old Town mill found guilty of embezzlement

Quebec firm buys northern lumber mill

Comments