Maine's real estate markets continue a measured march (WITH VIDEO)

The assembly of real estate professionals at the 2012 Maine Real Estate and Development Association forecasting conference offered a constellation of bright spots of activity against a drab background of stagnation.

Most of the state will continue to see flat or marginal growth in industrial, residential, retail, hospitality and commercial sectors as Maine's economy struggles to provide jobs and incomes to spur investment and sales. Portland's residential sector continues to hold its own as sales volume and prices hold steady, while much of the rest of the state sees a decline in home prices. Single-family home sales in Maine rose nearly 7% in the fall of 2011 compared to the same period in 2010. But the median price slipped 3% to $165,000.

Other bright spots include downtown Bangor, where retail vacancy rates dropped from 14.5% in 2009 to 9.4% last year. A $130 million investment in Hollywood Slots and $65 million in a new auditorium and conference center this year are expected to sustain that momentum. Likewise, downtown Lewiston-Auburn is experiencing a renaissance, although a resolution of the Bates Mill No. 5 building continues to elude Lewiston planners.

Around the state, industrial sector vacancies compare more favorably with regional and national statistics, especially in Portland, where industrial vacancies are 7.3% compared with Boston's 14.5% and the national average of 13.5%. Although money is available and interest rates are low, high down payments and a general lack of confidence are thwarting investment. In Augusta, soft demand for office space is expected to boost inventory increases amid the consolidation of state agencies.

Here are summaries of interesting commercial activity in three sectors:

Hospitality sector

Maine hoteliers ought to look at their room rates as a mechanism for increasing revenues in 2012, as occupancy rates are expected to remain flat.

That was some of the counsel from Daren Hebold, a commercial broker with Daigle Commercial Group in Portland, who presented at the MEREDA conference on the hospitality sector. Hebold said occupancy rates are expected to remain unchanged in 2012, hovering around 58%, as they did in 2011 and 2010. But both the average daily room rate and the revenue generated per available room should bump up $3 over the course of the year. Hoteliers should see an average room price of about $100 per night and captured revenue of about $58 per available room.

"The average daily rate is the best in recent history and is outpacing the nation in hotel rate growth," he said.

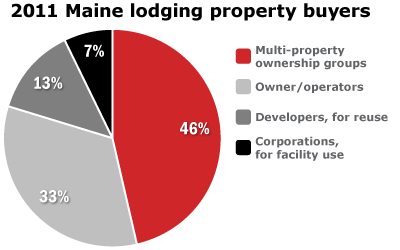

Property sales have been very uneven, he said, noting a scarcity of quality properties on the market that will likely fuel more off-market transactions in 2012. The makeup of those hotel buyers also continues to change, with multi-property owners dominating the field while owner/operator buyers drop to second place. Properties bought for redevelopment and as corporate facilities made up 20% of hotel sales last year. Among them were the $1.3 million sale of Jeremiah's Cottages in Old Orchard Beach, which was razed for new development, and the short sale of Point Lookout in Northport, which was developed in the late 1990s for about $50 million as a corporate retreat for MBNA and sold for $7.8 million to athenahealth for use as a corporate retreat with some public function space.

Hebold said savvy hotel owners will pay close attention to their Internet presence as more than 75% of reservations are made online now and websites are critical in attracting and retaining guests. They also need to have well-maintained properties and well-trained staff, and be plugged into global reservation systems such as Expedia and Orbitz.

The "remarkably slim" number of hotel rooms expected to be built this year — 230 — will do little to affect Maine's supply of 35,000 available rooms.

"That's probably healthy for the sector," said Hebold, noting less new competition might allow for hoteliers to raise room rates to drive revenues.

Carol Coultas

Greater Portland retail sector

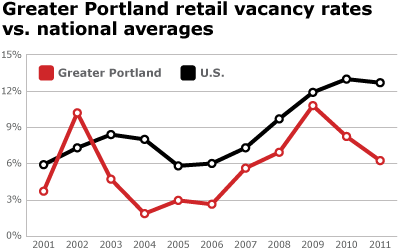

Retail vacancy rates in Greater Portland for 2011 continued to drop from the 10-year high of 2009, putting the region at about half of the national average, and could bring renewed retail growth this year, especially in terms of low- and high-end stores.

Greater Portland's retail vacancy rate in 2011 was 6.24%, down from 8.34% in 2010 and 10.8% in 2009. Windham ended 2011 with the lowest vacancy rate in Southern Maine, at 3.7%. Development was spurred by the opening of Goodwill and Tractor Supply stores said presenter Karen Rich, vice president of Cardente Real Estate, who noted one other multi-tenant development is in the works for the coming year.

"The worst is behind us," she said.

Last year saw the closure of two major area retailers, Borders and Lowe's, and "very little" activity in retail construction. Rich predicted more big-box closings, while some stalled development projects should get under way.

Rich said vacancy rates should continue to drop as inventory is absorbed and lease rates — which dropped from $14.40 per square foot to $13.30 in 2011 — hold steady.

New franchises made their way into Greater Portland last year with the openings of Books-A-Million, Buffalo Wild Wings, Elevation Burger, Five Guys, Urban Outfitters, J.Jill, Avenda and White House | Black Market.

"I think this information is really positive," said Rich. "When you look at the fact that Maine is kind of the end of the road, a lot of times we are the last people to get some of the new franchises."

Overall, Maine is experiencing "hour glass" retail activity where high- and low-priced retailers prosper and middle-tier retailers stall, said Rich. Retailers like Renys, Mardens, dollar stores and thrift/secondhand stores are doing particularly well.

"Middle-priced retailers are being edged out," Rich said.

Three new Family Dollar stores opened in 2011, and Rich says at least three more are planned for 2012, as are at least three new Dollar Tree stores. On the high-end retail side, Starbucks is planning to open three or four stores this year.

Rich said the Old Port, as well as Brunswick's downtown, continue to be strong.

"There is nothing but positive news in the Old Port," said Rich.

Randy Billings

Greater Portland office market

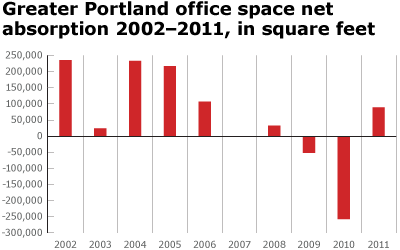

After a rough two years, 2011 showed some improvement in Portland's office market. Overall vacancy rates ticked up only 0.27%, coming in just under 13% — a welcome development after vacancy rates jumped more than 2% from 2009 to 2010. Total downtown vacancies rose a little more than 1%, to 16.5%, with the biggest change in Class A space — where vacancies jumped from 11.4% in 2010 to 15.2% in 2011. Significant properties remain vacant, such as 75,000 square feet at One Monument Square and 82,000 square feet at 390 Congress St.

But net absorption, the amount of occupied space at the end of the year, was positive for the first time since 2008, up nearly 90,000 square feet. 2011 also brought the highest lease transaction volume since 2006. The available office space in the region grew 10%, topping 10 million square feet for the first time.

Greater Portland's vacancy rates continue to trend well below those of other New England areas such as Boston and Hartford, where vacancy rates in 2011 were 18% and 20%, respectively. And Portland's highest Class-A lease rate, $25 a square foot, still compares favorably to Boston's rate of $43 a square foot, though Boston's rates have slid from $65 a square foot in 2008.

Despite the generally positive news, vacancies rates remain higher than historic averages, said Jim Harnden, a partner and broker at Malone Commercial Brokers. That means it will continue to be a tenants' market for office space in 2012, especially for larger tenants willing to make long-term commitments. "They'll get really attractive proposals from landlords," he said.

He expects the vacancy rate to remain flat or even decrease slightly in 2012. And despite lenders' relaxation of criteria and willing buyers, property sales will also remain flat because of a "buyer-seller disconnect" stemming from owners who are unwilling to sell their properties for the market's going rate, he said.

A few major developments could gain traction in 2012, including the $100 million Forefront at Thompson's Point and Federated Cos. mixed-use development in the Bayside neighborhood.

All in all, activity in 2012 "won't be going gangbusters, but it will continue the positive trend," Harnden said.

Mindy Woerter

DOWNLOAD PDFs

2012 forecast for Maine's hospitality sector

Comments