Venture-backed biotech companies race to public markets

Photo / Tim Greenway

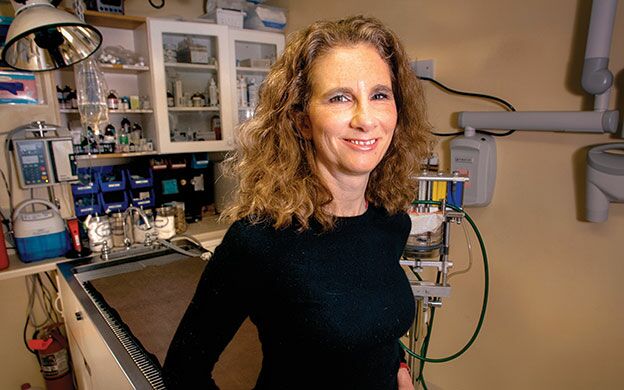

Jean Hoffman, founder and former CEO of Putney Inc., which was bought by Dechra Holdings US Inc. for $200 million.

Photo / Tim Greenway

Jean Hoffman, founder and former CEO of Putney Inc., which was bought by Dechra Holdings US Inc. for $200 million.

Biotechnology companies backed by venture capitalists continued to outpace the technology sector in both initial public offerings and mergers and acquisitions in the second quarter of this year.

In the quarter there were 12 venture-backed IPOs that raised $893.9 million, up 56% in dollars and up 100% in number of offerings versus the first quarter, according to a report Tuesday from the National Venture Capital Association and Thomson Reuters. Nine of the IPOs were life sciences companies, while only three were technology IPOs that raised a total of $360 million in the second quarter.

Four of the IPOs were companies based in Massachusetts, while four of the six M&A deals in New England also were in that state, with one in Connecticut.

There also were 61 M&A deals, 11 of which had an aggregate value of $9 billion. That’s a 29% decline compared to the number of deals in the first quarter, but an increase of 74% by disclosed M&A value.

One large M&A deal, Putney Inc., was in Maine, Ben Veghte, vice president at the NVCA, wrote Mainebiz in an email.

Veterinary company Putney was bought by Dechra Holdings US Inc., an Overland Park, Kan., subsidiary of UK-based Dechra Pharmaceuticals PLC, for $200 million. Veghte noted that it took 4.6 years for the Putney M&A exit, which was completed on April 22 of this year.

The company’s funding to date is $36.78 million. It sold at a multiple of 5.44.

“Biotech IPO activity continues to be the bright spot to an otherwise sleepy IPO market for venture-backed companies, Bobby Franklin, president and CEO of the NVCA, said in a statement.

He added that the first half of 2016 is well behind the pace of IPOs at the same time the prior two years. If more private capital continues to flow into later stage companies, he contended, it’s likely that the IPO slumber will continue through the rest of this year.

There currently are 41 venture-backed companies registered for an IPO with the U.S. Securities and Exchange Commission, according to the NVCA. That doesn’t include confidential registrations filed under the JOBS Act, where many experts believe most venture-backed companies now file.

Read more

Women to Watch, Class of 2009: Where are they now?

Putney sold for $200M to UK veterinary company; founder to leave

Jobs reportedly cut as Putney deal closes

Following sale, Putney founder gifts nearly $1M to employees

Comments