Bankruptcy filings at post-recession low, but trouble's seen on the horizon

This year is shaping up to have the lowest number of bankruptcies since before the recession.

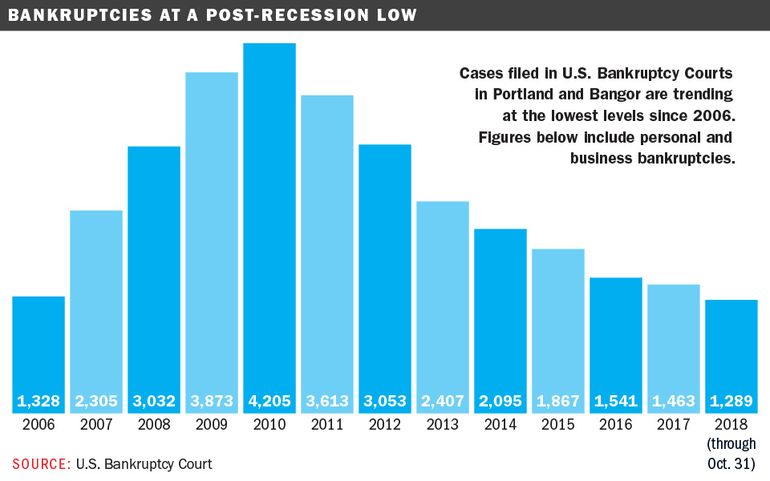

Through Oct. 31, there were 1,289 bankruptcy filings in the U.S. Bankruptcy Court in Portland and Bangor. The figure includes bankruptcies of all kinds, personal and business, Chapter 11 (reorganization) and Chapter 7 (liquidation), and so on.

At this pace, the year could continue a two-year trend of the lowest number of cases filed since 2006, when there were 1,328. Bankruptcy filings peaked in 2010, with 4,205.

By all indications, the low number of bankruptcies is a good sign for the economy, right?

Not so fast, says Edward Altman, who in 1968 developed the Z-score method for predicting bankruptcies. Quoted recently in Bloomberg, Altman said the next recession could be characterized by many more bankruptcies and defaults than previous downturns.

He turns particular attention to business bankruptcies. “Over the last 50 years, it's clear that the average company in the world is more leveraged using more debt than ever before. There was no leveraged-loan or junk-bond markets 50 years ago. Now, these are big dynamic markets available to many firms. They take advantage of it. Interest rates in the last 10 years have been low and firms have been overjoyed to leverage their balance sheet to try to earn returns greater than the cost of capital. And the cost of capital, with the lower costs of interest rates, has come down,” Altman tells Catherine Doherty of Bloomberg. “When we have the next downturn, I think the consequences of these huge increases of debt will be quite dramatic. There will be much more bankruptcies and defaults, and larger than ever before.”

Andrew Helman, a bankruptcy attorney at Murray Plumb & Murray in Portland, told Mainebiz the “canary in the coal mine” could be rural health care. He cites a recent report showing there have been more than 20 hospital bankruptcies since 2016, and about three-quarters of the distressed hospitals operated in rural areas. The findings were released in October in the Polsinelli-TrBK Distress Indices Report.

Of the hospital bankruptcies, “75% are in rural areas where reimbursement rates are falling and the uninsured population is growing,” the Polsinelli report says.

“Folks in my space see recession on the horizon. There are especially troubling trends in rural health care,” Helman said. “I think Maine is like a canary in the coal mine, or perhaps part of the flock of canaries.”

Comments