Landlords can expect better negotiating positions in 2012

Souce: NAI The Dunham Group

Souce: NAI The Dunham Group

I am an admitted real estate nerd. I like talking about it. I like reading about it. And, obviously, I like writing about it. So it should come as no surprise that one of the highlights of my year is the annual Maine Real Estate & Development Association forecast conference where I presented on the industrial market. Here is a summary of what I think about the industrial market today, and what we can expect in 2012.

You have heard the saying, "you can't look forward without looking back." Well, I strongly believe that history is a great prognostication tool for commercial real estate. Analyzing things like vacancy rates and asking lease rates in particular areas and sectors can highlight trends and opportunities. Unfortunately, there was not a lot of data available for the industrial market. Area professionals had always relied on anecdotal evidence and our gut feel for the market.

I felt it necessary to create a Greater Portland Industrial Market Survey, a database that's a true inventory of every industrial building in Greater Portland. With this information, we would have quantifiable evidence of what the market trends looked like and which areas were stronger than others. This data is not only marketable information for town officials, property owners, brokers, etc., but it can also serve as an opportunity indicator for developers.

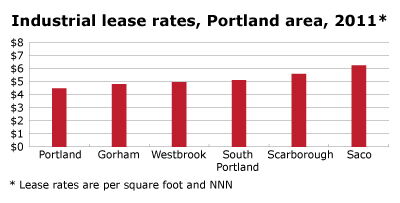

The study is inclusive and encompasses the entire market. I defined the Greater Portland industrial market as Portland, South Portland, Westbrook, Gorham, Scarborough and Saco. We inventoried 466 buildings totaling 14,511,385 square feet of industrial space. We then tracked each vacancy on the open market today and cataloged each asking lease rate for those vacancies. The total vacancy in Greater Portland was 1,058,197 square feet, which is equal to a 7.29% overall vacancy rate.

As we broke down the data further, it was fascinating to see how specific areas compared against others. Of the six towns we studied, Saco was by far the strongest with an overall vacancy rate of only 2.5%. Its industrial park just off of I-95 at exit 36 is particularly vibrant. It is largely made up of owner/users, so those buildings are 100% occupied. As for the investment properties, it seems over the last three or four years, landlords have been aggressive on their pricing to compete favorably with competition to the north. Tellingly, Saco will be home to the only speculative building project in the entire market in 2012. Jim McCarthy, a local developer, is building a 14,000 square foot warehouse on Wiley Road scheduled to be complete by late summer.

Elsewhere, Gorham and South Portland had the highest vacancy rates, each over 9%. It should be noted, however, when compared to New England and the nation, our market was extremely competitive. Greater Boston faces industrial vacancy rates of over 14% and the nation's average is 13.5%.

By studying the vacancy rates in more detail and looking at asking lease rates, we were able to identify several important trends. First and foremost, the old real estate saying "location, location, location" once again holds true. Parks that were geographically close to I-95 like Five-Star Industrial Park, Riverside Industrial Park and Evergreen Industrial park performed well. Each had overall vacancies of less than 3%. Pricing, as a result, directly correlated and those parks with lower vacancy rates asked the highest average dollar per square foot for their availabilities.

This data suggests that landlords in particular areas are actually regaining leverage over tenants. For over five years, we've all heard that this is a "great tenant's market." Well, in certain parks and locations, that is simply no longer the case. Of course, there are other areas where supply remains high. Along Presumpscot Street and Warren Avenue in Portland, vacancy rates were roughly 20%. And some parks like Rummery Park in South Portland and the Gorham Industrial Park were over 10%. In those cases, landlords are wise to note where their competition's pricing is at, be competitive and continue to aggressively court tenants.

Manufacturing indices continue to rise to levels not seen in years. As a result, I expect our vacancy rates to plateau in 2012. Correspondingly, asking lease rates will level and, in certain areas, tick up for the first time in years. This data is quantifiable and can be utilized by property owners, developers and tenants as it pertains to their particular businesses and property holdings. Real estate nerds rejoice.

Comments