Aviation companies prepare for takeoff as new trade group forms

Kevin Dauphinee didn't over-reach when he founded his company, Black Bear Aviation, in central Maine in 2011. He set up shop at the Dexter Regional Airport, where, he says, his leasing costs were low enough that he could charge aircraft maintenance and restoration rates that were 25% to 35% lower than competitors. He took on jobs ranging from aircraft engine overhauls to pre-purchase inspections. He let customers know he'd travel to them if they couldn't make it to Dexter.

His strategy of starting small and paying attention to customer service has paid off for Dauphinee. This spring the three-employee company is completing a move to a larger airport after signing a five-year lease with Waterville's city-owned Robert LaFleur Airport.

“We'd gone from one hangar to two hangars and then to three hangars,” he says regarding the decision to move. “We were running out of room.”

Black Bear Aviation's story mirrors upward trends reported by much larger aviation companies in Maine. They are all riding an increasing demand for aviation services, which a national report forecasts will see the aviation maintenance industry grow globally to $86.8 billion from its current $57.7 billion. Here in Maine, the 2014 market economic assessment released in mid-March by the Aeronautical Repair Station Association and TeamSAi Consulting puts total employment for Maine's aviation maintenance industry at 1,052 workers, with an economic impact of $124.7 million. Both figures reflect an upward trend from ARSA's 2009 report, which tallied 984 aviation maintenance workers in Maine and an impact of roughly $120 million.

Among recent developments within Maine's aviation sector:

- C&L Aerospace in Bangor announced in late March it was partnering with a Swedish company to buy 14 Saab 340B airplanes that will be refurbished in Bangor before being resold. The planes in that $10 million deal will be among the first to be painted at a new C&L facility that is part of the company's $5 million expansion at the Bangor International Airport.

- Tempus Jets, a $141 million company with more than 15 offices worldwide, is expanding into Brunswick Landing. Its move into Hangar 6 last September brought 18 full-time jobs paying an average $65,000 yearly salary to the former Navy base, but the company anticipates that number could eventually jump 10-fold if its long-term growth continues at the current pace.

- The Maine Aviation Business Association was launched last year to help recruit aviation service businesses to Maine and market those already here.

“The industry is on track to grow and flourish,” says ARSA Executive Vice President Christian Klein. “Maine companies can capitalize on that growth, assuming the [Federal Aviation Administration] gets smarter about how it regulates and Congress doesn't make it harder for U.S. repair stations to do business internationally.”

Marketing Maine's aviation assets

Steve Levesque, executive director of the Midcoast Regional Redevelopment Authority and a pilot himself, is bullish about the prospects of growing Maine's aviation-related industries. It isn't only that he has considerable assets at the former Brunswick Naval Air Station to market — namely, two 8,000-foot runways and 500,000 square feet of hangar space. He says Maine's 75 public-use airports and a labor pool of 14,430 workers with skills suitable for aviation maintenance, repair and overhaul work (based on Maine Department of Labor statistics) are largely underutilized assets.

“This is an opportunity to really grow Maine's aviation industry,” he says. “We have significant airport infrastructure built by U.S. taxpayers during World War II and the Cold War era. Almost 25% of all general aviation aircraft in the United States and 52% of all general aviation aircraft in Canada is within 500 nautical miles of Brunswick Executive Airport. It's a great opportunity. More and more airports around the country are land-locked. They don't have any room to accommodate any more aviation businesses.”

Levesque says the sense of an untapped potential is the primary reason behind last year's launch of the MABA. The nonprofit group, which operates out of MRRA's office at Brunswick Landing, says its goal is to make Maine the location of choice for aviation businesses looking to start up or expand.

Its president is Barry Valentine, a former acting administrator of the FAA in the late 1990s, whose resume includes stints as director of the Portland International Jetport from 1987 to 1991 and as a senior vice president for international affairs for the General Aviation Manufacturers Association. He also has represented the U.S. government and industry in numerous international aviation forums and was director of aeronautics for the Maine Department of Transportation from 1983 to 1987, when he worked closely with the FAA to expand and develop the state's biennial airport capital program.

“I've worked in aviation all my life, I'm nuts about airplanes. A lot of that activity took place here in Maine,” says Valentine, who returned to the state with his wife to retire. He says he still does some consulting work in Washington, D.C.

Aside from having airports with few close neighbors and unencumbered air space (which makes Maine ideal for flight testing and pilot training), Valentine says Mainers might not realize the reputation they have outside of the state of being hard-working and creative problem-solvers. He recalls being told by an administrator when he started working for the FAA, “'I know how you Mainers are: You show up on time, you work hard … and you wear flannel shirts.' In other parts of the country, that's how we're known.”

Valentine agrees with Levesque's assessment of Maine's airports as underutilized resources, citing Brunswick Landing's assets.

“The Navy built some large hangars there,” he says. “You'd have to live several lifetimes to recoup your investment if you were a business and tried to build one of them from scratch.”

He expects that in the coming year MABA will begin working with allies such as the Maine International Trade Center and the state's transportation and economic and community development departments to better market Maine airports, its work force and existing aviation businesses. A likely initiative that would advance those goals, he says, is having a state pavilion at the National Business Aircraft Association's annual convention in Orlando, Fla., this October.

“One of the things I've observed, because I've attended a lot of conventions and conferences, is that a number of states have a banner saying, 'Come to Colorado … or Arizona … or Virginia. We've got great aviation assets.' We'd like to be able to do that same sort of thing, and tell people, 'Maine is a great place to be, too. We've got a great work force. We've got great assets. The cost of locating in Maine is less.'”

Big players, big stakes

Scott Terry, president and CEO of Tempus Jets, says his company's decision to relocate its aircraft services from Newport News, Va., to Brunswick Landing last fall was driven by the hangar requirements for servicing large commercial aircraft such as Boeing, Airbus and Bombardier jets.

“We essentially grew out of our space there,” he says. “We did a nationwide search for hangars that were the size we needed. It's incredibly expensive to build new, so we looked at many, many places across the country.”

Although the nationwide search turned up some promising options, his wife's casual question, “'What about Brunswick [Naval Air Station]? Didn't that close down?'” turned his attention northward to a place he knew quite well, having flown P-3 Orions out of there more than 20 years ago as a Navy pilot.

“I called Steve Levesque on a Monday last August and within 30 days we had secured the space we needed,” Terry says. “He gave me almost everything I needed within 48 hours of that first call. He knows how to get the right people in the room at the right time. He's a professional, absolutely one of the best.”

Terry says besides the lease for 35,000 square feet in Hangar 6 — comprising half the space within the hangar built in 2005 — his company has lease options on another hangar and an adjacent manufacturing space. He's hired 18 full-time employees and has brought in as many as 20 independent contractors.

“We anticipate doubling our work force in the next six months,” Terry says. “We've got lots of room for growth. Having an option on the other hangar was a primary consideration in our move to Brunswick. A lot of the places we looked at have long runways just like Brunswick, but they don't have the space. There's no room to grow into.”

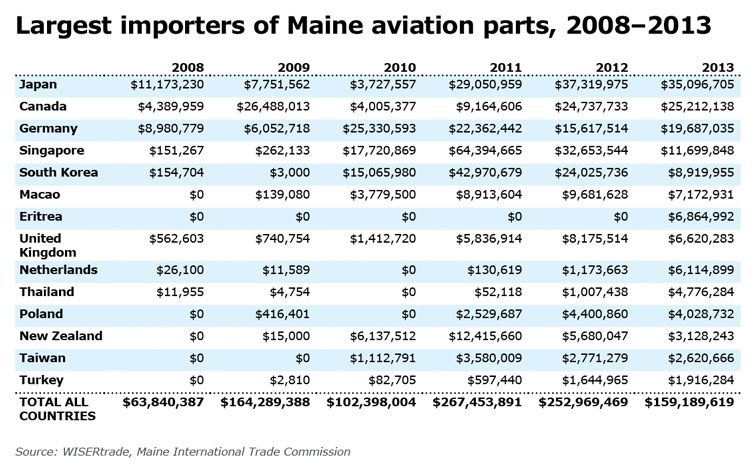

Besides finding the physical assets he needed at Brunswick Landing, Terry says the change in Maine's tax policy that exempts aircraft parts from Maine's sale tax also influenced his decision.

“In the last three months we've moved 16 tractor-trailer loads of parts into Maine,” he says. “So the elimination of the sales tax is a significant amount of money that we've saved.”

Noting there are only five or six other states that don't charge some kind of sales tax on aircraft parts, Terry says the Maine Legislature's decision last fall to extend the exemption for 20 years gives his company greater assurance in any decisions to expand in the state.

A little more than 100 miles north, Bangor-based C&L Aerospace, a global aviation services company specializing in parts, service, sales, leasing and maintenance for Saab 340 and Hawker 800 series aircraft, is in the midst of an expansion guided by CEO Chris Kilgour's vision of a vertically integrated one-stop-shop for regional airline operators.

“We're growing, we're building new facilities that triple the space we'll have [at Bangor International Airport],” says Kilgour, noting that his company now has 130 employees, more than double the work force he had just two years ago. He anticipates that number could grow by another 40 employees as a result of the company's $5 million expansion, which includes a new paint hangar scheduled to open this summer.

The expansion will be completed none too soon, given the 14 Saab aircraft C&L workers will paint and refurbish in Bangor. The planes then will be sold or leased to airlines. Kilgour says his chief worries looking ahead are whether he can meet his long-term work force needs and be able maintain a sufficient supply chain in Maine to meet his customers' needs.

“In this business, people want good quality and they want it yesterday,” he says.

Although he understands the rationale behind MRRA's goal at Brunswick Landing of developing a hub of aviation-related businesses there, he says C&L is very happy being the lone aviation services company in its neck of the woods, which reduces competition for his skilled work force.

Dauphinee of Black Bear Aviation has a different take. In moving to an airport with two runways and more space, he's gaining two established aviation businesses as neighbors: Airlink Aviation LLC, which offers flight instruction, scenic flights, aircraft charter and aircraft sales, and Aviation Appearance Plus, which has a full range of aircraft detailing services. The Waterville airport also provides FAA exams and other professional licensing/certification computer-based proctored exams.

As Dauphinee sees it, there are bound to be synergies that will not only benefit each business but also add to greater Waterville's economy.

“We all hope to grow, that's the name of the game,” he says. “I'm hoping to staff up some more. We're all going to be able to complement each other's work. I really think that's going to work out well.”

Comments