Are incremental improvements in hydropower enough?

A much-anticipated report on Maine's dams, due out in January, is expected to reveal how much more hydropower might be eked out of existing infrastructure, and whether any incremental increase will make a difference in the state's supply and cost of energy.

Industry pundits remain divided as to how much of a role hydropower can play in relieving the high prices and energy shortages that chilled the bottom lines of businesses last winter. Updating old hydroelectric dams or converting non-hydro dams into electricity producers is expensive and requires a still-lengthy federal permitting process, making the payoff questionable, some say. Others say the hydropower supply, as the top renewable energy in Maine, needs to be kept stable or increased.

Proponents also point out that hydropower has contributed to Maine's top ranking as a clean state, and say it is needed to help meet federal carbon emission targets by 2030.

Even when the report finally lands in the Legislature's hands as part of the state's Comprehensive Energy Plan update, its role will be to spark discussion rather than provide a future roadmap for the state's dams, says Patrick Woodcock, director of the Governor's Energy Office. Like all talk about energy, the discussion is expected to be complicated.

“I don't think it will be a significant amount of electricity that would transform the state,” says Woodcock, who emphasizes that the hydropower study is not yet completed. However, he says there could be about 10 megawatt-hours of power from current non-producing dams, and upgrades at some existing hydropower dams could improve their efficiency by about 10%.

He cites the Stillwater Dam, which was part of the Penobscot River Restoration Project, as an example of a dam where efficiency was increased by adding a new powerhouse and turbine, more than doubling output to 4.19 megawatt-hours from the previous 1.95 megawatt-hours.

Hydropower accounts for 29% of the state's energy generation, followed by biomass with 25%, according to a recent study by Clean Edge Inc., a research firm in Portland, Ore., and the San Francisco Bay area. By comparison, contributions to the state's energy generation by solar utility and geothermal projects were negligible in 2013.

However, in the overall scheme of things, hydropower may not have a substantial or immediate impact for businesses.

“Most businesses will want to know if this will reduce their power bill. Not a chance,” says Mark Isaacson, a partner in the Worumbo Dam in Lisbon Falls, the first dam in Maine to receive federal Low Impact Hydropower Institute certification. He also was a partner in the Edwards Dam in Augusta, which was removed in 1999. Isaacson is chairman of the board of Competitive Energy Services, a Portland-based strategic management firm that aims to help contain clients' energy costs.

“I'd be surprised if all that we add equals what we have subtracted,” he adds, referring to dams that were pulled down or aren't economically feasible to operate.

However, Woodcock believes that with some incentives from the state, dam owners could be enticed to improve their facilities. He adds that Congress has passed legislation to streamline the permitting process and application for hydropower.

“One thing we could explore is providing certainty in pricing that doesn't cost the state, but gives clarity for a company to make investments,” says Woodcock. “That may facilitate more investment in non-functioning dams. We want to explore this.” He adds that hydropower is now subject to price changes over the long term.

A shift from new to making do

When the last hydropower report was conducted, in the 1990s, the thought at the time was to build new dams. Nowadays, it's more on making better use of what's available, says Gary Liimatainen, senior vice president of the hydro services department at Kleinschmidt Associates, a Pittsfield provider of engineering, regulatory and ecological services that is one of the three parties preparing the report. Ocean Renewable Power Co., experts in marine hydrokinetic technology, and TRC, which focuses on hydropower regulatory and policy issues, are other partners in the study, for which the Governor's Energy Office reportedly directed up to $125,000.

“There's lots of activity,” he says. “It started with the deregulation of hydro assets from utility companies in 2000. Lots of projects were sold and resold.”

“Hydro developers are looking to the future when the value people place on renewables will give them a premium,” adds Liimatainen, who has a particular fondness for the simplicity of hydropower. “Once hydro is in your blood, you stay with it forever. It's renewable, green energy generation with environmental and recreational benefits. And it's simple to understand.”

He says smaller dams can adopt new technologies. A lot of the equipment in Maine's dams dates to the 1920s, so its efficiency has diminished over the years. “They could improve the runners and generators,” he says. “It makes sense to upgrade the turbines.”

Current hydropower efficiency is in the mid 80%, which is high. Liimatainen says better insulation on the generators, more computer-aided design for the runners and turbines as well as better bearings could improve efficiency in the single digits. Transmission line losses also could be reduced, he says.

“My gut says there's good potential for upgrades in the state of Maine,” he says. “If there's 1 megawatt-hour of potential and you have policy issues, the Legislature won't care about it, but if there's 100 megawatt-hours of hydro potential, it may get the Legislature's attention. There's a potential to change policy.”

Potential inventory

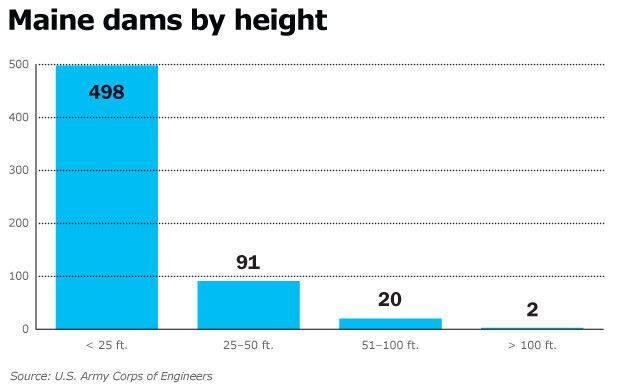

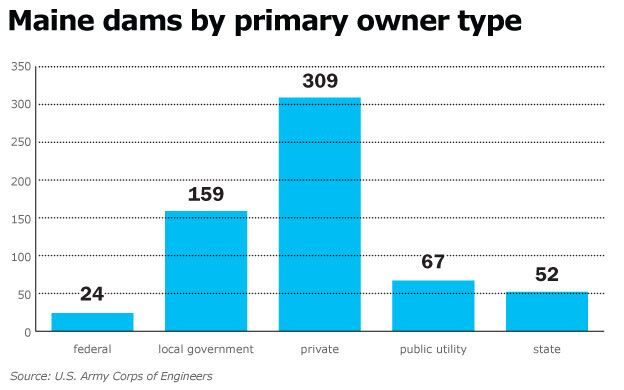

Maine has 611 dams of all types, with 199 of them having hydroelectric generation as their primary purpose, according to the U.S. Army Corps of Engineers. About half of the hydroelectric dams are currently operating under Federal Energy Regulatory Commission licenses. More than half of all dams in the state — 309 — are privately owned, followed by 159 held by local government. Some 361 are made of concrete, and the majority — 498 — are less than 25 feet high. Only two are higher than 100 feet.

The greater the height or “head,” the greater the power generation as the water moves downward from a higher elevation through pipes or tunnels, causing turbines to rotate and drive generators, which convert the energy into electricity.

Most Maine dams were built before 1910, with the number of new dams trailing off until today: only four dams have been completed since 2000.

Dams in the northeastern United States pale in comparison to the size of the nation's mighty dams. In Nevada, Hoover Dam, stands 726 feet, some 171 feet taller than the Washington Monument. It impounds Lake Mead, the largest reservoir in the country by volume. Its 17 generators supply an average of 4 million megawatt-hours of hydroelectric power annually to Nevada, Arizona and California, serving 1.3 million people, according to U.S. Bureau of Reclamation figures. By comparison, the 100 FERC-approved hydropower projects in Maine each generate fewer than 20 megawatt-hours of power, with most producing less than 2 megawatt-hours.

Bootstrapping small dams

Many of the dams in the state are owned by large companies. For example, Canada-based Brookfield Renewable Energy Group has been buying up dams, including nine dams last year from Black Bear Hydro. Vanessa Pilotte, director of communications for Brookfield, in an email declined comment on its hydropower strategy in Maine.

But individuals are starting to see hydro's potential and are stepping up. For example, when Belfast let its option lapse to buy Goose River Hydro Inc.'s five dams and three power plants, citing high regulatory and improvement costs, Nicholas Cabral, 22, and his Maine Maritime Academy classmate Nicholas Berner, 23, weren't daunted when they heard the dam was for sale during a class on renewable energy.

“The numbers added up,” says Cabral, president and co-owner of Goose River Hydro with Berner, who is vice president and treasurer.

In an effort a mutual friend calls a “great combination of perspiration and aspiration,” the two fifth-year students bought the dam operations last year to use, in part, as their senior-year project. With a lot of elbow grease, help from friends and experts at the academy, they now have the first dam rehabbed and running.

Cabral says they chose the Mason Dam first because it required the least investment to update the electronics and other components. It went online Aug. 1 and is connected to the grid, supplying power to about 30 homes, he says.

Central Maine Power buys all of the power the dam produces and Belfast is the end user. FERC lists Mason Dam as having a total capacity of 75 kilowatt-hours of hydroelectric power.

The other Goose River Hydro dams are CMP Dam, the biggest dam, with 200 kilowatt-hours of power, as well as Kelly Dam, Mill Dam and Swan Lake. The total capacity of the five dams is 369 kilowatt-hours.

Cabral says the academy teaches its students how to work with large power plants aboard vessels, and the dam gave him and Berner a chance to apply the electronics and electricity theory they learned. “A lot of it was going in and getting dirty,” he says. Sweat labor saved them a lot of money over having to hire expensive engineering expertise.

“We've been fairly successful without huge amounts of funding,” says Cabral, figuring the total cost to upgrade Mason Dam was about $50,000.

The duo got an approximately $200,000 balloon loan from a private investor before they bought Goose River Hydro for $125,000. They plan to use their schooling to get maritime jobs and bring that capital back to their business in Maine as well as repay the loan.

“This runs 24 hours a day. It produces income while you sleep,” Cabral says. “The difficult part is dealing with the regulatory agencies.” He says the company needs resources and people willing to work with it on the business and regulatory aspects. The current regulatory license is valid until 2020.

The dams haven't run into environmentalists' complaints about fish passage, he says.

“This dam is a revenue stream now. It's slowing the bleeding for us as a startup company,” Cabral says. “But I'd like to do more automation with this.” For example, cleaning the trash racks, the area where fallen leaves build up and slow down the turbine.

“We want to bring the dams into the modern age,” he says. “Hydropower is the most efficient renewable energy out there.” Cabral says the remaining dams should be up and running within the next five years.

Tony Grassi and his wife Sally also were eager to buy and revive the Mill at Freedom Falls, a former grist mill built in 1834 that became a wood-turning mill in 1894 and then a sawmill in 1913. A former investment banker who was chairman of The Nature Conservancy as well as American Rivers, Grassi had worked to remove hydroelectric dams on Maine's Penobscot River to restore migratory fish passage. But Freedom Falls presented an opportunity to restore a dam, as there was no history of Atlantic salmon or alewife runs on Sandy Stream, where it is located.

The mill originally ran on mechanical power. It's been out of commission close to 50 years, Grassi says. “We want to use hydroelectric tied to the grid rather than mechanical power.” That required installing a 50-kilowatt turbine, which will provide power to the school and restaurant that now occupy the mill building, with the surplus going to the grid.

The historic building is on the National Register of Historic Places. “It's been the heart and soul of the community for a long time,” he says. “The basic structure is in good shape.”

He received a U.S. Department of Agriculture Rural Energy for America Program grant for his renewable energy system, which is for up to 25% of the total capital costs for the dam, or $50,000. He will put up the remaining $150,000 himself.

He expects his company, Freedom Falls LLC, to see returns from selling power and collecting rent from his two tenants. He bought the property in 2012, and expects a payback in eight to 10 years. The dam has a FERC exemption forever.

Says Grassi: “This is a beautiful historic mill, and a place where you can put in hydropower without disrupting migratory fish passage.”

Read more

Report: Limits on Maine hydropower expansion

Comments