From trap to plate, Maine lobster distribution is a complex system

David Cousens has been fishing for lobsters for about 40 years.

For seven months each year, Cousens — a South Thomaston resident and long-time president of the Maine Lobstermen's Association — heads out early in the morning on his Young Brothers boat, “Three Sons,” to tend 800 traps, spending 10 to 11 hours per day on the water. During the spring and early summer, the lobsters that crawl into his traps are still encased by shells that hardened up for the winter. By July, the growing lobsters are shedding their hard shells and beginning to grow new shells. Like that of other Maine fishermen, 85% of Cousens' annual haul is new-shell lobsters, harvested through the rest of the summer and well into the fall.

“Our season is set up year-round, but our big months are August, September and October,” he says.

Trends show the lobster resource is shifting east, possibly due to the warming ocean temperature. Living midcoast, Cousens sees great fishing. Prices are good, too. This year, his earnings per pound averaged more than $4, an improvement on 2014's average $3.69, and coming close to the 2007, pre-recession level of $4.60. Prices are generally consistent coastwide, but fishermen to the west may be earning less simply because they're finding fewer lobsters in their traps, he says.

Cousens declined to cite revenue, but it's enough to make a living while covering a bucket load of professional expenses. These include bait and fuel, costing him $30,000 to $35,000 per year, approximately the same amount to pay his sternman, and $10,000 to $15,000 per year for boat and trap overhead.

“And that's before you take any money out of it,” he says. “You have to have a fairly good price to make any money.”

According to the Gulf of Maine Research Institute report “Understanding Opportunities and Barriers to Profitability in the New England Lobster Industry,” lobstermen in 2010 reported average gross revenues of $97,333, with an average $24,847 in profit after expenses.

The lobster industry largely caters to the disposable-income market, and so is vulnerable to economic downturns. When the economy crashed in 2008, fishermen fared poorly, earning only $2.50 a pound.

“Lobster's a celebration food and so, when the economy's bad, the market's bad,” Cousens says.

These days, though, thanks to industry marketing initiatives and a growing processing sector that eliminates the need for consumers to deal with live crustaceans, lobster is gaining broader appeal as a healthy, wild-caught protein.

“There's more market now,” says Cousens. “The Asian market has taken off and the domestic market is doing better. More people are eating lobster: They understand the health benefits. Plus, the economy is better. All of that works together.”

Economic multiplier

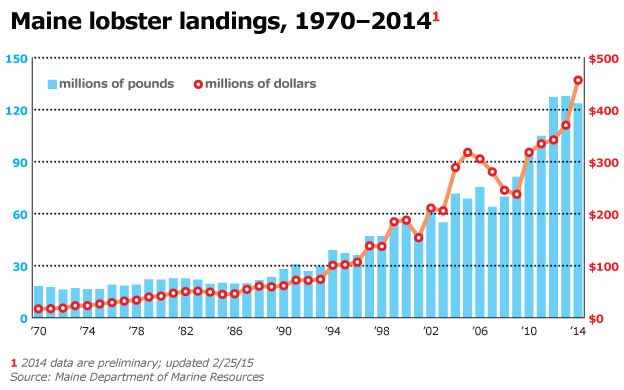

Maine's lobster industry is the state's largest commercial fishery. Cousens is one of approximately 5,800 people in Maine who hold a Class I license (no additional crew); Class II license (one additional crew); Class III (two additional crew); or student license. Fishing approximately 2.9 million traps in 2014, they generated $456.9 million in dockside value for landings of 123.6 million pounds. The latter figure compares with relatively constant landings, up until the late 1970s, of 30.87 million pounds per year, according to the Atlantic States Marine Fisheries Commission.

Accounting for the fishery's wider economic impact, the value rises to over $1 billion, according to the GMRI report. This includes an extensive network of suppliers and buyers, everything from bait and fuel to processing and trucking.

“Each one of those layers, you're looking at a lot of jobs in this industry,” says Annie Tselikis, executive director of the Maine Lobster Dealer's Association. “It's often overlooked, but it's a huge contribution to rural communities — especially in Downeast Maine, where you see an unknown economic multiplier in these communities. People working in the lobster business are huge contributors to their coastal economy.”

The price per pound makes a big difference in earnings. Although 2014 landings were on par with 2013 and 2012, fishermen earned $86.65 million more in 2014 than they did in 2013. That's because the price of $3.69 per pound was 79 cents per pound more than 2013's price, the largest one-year increase in per-pound value since the DMR and National Marine Fisheries Service began keeping records. The one-year increase in overall value was also the largest on record. The value of the increase itself was more than the total value of the fishery 21 years earlier, according to the DMR.

The fishery is also vulnerable to environmental conditions. That was highlighted in 2012, when an early shed created a supply of new-shell lobsters before processing plants were ready to take them, and the live market was unable to absorb the supply. This depressed value, with fishermen generally earning less than $3 per pound. Nevertheless, the fishery's overall value that year held steady because fishermen made up for low earnings by bringing in more product.

High landings reflect robust growth of the resource, which has expanded dramatically since the late 1980s, particularly in eastern Maine in the last 10 years, due to favorable environmental conditions for growth along with effective conservation measures.

“Current stock abundance is at all-time highs,” says the Atlantic States Marine Fisheries Commission's 2015 lobster stock assessment, issued in September.

The current fishing year is on track for high landings, too, says Patrice McCarron, executive director of the Maine Lobstermen's Association. Final figures, compiled by the DMR, await the end of the year.

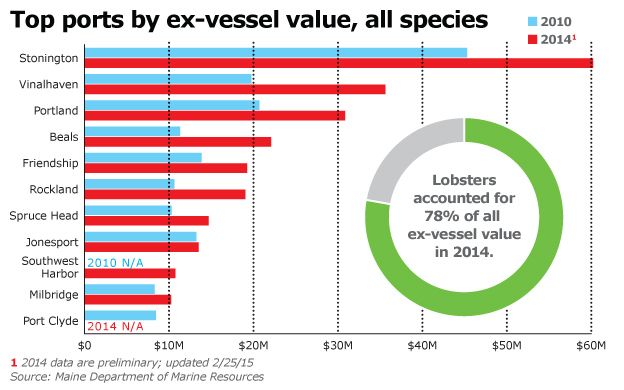

In tandem, landings have shifted eastward, with Washington, Hancock and Knox counties experiencing escalating numbers since 2007, says GMRI. According to DMR figures, midcoast Stonington and Vinalhaven were Maine's top ports in 2014, landing $60.22 million and $35.61 million worth of lobster respectively.

In response to these developments, the industry has moved to find new or expand existing markets, through initiatives funded by increased license surcharges. After hiring global public relations firm Weber Shandwick, the outcome was the launch early this year of a campaign to brand and promote Maine new-shell lobster as a particularly tasty commodity, to recruit and deploy a network of “star” chefs as ambassadors across an expanding slate of American cities, and to bring in lobstermen to tell the story of their trade, thus capitalizing on growing consumer demand to know where their food comes from.

The industry is also working to expand the export market. In September, for example, Maine lobster received a big promotion when President Obama served it at a state dinner for Chinese President Xi Jinping. According to the MLA, the menu was highlighted in dozens of Chinese media articles and reached hundreds of millions of people.

According to Jeff Bennett, a senior trade specialist with the Maine International Trade Center, Maine exported $365 million worth of lobster in 2014. Of that, $349 million was shipped live, $16 million frozen, with $300 million of that going to Canada for processing; $40 million going to Asia (China $21 million, Korea $11 million, Hong Kong $8 million); and $10 million to Europe (United Kingdom $6 million, Italy $4 million). The potential is great to expand exports, due to large seafood consumption rates in other countries, Bennett says.

“As large as the U.S. domestic market is, 95% of [seafood] consumers live outside of the United States,” he says. “It's always advantageous to diversify your customer base. Maine lobster exports to China alone have tripled since 2012,” to $21 million.

“Our hope is to drive demand and awareness,” says Matt Jacobson, executive director of the Maine Lobster Marketing Collaborative. A chunk of that is providing basic education. “A Chicago friend of mine has two restaurants and a cooking show on Univision. I said, 'Try Maine lobster.' He said, 'Sure, send me some.' We sent him some. He called and said, 'It came, but it's alive. What do I do with it?' You start to realize there a lot of chefs out there who don't know how to work with Maine lobster. We can educate them about the culinary piece and the sea-to-table story. And then, if we have more people asking for Maine new-shell product, that would increase demand, and that would increase prices for the whole supply chain.”

Complex supply chain

The lobster industry starts with fishermen like Cousens and moves into a complex distribution system. Because of the network's dispersed nature, it can be hard to put a value on each segment of the industry.

Lobsters travel from thousands of independent fishermen to hundreds of licensed dealers or fishermen co-ops, each with proprietary customer lists and methods of distribution. Here, the product is graded, handed to shippers and transported either to another live-lobster dealer or a wholesaler or a processor.

Over half of what's landed goes to Canada for processing and, in Maine's off-season, Canada lobster is imported. According to GMRI, the live lobster market is divided between lower-price new shells and often-higher-priced hard shells. New shells, caught between July and the end of November, are predominantly used for the summer and fall restaurant market and the processing sector. Processed lobster or value-added products, such as lobster mac-and-cheese, is sold to grocery or food service distributors, who sell to supermarket chains, institutional food providers or food service outfits.

The live hard-shell winter and spring product, better able to withstand transportation, goes into local, national and international markets via importers or wholesalers, who then sell to restaurants, grocery chains or retailers.

At Greenhead Lobster, owner Hugh Reynolds offers an integrated model of services to fishermen and sales to customers. Reynolds started his live-lobster dealership in 1997. He owns a wharf in Stonington, is phasing out another in Kittery and is opening a distribution facility in Seabrook, N.H. In an era of the working waterfront commonly being sold for high-end residential use, his wharf is an essential place to land product and buy fuel and bait.

“We're also one of the last people in Maine to have tidal lobster pounds that store lobsters for the winter. And we have a state-of-the-art holding facility with modern pumps and refrigeration technology,” he says.

This allows him to supply product through the winter. Buying from about 125 Hancock County fishermen, Greenhead purveys 10 million pounds per year, 70% bought locally and 30% imported from Canada, whose fishing season dovetails with Maine's.

“Our fishing finishes up in December, and theirs is just getting started, so we want to give our customers a continuous supply,” Reynolds says.

Sales are split 50/50 between domestic and export markets; domestically, most product goes to the New England summer market, with other shipments going as far as Alaska and Hawaii. His biggest export market is Asia. Reynolds recently returned from meeting with potential partners in China and Japan, as part of MITC's trade mission in October, to expand awareness of Maine lobster and promote the Greenhead brand.

“[Expenses] are tremendous,” he says, citing labor, transportation, capital investment, and the sheer challenge of maintenance and repairs in a salty environment.

“It's a very competitive, low-margin business,” says Reynolds, who also works to continually improve handling techniques in order to mitigate “shrinkage,” the loss of dead lobsters. “The key to success is to make as few mistakes as possible,” he adds.

Lobster processing

John Norton, owner of the processing firm Cozy Harbor Seafood in Portland, calculates shrinkage as one of his biggest cost implications.

“Lobsters die between the time they're unloaded from the boats, into crates and through to both live lobster and frozen lobster dealers,” Norton says.

Norton was part of the first wave of Maine's lobster processing sector. He founded the company in 1980 to process groundfish, then added shrimp in 1989 and lobster in 1993. The company owns buying stations on Casco Bay's Long Island and in Tenants Harbor, and buys at other stations along the coast, dealing with 400 to 500 fishermen. In 2014, Cozy Harbor processed about 7 million pounds. Its customers are in the United States, the United Kingdom and Asia and include supermarket chains, food service distributors and wholesale distributors.

A “shrink factor” is built into every point of sale: The industry accepts a standard maximum loss of 4% for dead and short-weight lobsters. “If you're starting out with a $4 lobster, that lobster actually costs, before any processing, $4.17. Seventeen cents accounts for the short weights and dead lobsters,” Norton says.

Among live-lobster dealers, he says, it's not unusual to have 3 to 4% shrinkage, starting out at $4.17, then to take another 4% shrink factor before moving the product on, bringing the base price to $4.35 per pound.

“And each time it changes hands, you add more on top of that,” Norton says. “So by the time it gets to, say, a restaurant there could easily be a built-in cost of $1 to $1.50 to account for 'deads' through the different players in the system.”

Processors have a yield loss as they convert lobsters from whole to finished product. Norton says 100 pounds might yield 26 pounds of salable product. What the consumer pays for the lobster reflects the additional cost of labor, packaging, freezing, infrastructure, transportation and cold storage.

“Sales don't match up on the same timeline as supply does,” Norton says. In the frozen business, processors bring in supply during the fishing season, hold inventory and match sales to demand. “In Maine and New England, all supermarkets sell live lobsters all the time. But you get beyond the New England region and supermarkets only promote lobster at certain times — Christmas, Valentine's Day, the Super Bowl. In Japan and China, it might be Chinese New Year or the Moon Festival. So the demand side does not work with the supply side without having big inventories in the middle to be the shock absorber.”

The complexity of Maine's distribution system is fairly unique, says Tselikis.

“We've seen a lot of consolidation in commercial fishing worldwide and in the United States,” Tselikis says. “You don't need to look further than the groundfish industry in New England to see some level of that consolidation of the fleet, but there are other fisheries and companies within the seafood industry that have more control over the supply from sea to consumer.”

By contrast, the diverse lobster fleet and the many businesses that operate in the supply chain, combined with the fact that this is a wild-capture fishery, prevents real control of the supply, she says. “There are pluses and minuses to these different structures, but the fact remains that the lobster industry has kept communities like Jonesport and Stonington on the map, so to speak. If the lobster industry were consolidated to Portland and Rockland, we'd be looking at a very different coastline. This industry supports thousands of people and businesses along the coast, and we are lucky to have it.”

Read more

Lobster industry focuses on marketing

Opponents outnumber supporters of new lobstering proposal at hearing

Jump in domestic lobster processing could drop prices

Lawmakers endorse stripped-down version of lobster license change

Grand Theft Lobster: Jeffery's Ledge

A historic $495M year for Maine’s lobster industry

Swedish officials push to label 'Maine lobsters' as invasive species

Comments