Maine-based banks fill a void left behind

As national banks pare down their presence in greater Portland, community banks are rapidly expanding in the market.

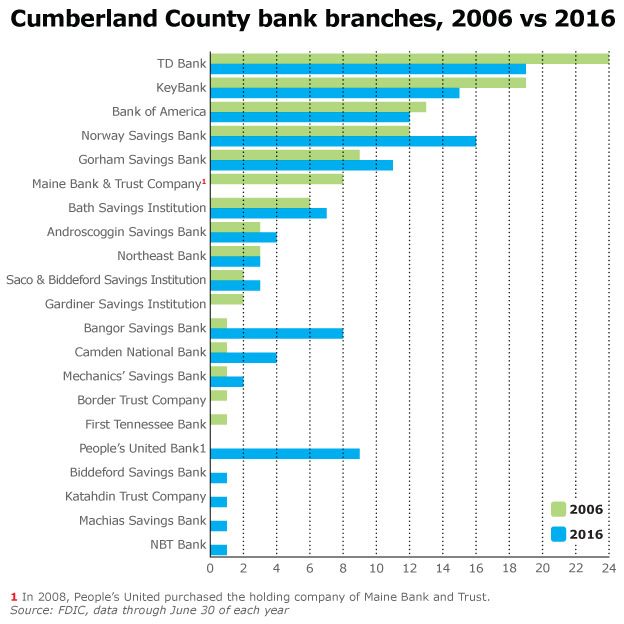

TD Bank, KeyBank and Bank of America have closed branches in Cumberland County over the past decade, while community banks like Gorham Savings Bank, Bangor Savings Bank, Camden National Bank and Norway Savings Bank have stepped up their presence in the market.

For the community banks, the economic hub of fast-growing Portland represents fertile new territory. But for big banks, Maine's size and growth potential pales in comparison to major metro areas like Boston, New York and Atlanta and the booming frontiers of online and mobile banking.

“Banks expanding into the area from outside of Portland see this as an opportunity to grow their business,” says Gerard Cassidy, a Portland-based analyst who is managing director of equity research for RBC Capital Markets. But for large banks, “the reallocation of capital to better growth markets and the increased use of digital channels has reduced the need for as many branches.”

Global trends, local impact

What's happening in Portland is being driven by forces that are transforming the industry nationwide. Over the past decade, the banking industry has cut 3,012 branches. But banks with less than $1 billion in assets have actually opened a net of 3,275 branches, while larger banks have cut more than 6,000 retail sites, according to S&P Global Market Intelligence.

Smart phones and consumers' voracious appetite for mobile services have forced banks to invest heavily in technology and cybersecurity. While interacting in person at a branch is still the most common method of using financial services, online banking services are nearly as popular as ATMs. Today 71% of consumers use online banking and 38% of consumers use mobile banking, according to a 2016 survey conducted by the Federal Reserve Bank.

“We've seen more change in our industry in the last 10 years than in the previous 50 years,” says Gorham Savings Bank President and CEO Chris Emmons. “We must continue to evolve in order to meet the challenges and opportunities of this dynamic marketplace.”

Now that convenience has been redefined as the ability to bank 24 hours a day, seven days a week, from any place on the planet, financial institutions have had to rethink what kind of bankers' hours make sense.

TD Bank, which uses the moniker “America's Most Convenient Bank,” has long kept many of its branches open seven days a week, some days as late as 7 p.m.

Now that the bank has a full suite of mobile and online services, it has shortened hours at some branches.

“What we've discovered is that the number of physical locations is not a good measurement of convenience,” says Larry Wold, TD Bank's market president for Maine. The Cherry Hill, N.J.-based bank has 19 locations in Cumberland County, down from 24 locations a decade ago.

“Having people who are highly trained and highly accessible is much more important than having a lot of bodies out there,” Wold adds.

Competing for community bank customers

Community banks strive to offer a more personal touch than big banks. But with so many small banks competing for Portland-area customers, they must find ways to differentiate themselves from one another.

Bangor Savings recently acquired Buoy Local, a purveyor of gift cards for roughly 100 local retailers, restaurants and service providers that markets its members, and provides them with valuable market research.

The acquisition strengthens Bangor's ties to the small-business community, and enhances the services the bank can provide to its 3,000 existing merchant services customers, says Jim Donnelly, the bank's executive vice president and chief consumer officer. The bank plans to expand the Buoy Local program.

Camden National Bank expanded its southern Maine presence in 2015 with its purchase of Bank of Maine, becoming the largest Maine-based bank. It recently merged its Acadia Trust and banking units to create a new division, Camden National Wealth Management. The merger will allow Camden National to leverage the technology, capital and resources of both companies to better serve clients, says Renee Smyth, the bank's chief marketing officer.

Patricia Weigel, president and CEO of Norway Savings Bank, says that maintaining a competitive edge will boil down to what it always has — relationships.

“Customers really want to do business with people they know and trust,” Weigel says. “Particularly when their interests may involve large amounts of money such as when they are borrowing money for a home, investing their retirement funds or buying a new business.”

Staffing the growth

Relationships, of course, require people. And community banks are striving to hire and develop the human resources they need to support their expansion. That's not easy in Maine's tight labor market.

“The talent resources out there are obviously shrinking with the demographics,” says Gregory Dufour, president and CEO of Camden National. “Young people are moving out of state and a lot of people are retiring. We don't see a lot of young people coming in.”

Dufour, like many bankers, says that his institution is investing heavily to develop its next generation of leaders and strengthen the connection they feel to the organization. There too, he says, size is an advantage.

“We're big enough to offer growth opportunities and still small enough that anyone can call me if they have a question,” Dufour says. “You get into large companies, and you don't have access to the CEO. Myself and the rest of the executive team — we spend a lot of time with our employees.”

Bangor Savings is partnering with Maine colleges and high schools on workforce development. Last year, the bank launched two-year accelerated training programs for commercial credit and mortgage lenders. The programs are designed to help new college graduates jump-start their banking careers and develop management and leadership skills. The bank also offers a generous tuition reimbursement benefit. The bank prepays tuition and fees for up to six courses each year for any employee working at least 20 hours per week. The courses don't even have to be related to business or banking and employees are not required to stay at the bank after completing the course.

These efforts seem to be paying off. The last time Bangor Savings had an opening for a branch manager, 51 people applied, says Donnelly.

Investing online and on-the-ground

Even as community banks build branches in Maine's hottest real estate markets, they also must spend heavily to provide the digital services and security that their customers demand.

“In some ways we are competing against large and multinational competitors, but also competitors who may only have one or two branches,” says Dufour. “We have to have people who are manning our branches and know customers' names. But we also have to staff up a call center to serve customers who are conducting business online.”

Gorham Savings has opened two branches in Cumberland County in the past decade, including a prominent commercial lending center on Marginal Way. It is currently redeveloping Portland's historic Grand Trunk building on India Street. When it opens in the spring, the branch will be Gorham's 12th location in Cumberland County.

At the same time, Gorham Savings has invested heavily in online products, including an online banking app, mobile check deposit, Apple Pay and a peer-to-peer payment system called People Pay.

In 2014 Gorham began rolling out Interactive Teller Machines known as ITMs. These are ATMs with the option for live video interaction with customer service representatives, so customers can do things like change their PINs and make withdrawals without a debit card.

Norway Savings has added four branches in Cumberland County in the past decade, even as it has added online services like mobile payments, person-to-person payments and Apple Pay.

“We believe customers will find more value in our products and services when we are more visible in a greater number of communities,” says Weigel.

Norway's newer branches have a smaller footprint and fewer employees than they once did, reflecting a drop in lobby traffic, Weigel added. Instead of standing behind counters, bankers work at less-restrictive “dialogue pods,” where they can stand beside customers, share their computer screens and assist with teaching new technology if necessary.

“Traditional teller lines are becoming an institution of the past,” Weigel says.

Cassidy, the bank analyst, noted that while most community banks do not have the same pressures for profitability and growth as the large national banks, it will be a challenge for them to manage the expenses of building both high-tech and high-touch resources.

“The community banks have an incredible hurdle in front of them [with] the increased costs to offer the level of services that are needed to succeed,” Cassidy says.

Big banks are here to stay

Though national banks have a smaller footprint in Cumberland County, they're not leaving the market any time soon. And some larger banks have expanded their presence. Bridgeport, Conn.-based People's United Bank, which came into the market in 2008 with the acquisition of Maine Bank & Trust, has developed a significant presence here, with 5.31% market share in Cumberland County.

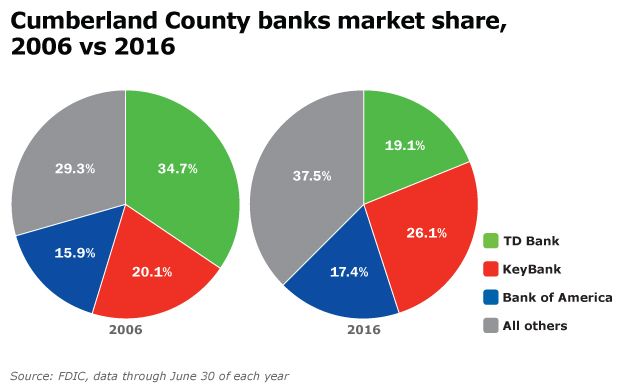

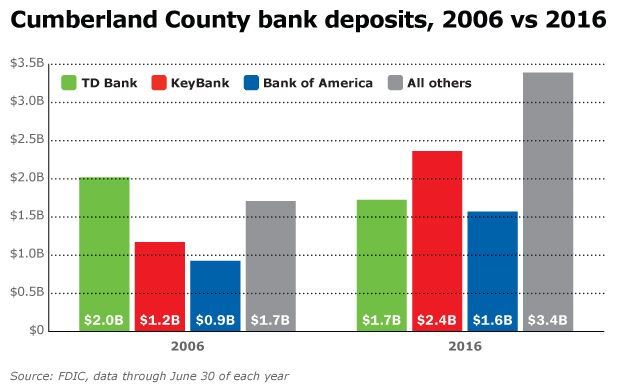

KeyBank, TD Bank and Bank of America still dominate the market, combining for 62% market share (compared to 71% in 2006), without the physical presence they once had. KeyBank, for instance, has four fewer branches in Cumberland County than it did in 2006, but its market share has jumped from 20% to 26% in that time.

Throughout KeyBank, twice as many transactions are conducted via online and mobile channels as those completed at a branch office, says Sterling Kozlowski, regional executive for New England. Yet the Cleveland-based bank has seen consistent deposit growth in Maine over the past four years, including 14% growth in the past year, Kozlowski says.

Wold, of TD Bank, says that having fewer branches with more deposits and more, well-trained people in each branch helps the bank's long-term viability.

“Improved efficiency results in more resources to invest in people, products and technology,” he says. “It creates a better employee and customer experience.”

And Wold isn't worried by the increased presence of community banks.

“Just as a smaller banks will argue that they offer a more personal approach, we'll argue that we have more capacity, more products and services, sophistication and technology that makes it more convenient,” he says. “We work with our relationship managers to become trusted advisors of their clients, not just bankers. If you have a banker who knows you, and who you like and trust, the size of the organization becomes almost insignificant at that point.”

Comments