State lawmakers make case for scrapping 3% tax surcharge

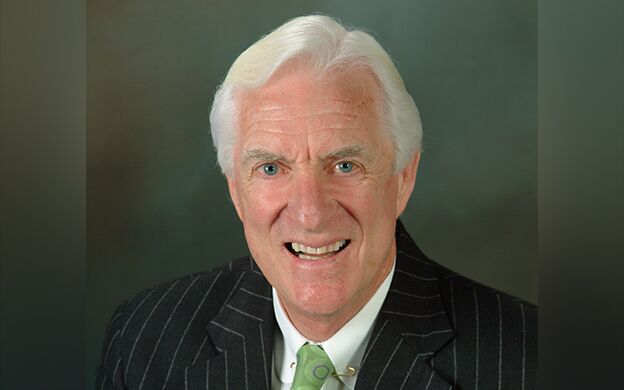

Courtesy / Maine State Chamber of Commerce

Dana Connors, president of the Maine State Chamber of Commerce, said legislation proposed by state Sen. Dana Dow, R-Lincoln, aligns most closely with the chamber's position on repealing the 3% tax surcharge approved by voters last November.

Courtesy / Maine State Chamber of Commerce

Dana Connors, president of the Maine State Chamber of Commerce, said legislation proposed by state Sen. Dana Dow, R-Lincoln, aligns most closely with the chamber's position on repealing the 3% tax surcharge approved by voters last November.

State lawmakers seeking to repeal the controversial 3% tax surcharge or limit its effects fired their opening public salvos in Augusta on Monday.

Sponsors of five bills made their case at an afternoon hearing before the Joint Standing Committee on Taxation. The surcharge took effect this year after voters approved it by a narrow margin last November.

Supported by the Stand Up for Students initiative, the measure aims to raise up to $157 million a year for education by increasing the top marginal income tax rate to 10.15% on households earning $200,000 or more. The 3% comes on top of the 7.15% regular income tax rate for everyone, and would affect more than 16,000 taxpayers, including owners of small businesses.

State Sen. Dana Dow, R-Lincoln, a small business owner and former schoolteacher, said he’s mainly concerned about the 11,000 small businesses affected by the tax.

“The problems created by Question 2 are reverberating throughout the state and can have detrimental effects and additional burdens placed on our small businesses,” he said.

Dow’s proposal would get rid of the 3% levy and draw the needed education funding either from the tax on recreational marijuana, or from all surplus revenue generated by economic growth.

State Rep. Heather Sirocki, R-Scarborough, wants the surcharge repealed for similar reasons but would like to see the matter put to another referendum next year after hearing from scores of voters with “buyer’s remorse.”

“How can we expect the public to fully understand what they voted on?” she said. “I don’t think they had all of the information that they needed to have in order to make an informed decision.”

Some proposals urged tweaks rather than a full repeal. Sen. Bill Diamond, D-Cumberland, suggests applying the 3% surcharge only to individual incomes above $200,000, heads of household earning more than $300,000 and married couples making over $400,000.

“The purpose of this bill is to bring to your attention we have a serious matter at hand and we need to address it,” he said.

Dana Connors, president of the Maine State Chamber of Commerce, told Mainebiz after the hearing that Dow’s bill is the one that’s the “most consistent with our position” to support education, but with an alternative funding source that doesn’t do as much harm to the economy.

He also said complex tax issues should be resolved in the Legislature rather than via a referendum influenced by sound bites.

“Those complex issues need to be thoroughly vetted and understood, “ Connors said. “I would advocate any day — be it education policy or tax policy — that the place to deal with that is right here.”

'Stand with students, teachers and taxpayers'

Among legislators against a repeal, state Sen. Democratic Leader Troy Jackson of Aroostook said that rolling back the surcharge would ignore voters’ will and jeopardize education funding, putting additional pressure on property tax rates.

“The choice with these bills is simple,” he said. “Are we going to stand with students, teachers, public schools, property taxpayers and hardworking Mainers all over our state who are struggling to get by? Or are we going to stand with the rich, to the detriment of our schools and our communities? To me, that’s an easy choice. Our schools and our property taxpayers need our help. The rich don’t need another tax cut.”

Comments