A question of balance: Walmart evaluating 74 regional stores in face of online shopping trends

Photo / Lori Valigra

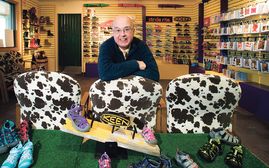

Jack Williams, the new regional manager for Wal-Mart Stores Inc., including Maine, plans to rehab older stores and add e-commerce features to others such as online grocery pickup at the store.

Photo / Lori Valigra

Jack Williams, the new regional manager for Wal-Mart Stores Inc., including Maine, plans to rehab older stores and add e-commerce features to others such as online grocery pickup at the store.

It's mid-August, and Jack Williams is assessing the recently arrived Christmas fabric and back-to-school items at the Biddeford Walmart.

The Wal-Mart Stores Inc. (NYSE: WMT) regional general manager is visiting all 74 stores in his coverage area of Maine, New Hampshire, Vermont and eastern Massachusetts to assess whether stores need to be upgraded or whether its customers prefer mulling around inside a store or shopping online and then picking up their items, already bagged, outside the store.

It's a dilemma many retailers now face.

“Customers are changing over time,” says Williams, 49, who became regional manager in May after joining Walmart as a cart pusher in central Indiana and working his way up until he most recently was a divisional operations coordinator in the company's Bentonville, Ark., home office. He's charged with expanding e-commerce operations, rehabbing aging stores and elevating training for employees, which Walmart calls associates.

He continues, “Many are going online, but our core customer wants to shop at a store. I've been at Walmart 29 years and we're best positioned now to meet the needs of both customers. We work hard to see where customers are heading next and what we need to do to go fast. We need to stay ahead of the competition on price, selection and service.”

In Maine, Williams oversees 25 Walmart stores, as well as three Sam's Clubs and a distribution center in Lewiston. Williams, who works from the retailer's Boston office, says it's like “I drive in a postcard every day.”

In Maine he's focusing on upgrading some of the older stores and assuring associates that they have a career growth path within the company. He's also identifying online opportunities at stores.

“My job is to run great stores that are fast, friendly and clean, and to bring along workers and the customer base as we move into our omnichannel plan,” he says.

Next year, online grocery pickup will become available in certain Maine Walmarts, something competitors like Hannaford are already doing. Customers will be able to order online and then pull in at the store and wait less than five minutes until an associate brings their order to the car. Associates will pick out items from store shelves and bring them to customers, and also provide a refund or item exchange right at the car.

“The future belongs to people who move fast,” he says.

He says that while Walmart is well positioned with the number of locations in Maine, it is always looking for opportunities to grow the business in new or existing sites. Some of the older stores are being updated. Auburn has one of the oldest Walmarts in Maine, and is in middle of extensive renovations.

“Auburn is getting the newest things, new shiny polished concrete floors instead of tiles, white color to let the products be the rock stars and a new entertainment department with interactive displays,” he says. “We'll complete that remodel in the fall. Scarborough will be remodeled next year along with a handful of others, including Brunswick.”

Catering to changing customers

New England is a strong region for Walmart because its population is dense and much of the region is a tourism destination. And that's where becoming a nimble merchant is necessary, Williams says.

“We're serving customers who reside inside local areas and those taking vacations or buying school supplies,” he says. “So we may display core customer things during the week and on the weekend shift to those on vacation. For example, in Ellsworth vacationers come in to buy for a week at a time, items like bedding, towels and food.”

“There are many locations like that up and down the coast of Maine,” he adds. “Populations turn over quickly, like in Thomaston, Scarborough, Brunswick and Biddeford. It's a different beach customer than in the Carolinas. I help the company [headquarters] to understand that.”

He says lawn and beach games perform very well in New England whereas in Myrtle Beach, S.C., swimwear sells well.

Walmart also is adding Walmart Pay, a phone app that lets customers prepare shopping lists online. When they get to the store the app will direct them to the aisles where the items are and quickly tabulate what they owe. The first time they order an item they will have to scan the QR code inside the Walmart network. They can call up past orders, reorder the same items or tell the app how they plan to pick up the items. For example, customers have the option of selecting produce themselves or having it selected by associates who can ready it for pickup at customer service.

“We can leverage Walmart.com, pickup inside the store or online grocery pickup outside for access to fresh foods,” Williams says.

Walmart has started sourcing some produce locally, including Maine blueberries. It also sells tomatoes from Backyard Farms in Madison.

Behind the scenes

Walmart is in a strong position now compared to Amazon.com, because of its longer and more extensive in-store and online presence, meaning it has the ability to build up its online advertising business, according to Ed Yruma, managing director of equity research at KeyBanc Capital Markets. Yruma wrote in a recent client note obtained by CNBC that Walmart has been quietly building up is online ad business, opening a new revenue channel.

Yruma cited as evidence banner ads on Walmart.com by third-party sellers with links to product pages or vendor websites. And the retailer is linking its in-store and online shopping data, offering up more information about both online and in-store customers than Amazon currently can.

Amazon plans to boost its physical presence. In late August, it acquired Whole Foods Market and immediately slashed prices.

In its bid to up its online presence, Walmart acquired shopping website Jet.com in August 2016, and subsequently bought e-commerce women's clothing retailer ModCloth and online men's clothing retailer Bonobos. It also partnered with Google to offer items via Google Assistant, a voice-activated shopping platform.

In its second quarter results, Walmart said that the value of what it sold online rose more than 60% over the same quarter last year, though it also America's largest brick-and-mortar retailer. The company said most of the online sales growth was organic through Walmart.com.

“In the future people who will do well in retail will understand there are needs that must be met,” says Williams. “Brick-and-mortar and online: there's a need for both.”

Comments