Crowded field of Maine businesses expected in race for $349B in small biz loans

Photo / Renee Cordes

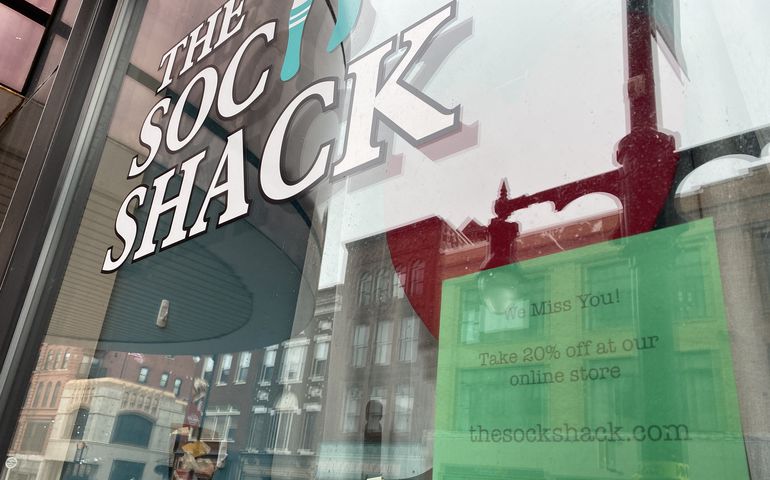

Small businesses nationwide, including retailers like this one in Portland, have been forced to close during the public health crisis.

Photo / Renee Cordes

Small businesses nationwide, including retailers like this one in Portland, have been forced to close during the public health crisis.

More Information

Like Black Friday bargain hunting, the race among small businesses for $349 billion in federal loan forgiveness may turn ugly as soon as the doors open.

That's the word from Maine-based legal experts and bankers on the new Paycheck Protection Program that could become operational as soon as Friday.

The $349 billion lifeline will come in the form of forgivable loans for small businesses to pay their employees during the COVID-19 crisis.

Still anxiously awaiting final guidance from the U.S. Small Business Administration on how the program will work, bankers and their advisers are getting ready as best they can amid some concerns there may not be enough funding to go around.

"Everyone wants to make sure they're in the queue when it opens up," said Jack Manheimer, a partner with Portland-based law firm Pierce Atwood who advises local and community banks. "They're worried about the money running out, and I don't think that's an unreasonable concern."

Verrill partner Mark Googins, co-author of the Maine Commercial Lending Handbook, foresees a similar scenario for banks he envisions as shopping at Walmart the day after Thanksgiving. "You don't want to be responsible for somebody getting hurt on the way into the store," he says. "There's a lot of anxiety about that."

SBA officials told Mainebiz they're still awaiting final guidance on specific provisions of the program, with Maine District Office Deputy District Director Diane Surgeon saying via email: "We're all really anxious to get everything moving for the small businesses and our lending partners, too."

In the meantime, she suggests that borrowers and lenders look at a U.S. Treasury Department web page as a guide on what they need to gather. She anticipates additional guidance to be out soon, though there's not yet a specific time frame on that.

She also said that at this point, banks in Maine that will be able to participate in the program include any lenders that have an agreement with the SBA to make 7(a) guaranteed loans. That includes 42 Maine-based banks and credit unions, as well as national and regional lenders with a presence here. They do not have to be an SBA Preferred lender, she added.

What banks are doing

Maine banks eager to get additional guidance from the SBA , and for the starting gate to be moved into place, are busy preparing and fielding a large volume of customer calls.

'We feel that a majority of our 7,000-plus commercial customers are potential applicants as this program will benefit not only our current borrowing customers, but business owners who currently do not have borrowing needs," said Chris Fitzpatrick, executive vice president of business banking at Machias Savings Bank.

"Each situation is unique so we want to review with the customer what program, or combination of programs, is most beneficial for them. We have been contacted by several hundred customers so far with more calling every day."

He added that while Machias Savings is setting up internal systems and processes to handle the expected volume, "until we have the final guidance from SBA we are somewhat limited. Each day we hear about changes to the program."

Andrew Silsby, president and CEO of Augusta-based Kennebec Savings Bank, said his bank is also getting lots of calls about the program.

'Our list to call businesses back when firm details emerge from the SBA is over 150 businesses long at this point," he said. "SBA is in a tough spot to spin this up with no time and thousands of questions. We will get through this, but it can’t happen soon enough for these small businesses."

At Camden National Bank, President and CEO Gregory A. Dufour said his bank plans to participate in the program and assist all businesses.

"However," he added, "we believe there is strong demand for the PPP program and will prioritize current customers. For any business that reaches out for information, we will provide program guidance, as the health and wellness of our customers and communities continue to be a top priority."

Kate Rush, director of community relations and senior vice president at Bangor Savings Bank, said that bank's team has been working with customers since late last week with an interest in applying.

"Folks are very excited about the program," she said. "It has the potential to help a lot of folks." She also said the bank anticipates being able to accept applications starting this Friday.

She also said that while applicants need not be existing customers of the bank, they will probably need to open an account there.

And at Gorham Savings Bank, President and CEO Steve deCastro said the bank has received a tremendous amount of interest in the PPP program and is aligning resources to help process applications from existing customers. That includes the formation of a working group to manage the expected workload.

"Additionally, we are maintaining a list of all non-customers who are interested in having [Gorham Savings Bank] be their partner on the PPP application process," he said. "Once we are through the initial wave of customer applications, we will move on to the list of non-customer requests."

Credit unions

Jennifer Burke, a spokeswoman for the Maine Credit Union League, told Mainebiz she isn't aware of any financial institutions not wanting to participate in the new loan-forgiveness program for small businesses.

"However, in order to participate, the bank or credit union must be a SBA lending institution, meaning they must have a Lender’s Loan Guaranty Agreement in place with the SBA, "she said, noting that not all Maine credit unions are SB lenders. "The good news is, we just learned that the SBA will soon be accepting new LLGA applications and expediting their review process of these applications, which means more institutions could offer this program down the road."

For businesses in need of immediate assistance, the group recommends going directly to the SBA and applying online for an Economic Industry Disaster Loan.

On a more general note, Burke said: "Credit unions are here to help our members and are working hard to find the right solution to meet each member’s individual needs. We are encouraging our members to contact their local credit union for assistance.

Other advice

Another recommendation, from Machias Savings Bank's Fitzpatrick, is that business owners go ahead with downloading the SBA application for the Paycheck Protection Program and fill it out.

Though the guidelines have net yet been published, "it is clear you will need to establish an average monthly payroll including benefit cost for the last 12 months, having the detail for that by month will be helpful," he noted. "Monthly interest on mortgages, rent expenses, utility expenses and interest on other debt obligations will also be necessary to determine the forgiveness amount."

Similarly, Verrill partner Googins urges acting sooner rather than later.

His advice to business owners: "Make friends with your banker and get in line."

0 Comments