As a place to retire, Maine ranks high for health care and quality of life — but is the seventh-most expensive state for people to live out their golden years, according to new findings from personal finance website WalletHub.

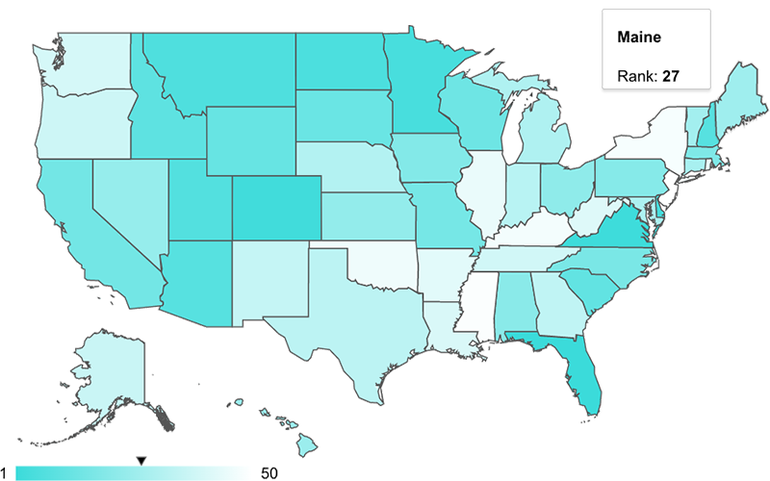

The 2022 analysis, released Monday, puts the Pine Tree state at No. 27 overall as a place to retire, between Hawaii (No. 26) and Vermont (No. 28) but 44th out of 50 when it comes to affordability.

Elsewhere in New England, New Hampshire was No. 9 overall (in a tie with Arizona); Massachusetts was No. 19; Connecticut was No. 29; and Rhode Island was No. 44 in the overall rankings.

Affordability rankings were based on factors including adjusted cost of living, general tax-friendliness and the annual cost of in-home services and adult day care.

In other metrics, Maine was ranked ninth-best for health care and 11th-best for qualify of life, which takes into account the share of population aged 65 and older along with museums per capita, golf courses per capita, and shoreline mileage.

Another plus for Maine: One of the lowest property crime rates compared to other states, trailing only Massachusetts, New Hampshire and Idaho.

Florida leads the overall list, followed by Virginia, Colorado, Delaware and Minnesota, while New Jersey came in dead last at No. 50. The Sunshine State also has the highest percentage of population aged 65 and older, followed by Maine.

The report’s authors note that while 27% of non-retired adults haven’t saved enough money for retirement, those deciding where to retire may want to consider relocating to a state that lets them keep more money in their pocket without requiring a drastic lifestyle change.

To determine the best states to retire, WalletHub compared the 50 states across 47 key indicators of so-called retirement-friendliness, measured by affordability, health-related factors and overall quality of life.

Find the full report, rankings and survey methodology here.