These new leaders made a difference in Maine over the past year

The past year has seen a number of changes in key leadership positions around Maine. While the list is ever-evolving, here’s a wrap up of some of these key personnel moves.

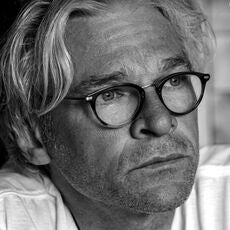

New PUC member has extensive background in energy and utilities law

Patrick Scully, former CEO of Portland law firm Bernstein Shur, has joined the Maine Public Utilities Commission, the three-member state panel that regulates electricity, natural gas, water and telecommunications services.

Scully was nominated by Gov. Janet Mills and received unanimous confirmation from the Maine State Senate.

Scully, 64, is “among Maine’s most knowledgeable energy and utilities attorneys,” according to Mills.

Scully told Mainebiz in an interview that the complex nature of the commission’s work can make it difficult for the public to take part in the process.

“Transparency is one of the challenges for the commission,” he said. “I would like to make it even more transparent.”

He replaced former PUC member R. Bruce Williamson, whose term ended in March. The three full-time commissioners serve staggered terms of six years and make all decisions by vote or action of the majority.

Scully joined Bernstein Shur in 1984, was named CEO of the firm in January 2014, and retired at the end of 2019. But he told Mainebiz that it was never his intention to “flat-out retire.”

He also said that because he backed away from energy work while CEO, he doesn’t anticipate having to recuse himself from cases involving his former firm.

“That should not require recusal unless it’s a matter that I was involved with, which is very unlikely at this point,” he said.

Maine Venture Fund ‘plugs in’ a Tesla veteran as director

Maine Venture Fund, a key financing arm in Maine’s startup community, has a new managing director with a solid background at startups — including Tesla, where he helped launch the company’s first electric vehicle.

Joe Powers, who has been a principal at the Maine Venture Fund for two years, took over July 1 from longtime director John Burns, who retired.

Maine Venture Fund, which was launched in 1996 and is based in Newport, has invested some of Maine’s startup success stories, including Sea Bags, Gelato Fiasco, MedRhythms, Defendify, HighByte, Hyperlite, Maine Craft Distilling, R.E.D.D. and Cerahelix.

From Powers’ perspective, Maine’s startup ecosystem works like this: A startup gets off the ground by going to Maine Technology Institute for a grant. As it grows, it may take out a loan from MTI or at some stage get a loan guarantee from the Finance Authority of Maine.

“When they get to the commercialization stage, looking to accelerate, they come to Maine Venture Fund,” Powers said. “We are doing equity investment, for the next five to 10 years.”

Powers, 38, is a native of Salisbury, Vt., and a Middlebury College graduate who also has an MBA from the Tuck School of Management at Dartmouth.

He has been involved in a range of startups, serving as founder of Ripso LLC, a digital marketplace for sustainable production and consumption; as senior manager of operations for Zoox Inc., a San Francisco-based maker of self-driving electric vehicles; and as director of business development at Clean Marine Energy, a low-carbon shipping concern.

Perhaps most notably, he spent six years at Tesla Motors (Nasdaq: TSLA), starting in 2006, focusing on sales and marketing and retail development, and working with founder Elon Musk. He was there when the company launched its first production vehicle.

“When I got there it was 100 engineers in a garage” in San Carlos, Calif., Powers said. By the time he left in 2012, Tesla had 4,000 employees and had moved to Palo Alto, Calif.

He still clearly remembers driving in an early prototype.

“From the first acceleration, you felt the electric drivetrain. It felt completely different. Tesla is a product-forward company. It showed me that if you can make a product better than anything else out there,” there’s a place for it, he said. “It gave me an appreciation for the intense focus it takes to build something novel and new.”

Powers sees the same entrepreneurial spirit in some of the Maine Venture Fund›s portfolio companies, including Hyperlite Mountain Gear, a Biddeford manufacturer that’s making “gear that’s lighter and stronger … They bring the absolute cutting edge to products,” he said.

He also praised Atlantic Sea Farms, which has been a pioneer in bringing edible kelp to the market, while providing fishermen an alternative source of income.

Maine Preservation draws on NYC nonprofit for next leader

Tara Kelly, an executive with the Municipal Art Society of New York, took over as executive director of Maine Preservation in early summer. She succeeded Greg Paxton, who retired in June after 13 years at the helm.

Kelly, who moved to Maine from Brooklyn, N.Y., has a decade of experience in historic preservation, nonprofit management, policy and advocacy initiatives, public and education programming and fundraising, according to the Yarmouth-based nonprofit.

For the past five years, Kelly has been vice president of policy and programs for the Municipal Art Society of New York, a 128-year-old advocacy organization that promotes historic preservation, urban planning and public art in New York City. Previously, she was executive director of Friends of the Upper East Side Historic Districts in Manhattan.

Kelly “brings a wealth of relevant experience and energy to the organization,” the release said, particularly in light of the recent launch of Maine Preservation’s expanded programming and new upcoming advocacy initiatives.

Aside from her career experience, Kelly has served on the board of directors of the Isles of Shoals Association, the board of advisors of the Historic Districts Council and as an alternate director for the East Midtown Public Realm Improvement Fund Governing Group. She also has been a member of the Island Heritage & Artifacts and Property Standards Committees of the Star Island Corp.

She holds a master’s degree in historic preservation from the Pratt Institute and a bachelor of science in linguistics from Georgetown University.

Maine Preservation, chartered in 1972, is the state’s only statewide, nonprofit historic preservation organization.

The Roux Institute’s Techstars division hires Silicon Valley vet

Lars Perkins, a former software entrepreneur, angel investor and consultant for startups in California, was named managing director of a key Portland’s new Roux Institute Techstars Accelerator. He started April 12.

Roux Institute, which was established two years ago with $200 million in funding and is part of Northeastern University, is based in Portland.

The institute’s Techstars Accelerator is designed to gather and train entrepreneurs working in artificial intelligence, life sciences and health, as well as data and analytics.

Perkins comes to the position after a career in software dating back to an enterprise company he took public in the 1990s. Since then, Perkins has served as the founding partner and managing partner of Idealab’s Boston incubator, where he launched Picasa, a well-known company that produced software for digital photography.

After selling Picasa to Google in 2004, he joined the Menlo Park, Calif.-based Google for two years, including a year as director of product management, according to his LinkedIn profile. He is also a certified flight instructor.

More recently, Perkins has been angel investing and consulting for startups including Community.com, a Santa Monica, Calif.-based company that manages direct messaging with large audiences on behalf of celebrities and other public figures, as a way of “monetizing” their social networks without direct involvement.

Perkins lives in Camden, and for his new job will commute between the midcoast town and Portland.

Interim leaders

A seasoned leader at Maine Community Foundation

Sterling Speirn, Maine Community Foundation’s interim president and CEO, is a seasoned foundation executive.

He led the W.K. Kellogg Foundation from 2005-13, and most recently has served as a senior fellow for the National Conference on Citizenship.

Speirn, who started in June, stepped in for Steve Rowe, who will retire after six years at the helm. Speirn, who has degrees from Stanford University and the University of Michigan Law School, has also led other foundations and even worked at Apple Computer Inc. in the late 1980s, according to his LinkedIn profile.

A search for a new president and CEO will start this fall.

Maine Community Foundation ranked No. 2 on the list of Maine’s top 15 foundations, published last September in the annual Giving Guide. It had annual giving of $27.18 million for fiscal-year 2018, the most recent year available, and assets of $524 million.

A veteran officer tagged as Finance Authority of Maine’s interim leader

When Bruce Wagner, longtime CEO of the Finance Authority of Maine, retired on Feb. 5, the board called on a seasoned FAME executive to lead in the interim.

Acting CEO Carlos Mello, who is chief risk officer at the quasi-independent state agency, has been at the agency for nearly nine years. He is former president and CEO of Prudential Bank and Trust in Hartford, Conn., and is a certified financial planner. He holds a bachelor’s degree in accounting from Boston College.

Wagner had been CEO since 2014, led FAME through two strategic planning exercises and guided FAME through COVID-relief efforts, offering clients loan deferrals, modified terms and interest rates and other special programs.

Overall, FAME is a key part of Maine’s financing infrastructure, stepping in to guarantee loans. According to the most recent Mainebiz Book of Lists, FAME’s largest loan in 2019 went to Gallery Leather Manufacturing Inc. in Trenton. Of the $2.1 million loan, FAME’s exposure was $999,000.

In December, the FAME board approved up to $1.9 million in loan insurance and a $1 million direct loan to help support increased access to broadband in Belfast and South Portland. In essence, the agency insured 20% of the overall $9.5 million needed to construct a fiber network.

FAME was also an investor helping bring back the Saddleback ski area, in November approving issuance of a tax credit certificate related to $1.5 million in investments through the New Markets Capital Investment program. It had previously approved leveraged loan insurance of 17% (or $2.5 million) on a $14.1 million loan.

A search for Wagner’s successor is underway. FAME expects to fill the CEO position by late year or early next, subject to approval by Gov. Janet Mills and the state Legislature.

Still to be filled

Central Maine Power Co.

As of press time, Central Maine Power Co.’s president and CEO, Doug Herling, retired at the end of June. He had been at CMP for 36 years, including three as CEO. CMP has not named a successor.

0 Comments