2 firms battle over Kennebec Valley natural gas market

Despite its modest market demographics, the Kennebec Valley has become the site of a showdown between two natural gas providers vying to supply service to the area.

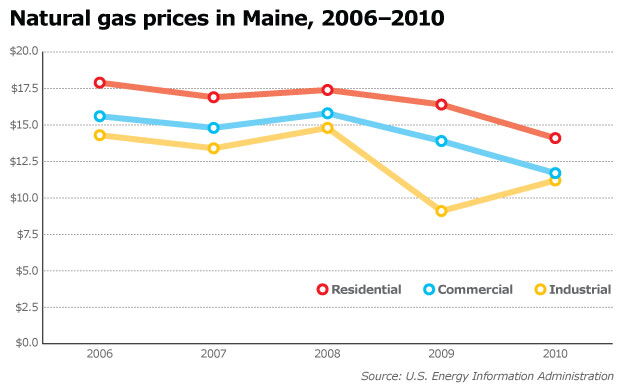

Falling natural gas prices have driven expansion throughout the state, with Mainers reporting between 30% and 60% savings in heating costs by switching to natural gas from oil. But the capital region is a relatively modest energy market in the state, with 52,000 potential customers and 25,000 homes within 10 miles of downtown Augusta.

That hasn't stopped Summit Natural Gas of Maine and Maine Natural Gas from simultaneously pursuing customers in the Kennebec Valley, with MNG inking a 10-year deal to supply Augusta's new MaineGeneral Medical Center and Summit obtaining a letter of intent to serve the city's 750,000-square-foot Central Maine Commerce Center. Now both companies wait for their chance to rebid on a lucrative state contract to provide natural gas to state office buildings in Augusta and Gardiner (see "A contract dispute," page 19).

MNG already has permission from the state to extend natural gas pipelines from an existing line in Windsor to new areas, and Summit expects to receive similar approval this month. But all the recent activity in the area begs the question: Why are these two companies so eager to serve the Kennebec Valley?

"The situation in Maine is not normal — in fact, it's extremely unusual," says Stephen Ward, a former member of the state's Public Utilities Commission and Maine Public Advocate.

Ward says the scenario playing out in Augusta wouldn't be possible if not for a unique quirk in Maine's public utility policy that allows multiple natural gas providers in the same service area.

"Typically a utility has a monopoly and the PUC oversees its pricing and services in order to simulate what competition would normally require for a viable business," says Ward.

But following two cases brought before the PUC in 1996 and 1997, the commission determined that because natural gas providers face so much competition in the marketplace, they do not need to be regulated as strictly as monopolistic utility services like electricity.

"It's a laissez-faire policy that lets the investment bankers decide if they are prepared to put money into an [area]," says Ward. "The assumption is that it is unlikely that two companies would build two parallel and overlapping sets of pipes in Maine."

That assumption is turning out to be false in the Kennebec Valley, where both Summit and MNG say they plan to pursue their plans for expanding into the region regardless of what the other is doing.

"We have the authority, we have the permits, we have the financing ... [and] we already have pipe in the ground with more on the way," says Dan Hucko, director of media relations for Iberdrola USA, the parent company of MNG and Central Maine Power Co.

"[Losing the state contract] would be a disappointment, but it's certainly not something that would stop us," says Timothy Johnston, Summit's executive vice president.

Corporate posturing aside, some energy experts say the PUC's assumption about utilities' wariness around building redundant utility infrastructure could be true, making the effort to serve the Kennebec Valley area a race against the clock.

"The concern is: Nobody wants to build a second pipeline to Augusta, and that's why they are competing to build the first," says Tony Buxton, an energy project development specialist with the law firm Preti Flaherty and the former co-owner of Kennebec Valley Gas Co., the first firm to propose building a natural gas pipeline in the region; the company was sold to Summit in the fall.

Buxton paints the Augusta battle as a sort of power play on the part of MNG, a subsidiary of Spanish utility giant Iberdrola that has been operating in the state since 1998. The Augusta project is the first foray into Maine for Colorado's Summit Utilities.

With the lucrative MaineGeneral contract under its belt, Buxton says MNG is positioning itself to corner the Kennebec Valley natural gas market, making it difficult for any other company to secure enough clients to make for a viable operation.

"Maine Natural Gas believes that if they can get Augusta lined up, they will be able to block Summit from Maine," says Buxton.

Chasing customers

While the state RFP process begins anew, the two companies are focusing on winning the hearts and minds of the Kennebec Valley residents and business owners, but going about it in very different ways. Summit is seeking letters of intent from municipal leaders within the Kennebec Valley while MNG focuses on soliciting binding contracts.

The competing strategies reflect the company's opposing business models, according to former PUC member Ward, with MNG putting more emphasis on landing large "anchor" clients like MaineGeneral while Summit is working to cultivate a mix of commercial and residential customers.

Ward says that as a subsidiary of Iberdrola, MNG's business presents "a couple of hairs on the tail of a very large dog, so their corporate strategy doesn't have a lot to do with building out natural gas [infrastructure] in Maine. They are proceeding very slowly."

Since 1998, Hucko says MNG has supplied natural gas service to 3,000 Maine customers. While 70% of its Maine customers are residential, they represent only 30% of MNG's revenues. Large corporate clients include Bath Iron Works, L.L.Bean, Bowdoin College and the University of Southern Maine.

"We find an anchor customer that is willing to enter into long-term agreement for a fair amount of natural gas and when we guarantee that revenue is going to come, we can start to add spurs and connect residential [customers]," says Hucko. "But it's driven initially by the large anchor customers."

By comparison, Summit has supplied 34,000 customers in seven rate areas throughout Colorado and Missouri since 1997. In the Kennebec Valley region, Summit has already lined up its own anchor client in Mattson Development, a developer with more than 750,000 square feet of local real estate.

"MNG's priority is landing anchor customers and letting in small customers when it's obvious that it's high demand, low risk," says Ward. "Summit has a very different approach. They've chosen to go into entire regions and hook just about everybody up, but [that] strategy is a more expensive one where you are running mains and pipes to locales where it's not clear when there will be high-density service."

"Summit has a much better prospect of serving everybody than MNG, [whose] growth has been very slow despite high demand for natural gas," says Ward.

The issue hits close to home for Ward, who has been involved with community action agencies like KVCAP, Midcoast Maine Community Action and PROP.

"Folks who depend on [low-income heating] programs like LIHEAP are now confronting an extremely difficult situation as heating oil continues to rise in price and federal resources get cut," he says. "I think it's a very sensible social policy to do whatever we can to help, and I think Summit fulfills that goal in a much more convincing way than MNG."

"The reason we chose Summit to sell to is that they have a strategy to serve as many people as they possibly can in a given community, with a target of 75%," says Buxton. "MNG's strategy has been to serve bigger loads and not a lot of residential customers. Unfortunately, that's not what the Kennebec Valley needs."

The drop in the cost of natural gas provides a unique opportunity for ratepayers, according to Buxton.

"You can go into a town like Madison, pay to replace the oil furnaces with gas heat, absorb that cost and still save customers $1,000 a year. We're talking about a 50% reduction in the cost of [heating] in the Kennebec Valley in one year; the opportunity to cut like that has ever happened in Maine before," he says.

Different business models

But the two companies disagree on how realistic the other is being with projections for service and cost savings across the Kennebec Valley and call into question their counterpart's business plan and profit margin.

Hucko says the MaineGeneral contract "is of a sufficient value (along with some other key agreements we have) as to make building the pipeline to Augusta a financially viable proposition for MNG even without a state contract."

Summit's Johnston disagrees.

"I look at the project they've described in the RFP, and it works economically if you include the State House ... But if you don't, it becomes much more difficult because they don't have a plan for getting to small commercial and residential customers like we do," he says.

Johnston says the natural gas demand for the state building contract works out to around 87,000 decatherms a year (one decatherm equals 100,000 BTUs). MNG's contract with MaineGeneral is another 100,000 decatherms, and the remaining service area that MNG could serve under its current plan would account for another 200,000 decatherms annually.

"Losing the State House would mean losing 20% of their anticipated connections," says Johnston. "That would put a big hit on their ability to make a return on that investment."

By eyeing the entire Kennebec Valley instead of just a narrow corridor into Augusta, Johnston says Summit would be able to turn a profit in the area even without the state contract. The regions consumes an average of 2.4 million decatherms of heat every year: More than enough to make up for the estimated 3% loss that losing the state contract would represent.

"Projects like the Kennebec Valley are what we do," says Johnston. "Nowhere else do we have less than 90% market penetration, and that's our vision for the Kennebec Valley, too. In the next five years, we would like to be in half the small businesses and homes, and in 10 years, all of them."

MNG also takes issues with Summit's proposed rate structure. Hucko says MNG's rates would be nearly half that of Summit's, which they say are far from the industry norm. For the state contract, Summit proposed a rate of $10 per decatherm while MNG's proposal came in at $6.08. Nationwide, natural gas prices for residential, commercial and industrial customers averaged $8.4 per dekatherm between April and September of this year.

"Their expected rates of return on investment start at 10%, then 15% and possibly up to 20%, which is really pretty high. Our average rate of return has been around 6.5%," Hucko says, adding that MNG has a fixed pricing structure.

Because they've proposed a more modest line into the region, MNG has lower overhead and can afford to charge less for service, according to Hucko.

"Summit can raise their rates if they are not getting the return on investment they expected. We suspect it's being driven by their owners, the J.P. Morgan Infrastructure Investments Group, who are expecting a certain return on investment," says Hucko.

Johnston confirms that Summit has the ability to raise or lower its rates subject to PUC approval, but says that, if anything, it would most likely be the latter.

"There is a provision where if the company is not earning the allowed rate, we could go back to the [PUC] and ask to have the rates raised, but the flipside is that if the company is over-earning, we would be expected to lower the rate as well," he says.

"We're a utility, so we don't go for a killer return. Utilities are good, low-cost, steady investments, and we have to stay with that philosophy for our investors," he says.

Comments