Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

MM&A's rail dilemma | If MM&A walks away from 233 miles of freight rail, will development stop in its tracks?

If Bob Grindrod, president and CEO of Montreal Maine & Atlantic Railway, was a more superstitious man, he would say the railroad he took over in January 2003 was cursed from the day the purchase and sales agreement was signed.

On that “infamous day” of Jan. 9, around noon, the papers were signed transferring the assets of the Bangor & Aroostook Railroad, which was in bankruptcy at the time, to MM&A. A few hours later, Great Northern Paper, the BAR’s largest customer, filed for bankruptcy. “If you think that was a coincidence, I have a bridge in Brooklyn I’d like to sell you,” Grindrod says on a recent morning in a conference room at MM&A’s headquarters in Hermon.

At the time, Great Northern Paper’s paper mills in Millinocket and East Millinocket represented 45% of the railway’s traffic, Grindrod says. The loss of its largest customer tapped MM&A’s reserves. The roughly $10 million MM&A brought to invest in the company “went down the drain to keep the railroad alive while Great Northern was flat on its back,” he says.

It took several months before the mill in Millinocket was back up and running under new ownership, and an additional year before the second mill was back on line. But the level of traffic from those mills never reached pre-bankruptcy levels.

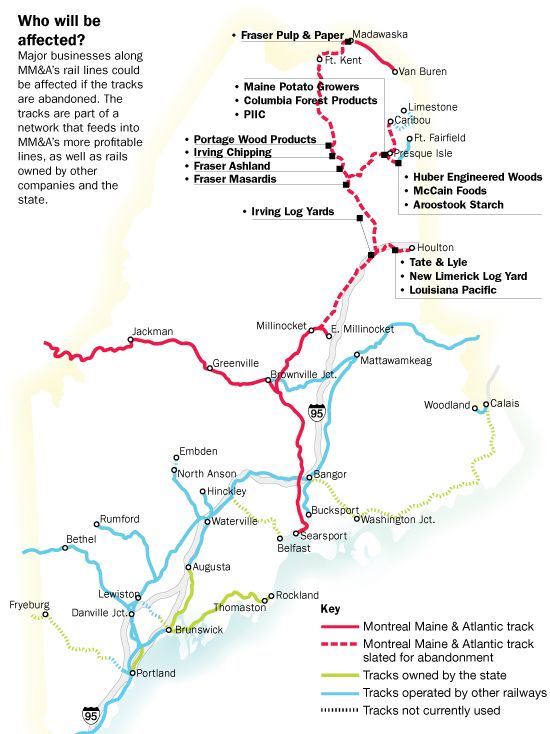

Fast forward to present day, after a downturn in the lumber market, the housing and credit crises, the recession, the closure of more mills, and MM&A is on its knees, bleeding money and seeking approval from the federal government to abandon 233 miles of track — roughly half the mileage it purchased in 2003 — that run between Millinocket and Madawaska, including eastern branches connecting to Houlton, Presque Isle and Caribou. Unlike a mill that can shut down for a few months to cut costs, when a railroad company goes deep into the red, abandonment is the only option, Grindrod says. “We can’t pick up and move assets where the business is better. We’re nailed to the ground here.”

The company in August 2009 made public its intent to abandon the tracks, and hinted that it wanted the state to step in and buy them. It wasn’t until February that the company filed its formal request to abandon the tracks with the federal Surface Transportation Board.

Grindrod says the company has done everything it could to keep the lines open, including laying off 35% of its employees (reduced from 325 to 205), enacting across-the-board 15% pay cuts, “Herculean efforts” to attract more customers, deferring an estimated $19 million in maintenance expenditures and reducing service to lower operating costs. But the economy, the reduction in shipments and resulting decreases in service created a vicious cycle that caused the company to lose $4.5 million last year on the lines. “An abandonment is a last resort,” he says. “We want to find a different solution, but having MM&A continue to manage the railroad and absorb the losses is not an acceptable solution.”

Faced with what would be a blow to northern Maine’s economy, the state has made it clear it does not want the lines abandoned, the tracks ripped up and sold as scrap. “The loss of rail service in Aroostook could be catastrophic for many Maine companies and communities,” Gov. John Baldacci said last month in a press release. “It’s clear that the state must act.”

After a failed attempt to secure federal funds to buy the tracks, which the state believes have a net liquidation value (the market value of an asset minus the costs associated with its disposal) of roughly $20 million, legislators pushed through a bond measure that includes borrowing $7 million, as well as using roughly $3.5 million from a transportation bond passed last year, to buy the tracks. The state would also use $7 million from its rainy day fund and look for the shippers on the lines to chip in $3 million. As this issue of Mainebiz goes to press, the state and MM&A are in closed-door negotiations in an attempt to find a fair and equitable price for the tracks. While the state pegs the value at $20 million, Grindrod says MM&A believes the value is closer to $27 million. Baldacci has appointed a task force, chaired by David Cole, commissioner of the Maine Department of Transportation, to oversee the state’s purchase and management of the tracks.

Assuming voters approve the bond, it seems likely that by the end of the summer the state will own the tracks and search for a way to keep freight service available to the 20 or so shippers who use the service. It’s possible that the state would lease the tracks to a third-party operator, and there’s been some discussion among private companies of forming a rail cooperative and bidding for freight that runs along the rails.

In any case, the state, the shippers and representatives of northern Maine say the tracks are crucial to the businesses that use them. The state estimates roughly 1,700 jobs are at risk if rail service is lost. The other, more intangible, losses are that of economic development potential. Losing rail as a transportation option hobbles the area’s ability to attract new business with remote markets, and the competitiveness of existing businesses that use rail for affordable delivery of products.

Economic development spur?

More than 80% of the freight on the tracks today is related to the forest products industry, making the railroad vulnerable to the housing crisis. Traffic on the portion of tracks slated for abandonment has been down between 35% and 40% since 2006, according to a report from Railroad International, a consulting firm hired by the state to study the tracks. Grindrod has watched revenue on his railway drop from a peak of $60 million in 2005, when both Great Northern mills were back on line, to $45 million in 2008 and $31 million in 2009. “I’ve said many times in public and privately that if we were a far bigger company and had far bigger reserves, perhaps we could wait out the recession and not have to abandon, but the simple fact is the best numbers I’ve seen from shippers is that a recovery is still three to five years away,” Grindrod says. “I can’t keep losing money at that rate for three to five years. The company will be dead by then and my board and investors would not like to see that become the outcome for obvious reasons.” (MM&A’s largest shareholder is the Quebec pension fund, Caisse de dépôt et placement du Québec.)

The rail line’s troubles are reflected along the abandonment route. The Louisiana Pacific mill in Houlton, which manufactures laminated strand board used in home construction, is one of the rail’s customers. Between 2003 and 2005, it shipped between 900 and 1,200 railcars a year out of Aroostook County. In 2009, that number plummeted to 130, says Travis Turner, the mill’s manager and a member of Baldacci’s task force.

The Louisiana Pacific mill is only operating at 20% capacity, but it’s not on its last legs, Turner says. Louisiana Pacific invested $140 million over the past three years to upgrade the mill. Turner says the railroad was a “key factor” in LP’s decision to invest in the Houlton mill rather than elsewhere and that LP “never would have invested in this plant had it not thought rail was going to be available.”

Turner, who recently moved his family more than 3,000 miles to manage the Houlton mill, says losing the rail would be a serious blow that would put the mill’s 80 jobs (150-160 if it were at full capacity) at risk. “We’d try everything we could to keep going, but it would definitely be tough to remain competitive without rail service,” he says. “I don’t want to sound all doom and gloom, but it wouldn’t be good for our plant.”

Stories from other shippers are similar. Higher transportation costs mean smaller margins and loss of competitiveness. John Cashwell III, manager of Portage Wood Products, which ships 150,000 tons of wood chips by rail to Old Town Fuel and Fiber, says “abandonment is an unacceptable outcome.” Allowing the tracks to be ripped up is “poor transportation policy,” he says. A recovery is inevitable, he says, and when it comes the tracks should be there to support the businesses that use them.

What’s at stake

No one doubts the loss of freight rail service would have an impact, but it’s a question of how much. Is rail service so important that the mills and businesses that use it would close without it? Or would businesses simply face some discomfort as they work to shift their freight traffic from railcar to truck?

Rob Elder, director of Maine DOT’s Office of Freight Transportation, points out that 90% of freight in Aroostook County is already shipped by truck. MM&A doesn’t think it will be hard for the shippers on the abandonment lines to transfer their freight to more trucks. (That would add an estimated 36,000 trucks to roads every year and cost an additional $3.6 million in annual highway maintenance costs, according to a consultant’s report.) However, that doesn’t mean shippers like Louisiana Pacific would ship their products to California by truck. In its abandonment application with the STB, MM&A mentions local transloading options, allowing transfer of freight from trucks to the MM&A tracks that are not being abandoned, including the possible construction of a transloading station in Millinocket. “We believe that rail customers served by the Abandonment Lines have alternative transportation, in the form of trucks and transloading opportunities, which will adequately replace MMA’s rail service,” Grindrod says in the abandonment filing.

It contradicts another stataement made by the company in August 2008, in an STB case involving a deal between Norfolk Southern Railway and Pan Am Railways that could potentially affect MM&A’s business in Maine. At the time, Joseph McGonigle, MM&A’s VP of sales and marketing, said, “In certain cases, the mills are highly dependent on rail service and likely could not survive if the most competitive rail routings were closed or made more expensive. The economic viability of MMA is closely linked to the well-being of these customers.”

To block the abandonment, representatives of northern Maine and the shippers must prove “that the harm that they will incur outweighs the harm to the rail carrier and interstate commerce resulting from continued operation,” according to MM&A’s abandonment application. MM&A doesn’t doubt shippers will be affected, but Grindrod believes the dour predictions are exaggerated. And, anyway, MM&A can’t help if it’s bankrupt. “This has become an economic development project, and a small company like ours can’t fund it,” he says.

The state has no interest in owning a railroad company, Cole says, but concurs with Grindrod’s assessment that this is an economic development project for the state. Because of that, Cole believes buying the tracks is appropriate. “Long term, this is the wood basket of the state, one of finest wood baskets in the Northeast. We can’t even speculate what products will be coming out of there in the future,” he says.

Investing $5 million to $10 million in upgrading the tracks over the first couple of years, Cole says, will allow for faster operating speeds and better reliability for shippers.

“I think it’s a risk worth taking at this critical juncture,” says Cole. “It’s the moment of truth. We tried the federal route. Now the state route is a last resort. But if we don’t step in and this abandonment takes place, and the tracks get scrapped and sold off, then this operation is gone and we might speculate in the future what might have happened if we stepped in.”

Whit Richardson, a writer based in Yarmouth, can be reached at editorial@mainebiz.biz.

Comments