Maine grocers squeezed by market newcomers

When Massachusetts-based Market Basket opens its first store in Biddeford as early as this July, it is expected to stir an already murky stew of competition in Maine's grocery business. That chain has a reputation for low prices and good service, but it's not the only one aiming to bite off a share of a market dominated by Hannaford Bros. Co. and Shaw's Supermarkets. Walmart Supercenter, Target, independent grocers and even drug stores like Rite Aid and dollar stores all are wooing an increasingly fickle, on-the-go consumer.

The escalating grocery wars mean lower prices for consumers, but possibly more belt-tightening and strategizing for traditional grocers, industry watchers say.

“Market Basket will ultimately drive down prices in other stores,” says Mike Berger, senior editor of The Griffin Report of Food Marketing in Duxbury, Mass. “There will be customer losses at all retailers. Market Basket has its own distribution center and it is non union. These two factors allow them to keep their prices low.”

Add to that shifts in consumer buying habits, more types of retailers selling groceries and household staples sold over the Internet (see “Is an online food fight imminent?” on page 18). Traditional supermarkets are fighting back with healthy choices, in-store dieticians, specialty foods, more freshly prepared meals and even greener buildings.

Twenty years ago, about 86% of groceries were bought at traditional supermarkets, but that has diminished to 49%, according to data by Malone Commercial Brokers presented at the Maine Real Estate & Development Association forecasting conference in January. Today, 25% of groceries are sold at Walmart Supercenter, while the remaining 27% is sold by Target, followed by Whole Foods, dollar stores, wholesale clubs, drug stores and other types of nontraditional grocery sellers.

A seismic shift

Shelley Doak expects Market Basket's entry into Maine to have as big an effect as Walmart's had 22 years ago. The executive director of the Maine Grocers Association in Augusta explains that while Maine was once dominated by local, independent grocery stores and larger stores like Shaw's and Hannaford, Walmart's emergence drastically changed that landscape.

“What sets Maine apart is the fact that we do have such a diverse retail channel for groceries,” she says. “Maine consumers ultimately benefit from these shifts. With Market Basket we will see another shift.”

All of the stores will be focused on brand loyalty and competitive pricing, she says, but contributions to the community make a difference as well, such as disseminating recipes, providing product information and even supporting Little League teams.

Hannaford, for example, does all of those, plus it has meats and produce delivered fresh daily, and has added organic, natural and gluten-free products to its shelves, says spokesman Eric Blom. The supermarket chain has a storewide Guiding Stars nutrition-navigation system that helps shoppers identify foods with the most nutrition for the calories using a shelf tag star system. Some of its stores have a pharmacy and some have areas customized to the local community such as a salad bar or a sit-down eating area.

“The heart and soul of our business is our face-to-face customers. The majority of grocery shopping is in person. And that's where we are focused now,” Blom says.

He adds that he's confident the dietician and healthy eating programs, along with the company's “Close to Home” local connections with partner farmers in Maine, help develop loyalty among customers. He could not give any figures about how those programs translate into revenues.

“Competition is something we are not unused to. We welcome the competition,” says Blom about Market Basket's forthcoming store. “It makes everyone sharper and better.”

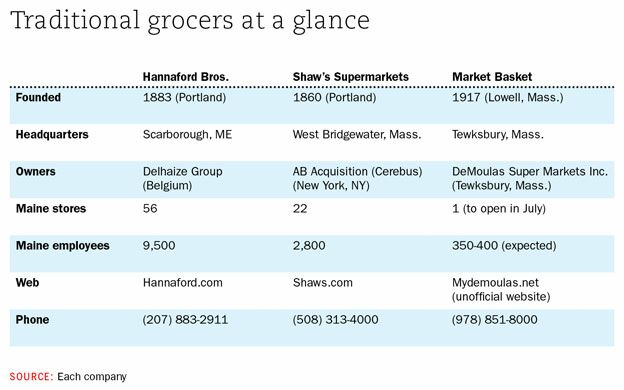

Hannaford is Maine's largest private employer, according to the Maine Department of Labor, with 9,500 full- and part-timers. It plans to add two new stores, one in Turner this summer and one later in North Berwick, each with 80-100 employees and sized about 35,000 square feet. Blom adds that Hannaford's recent employee downsizing and restructuring is complete. He would not comment on the number of layoffs that occurred in Scarborough.

Shaw's spokesman Steve Sylven says the chain is focused on developing and executing its plan, though he could not provide details. “Decisions are being made locally at Shaw's again for the first time in many years, and while I cannot discuss our strategies because we consider them proprietary, I can tell you that we are working to provide the products and services our Maine customers want,” he wrote in an email response to Mainebiz.

Keeping it simple

Bucking the trend toward frills and other extras, Market Basket plans to stay true to its successful strategy of selling a large variety of goods for low prices and keeping the shopping experience simple.

“Our format has been traditional supermarket offerings. We focus on variety and freshness,” says David McLean, operations manager at Demoulas Supermarkets Inc. in Tewksbury, Mass., which owns and runs the Market Basket chain. “Half of what our supermarkets sell is perishable. And busy stores allow produce to constantly rotate in.”

Simplicity of shopping is another key.

“We focus on keeping the shopping experience simple, with no gimmicks and no frequent shopping cards. We have no self scanners, which take twice as long or even more,” he says. “We have scan-and-bag with a cashier and bag clerk to get customers through lines as quickly and accurately as possible.”

There's a nostalgic element in the dark blue smocks, white shirts and ties worn by the baggers at Market Basket.

“Customer service is very good, and they're very old school in their operations,” says Michael Violette, senior vice president of sales and retail development at Associated Grocers of New England Inc., a Pembroke, N.H., wholesale grocery distributor owned by its more than 300 independent grocery retailers throughout New England. “And they do a good job of getting people out of the store.”

And unlike most employers, the concept of life-long employment continues at Market Basket.

“One strong point of our company is the longevity of our employees,” says McLean. “For career people, 20 to 40 years of service isn't uncommon. They can spend their whole life with one company.” He says about 25% of Market Basket's work force is career, full-time people, and 75% are part time, which will hold true for the upwards of 400 people the company plans to hire in Biddeford.

While Market Basket might seem to some to be invading the Maine grocery market, the company continues to focus on New England, and ironically is the only locally based major supermarket chain. Hannaford Bros. is owned by Belgium's Delhaize Group and Shaw's Supermarkets by Cerebus Capital Management's AB Acquisition of New York, N.Y.

In early January of this year, the city of Biddeford approved plans for Market Basket to move into the former Lowe's location off Route 111 at The Shops at Biddeford Crossing, which has 29 retail stores and restaurants, including Target. The site is now being redeveloped, with Market Basket expected to occupy 108,000 square feet. The largest Market Basket, located in Chelsea, Mass., is 135,000 square feet, making it one of the largest supermarkets in the country and possible the biggest for food offerings, with 60,000 different food items, McLean says.

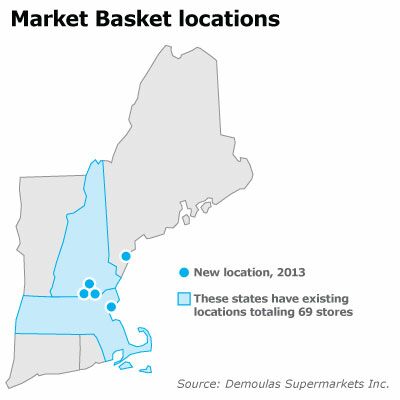

Market Basket, which has 69 stores in Massachusetts and New Hampshire, already has loyal customers and visibility in Maine. Some customers are transplants from Massachusetts who shop at its New Hampshire stores. And some Mainers work at the New Hampshire stores.

“We have many customers from Maine who have visited our stores along the New Hampshire border,” says McLean. “They wrote us and asked us 'When are you coming to Maine?'” He says if the current project stays on schedule, the Biddeford location is expected to open before the end of July.

The first Maine store is part of a series of new locations the company expects to open over the next few months. McLean says two new New Hampshire stores were scheduled to open in Bedford and Hudson in May, and a store in Nashua is slated to be replaced in June. A new store is planned in Revere, Mass., this fall, bringing the total number of Market Basket stores to 73. McLean says Market Basket looks for locations that are convenient to major driving routes and that are accessible from multiple directions. He didn't rule out additional locations in Maine, though he says there are no further plans yet.

Hannaford still leads the pack on the number of stores in Maine with 56, while Shaw's has 22. Walmart Supercenter has five stores, while Trader Joe's and Whole Foods each have one, according to the Griffin Report on Food Marketing October 2012 Market Share Report. The report listed others with fewer than 10 stores as Save A Lot (8), Big Lots (7), Food City (6), Paradis Family (6), IGA (5), Sam's Club (3), BJs (2), and Bourque's Market (2). There are 91 independent grocers.

Getting squeezed, tighter

Shaw's and Hannaford, already undergoing corporate reorganizations forced by market pressures, employ more than 12,000 people in Maine, so a further squeeze on their already scant margins could be felt throughout their communities. Each has had layoffs — Shaw's cut 700 positions across New England last November and Hannaford cut 350 earlier this year, both with an undisclosed number in Maine.

And while Berger says Market Basket isn't afraid to go head-to-head with Shaw's and Hannaford, the two big established grocery chains are no strangers to fierce competition.

“Our business hasn't changed much over the years. It's a penny business,” says Violette of Associated Grocers of New England Inc.

Adds Curtis Picard, executive director of the Retail Association of Maine, “What a lot of people don't recognize is that grocery has always been a very competitive sector in retail with very small margins of 2% to 3%.”

The Augusta-based group of 400 retailers includes Walmart.

“It has become more competitive in the last three-to-five years, especially with Walmart and Target. And consumers are changing their tastes,” Picard says. “But at the end of the day, most consumers are driven by price.”

A 2011 survey of supermarkets in the greater Boston area by Checkbook.org, an independent consumer organization, found that Market Basket, Walmart Supercenter and Target had comparably low prices on the 150 or so items that organization checked. However, Market Basket's prices averaged 21% below those at Shaw's and Stop & Shop, the largest chains in the area, and also major competitors in Maine. Walmart Supercenter's prices were about 19% lower, and Target's about 14%. That could translate into a price difference of $1,100 to $1,600 over a year for a family spending $150 per week at the supermarket, according to the Checkbook.org survey. Hannaford Supermarkets, with about a dozen stores in the Boston area, had prices about 6% lower than Shaw's and Stop & Shop. Trader Joe's, which carries many of its own brands, wasn't necessarily higher priced, while Whole Foods' prices were about 22% higher than the average prices at Shaw's and Stop & Shop.

More low-cost supermarket options are nearby for shoppers, such as Target, but they lacked variety. Checkbook.org found that it had only 56% of items in its selection of national brand products in stock, meaning shoppers would have to go elsewhere to get all their groceries. When Checkbook.org substituted cheaper generic and store brands for about 20% of the items in its basket, the prices dropped by about 7% at the two large chains. One Costco store was surveyed, and it beat Shaw's by 36%.

Sustainable sourcing

For their part, long-standing chains like Hannaford Bros. and Shaw's Supermarkets hope to deflect the newcomers' advances with services focused on healthy eating and local food sourcing. And independent grocers are trying to hold their own with traditional personalized service, home baked goods and better meat offerings. About 30 independents in Maine have developed distribution relationships with Hannaford under the Shop 'n Save name, says Hannaford spokesman Blom. That lets them take advantage of larger volume purchasing so they can pass the savings along to customers.

“There are a lot of promos and unique things in the stores, but it has always has been that way,” says Picard of the Retail Association of Maine.

Even Market Basket is succumbing to the trend at its newer stores. The Biddeford store will have a Markets Kitchen that will sell prepared food like sandwiches and meals-to-go, says McLean. Those who want to eat at the store can sit in an area with tables, free Wi-Fi and large-screen TVs. The store also plans to have a Markets Café with specialty coffee, tea, fresh fruit drinks and gelato. Thirty stores so far have a Markets Kitchen and about a dozen have the café.

“We're also adding a full-service gourmet meat case in the butcher's shop with high-end meats like Angus and choice,” he says of the Biddeford store.

Market Basket also is expanding its organic, health food and gluten-free items. Like Hannaford and Shaw's, it carries national labels and its own private brands. McLean says the new Maine store plans to forge ties with local farmers and flower greenhouses, as it does in New Hampshire and Massachusetts.

“We've seen a significant bump up during the noon hour and evening when people are coming from work,” says McLean of the company's kitchen and café areas. He would not disclose how much those areas were contributing to sales at the privately held company nor any other financial information. He adds that the chain has no intention of offering Internet home delivery or curbside food services.

Another strength of the chain, McLean says, is that it doesn't have zone pricing.

“All of our pricing is the same in all stores, except for items regulated by states, like milk and cigarettes,” he says. “And customers get the same prices even when they're on vacation.”

Consumer tastes change

Some of the new offerings from the supermarkets are in response to consumer trends, which have more people buying on-the-go, including from the Internet, as well as seeking healthy, locally sourced and fresh foods. But price still rules.

“People are price driven. They will go to four or five stores to get lower prices,” says Berger of The Griffin Report. “But some don't have the time to do that. A big general trend now is that more and more venues are creating food, for example, drug stores like Walgreen's and CVS have more food, though still not a great selection. But they are open 24 hours and offer convenience.”

The economy also is driving consumers, says Violette of the Associated Grocers.

“People are very conscious of what they are buying and they are buying down [cheaper items]. There's more [value] at dollar stores, which are giving them an alternative.” He also says consumers are trending away from one-stop shopping. “People can do a lot of shopping at Market Basket, and then also shop at Hannaford and Shaw's [for the extra services],” he says.

The question is how far consumers will drive to save money.

“The neighborhood grocery store is still very much a part of the future of Maine,” says Doak of the Maine Grocers Association. The question is whether 20 cents less for a can of peas will make a difference.

Says Doak, “Time will tell.”

Read more

Hannaford drops prices amid growing competition

Shaw's cuts rewards card, joins price wars

Market Basket now open in Biddeford

Hannaford's nutritional rating shifts buying habits

Portland Food Co-op plans storefront expansion

Market Basket gives ultimatum to protesters

Ousted CEO reaches deal to buy Market Basket

Comments