Investors drive boom in multifamily home sales

Multifamily homes are selling as soon as they hit Portland's hot housing market, spurred by high demand for rental units and millennials seeking passive income, home equity and an alternative to the stock market.

“Rentals in Portland are driving sales, also in Biddeford and Saco,” says John Graham, a broker at Sullivan Multi Family Realty in Portland. The pool of potential renters for multifamily units is strong, since Portland has a less than 3% vacancy rate and Saco-Biddeford and Lewiston-Auburn each have around 15%.

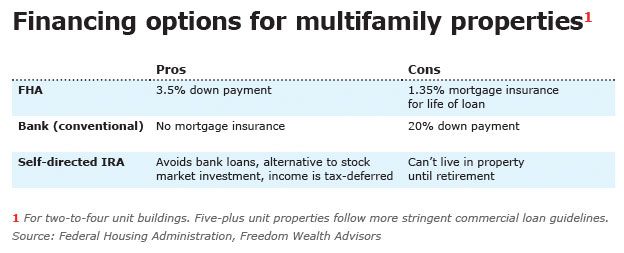

The allure of multifamilies is strong. Current renters can instead own a building, pay about the same or even less monthly and build equity while living in one unit and renting the rest to help cover the bills. While mortgage loan rates have risen in the past few weeks, they're still historically low, prompting buyers to move off the sidelines in anticipation of appreciating home prices. Banks also are loosening their purse strings, and alternative types of financing are coming into play.

“Rates are still really low. I thought it was a smart idea to buy and looked for something that will pay for itself,” says Amy Mullen, 25, a marketing manager for mobile advertising company Liquid Wireless. She recently bought a three-story, 2,600-square-foot multifamily on Cumberland Avenue in Portland that has two units. She initially will live in one and rent the second, but might eventually buy a house and rent out both. She figures she can get $1,800 in rent for the three-bedroom unit and $1,050 for the two-bedroom one, including utilities, cable and Internet. She paid $282,000 for the property with a 3.5% down payment Federal Housing Administration loan and a 3.7% mortgage.

“It seems like a trend to me,” she says of buying the multifamily. Indeed, a co-worker bought a multifamily a few weeks ago, her parents are looking for one and her grandmother bought one a couple of months ago.

“It's for the extra income. I'm using it as an alternative to stocks,” she says. The initial driver to buy, she says, was her $410 monthly rent that didn't yield any equity. Now, she pays about $600 in an equivalent of rent, but owns the property.

As Portland goes…

The trend also is catching on in the Saco-Biddeford area, say real estate professionals, who expect it to spread to other population centers statewide. In Biddeford, for example, the real estate market hasn't been strong in four or five years, but it has seen a drastic improvement, Graham says.

“Investors are buying up short-sales and foreclosed homes,” he says. “There are enough buyers cleaning stuff up that the inventory is going down. And the average sales price is creeping up.” He has 43 listings so far this year in Biddeford of two-to-10 unit properties, and has 20 pending sales. That's compared to 60 to 70 listings for all of 2012.

Lewiston-Auburn also is heating up. “The trends are created in Portland and the outlying areas follow suit,” notes Chad Sylvester, broker at Fontaine Family Realtors in Auburn. He says there are 129 multifamilies listed in Lewiston and Auburn, with 107 of them being the smaller two-to-four unit buildings that are owner-occupied.

“This is an opportunity for passive cash flow. It's almost too good to pass up,” says Scott Surapas, mortgage development officer at Bangor Savings Bank in Portland. In fact, more people are looking for multifamilies than there are places to buy, a trend especially noticeable among first-time homebuyers in Portland. But he says buyers are being a lot more conservative now when borrowing. “They are more concerned with the real world payment [including other costs] than the qualifying payment,” he says.

The bank has developed a 10% down payment specialty loan called the Welcome Mortgage for those homebuyers. Unlike FHA loans, it requires no mortgage insurance, which can cost several hundred dollars monthly. Another bonus to the 10% loan is that expected rental income may be used as qualifying income. Still, he advises keeping a diverse portfolio — not putting all your money into real estate — to shield it from market fluctuations.

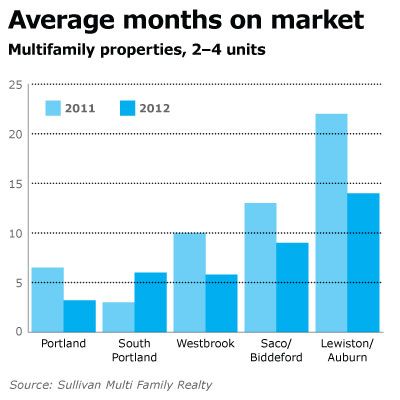

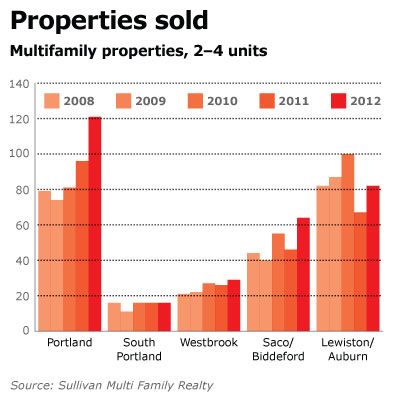

Most multifamily sales now are the two-to-four unit buildings, which qualifies them as residential sales subject to typical bank loan qualifications, since many of those units are owner-occupied. Sales of such units rose 25% in Portland from 2011-2012, 12% in Westbrook, 39% in Saco-Biddeford and 22% in Lewiston-Auburn, according to a Sullivan Multi Family Realty report on the multifamily market.

The commercial market for multifamily buildings with five or more units — where loan qualifications are tougher — also is starting to turn around, Graham says.

“Local banks have decided the market won't keep falling, so they've gotten back into the game in the past year. Before that, [commercial] buyers couldn't find financing.”

His sales now are about 60%-70% first-time buyers versus about 30% for commercial buyers, who are primarily investors and landlords who put 25% down. Portland short sales are less than 1% and in Biddeford about 5-10% of sales.

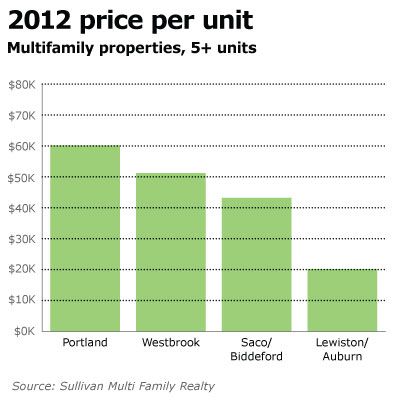

The financing and owner occupancy result in different per-unit values in the multifamily buildings. Residential buildings in Portland have per-unit sales prices averaging $100,000, while commercial mutifamilies sell for around $60,000 per unit, according to Sullivan report estimates.

Most of the residential multifamily home sales are to first-time buyers, many of whom are using FHA loans and putting down 3.5%.

“That could be $15,000 to $20,000 down, so they get their money back in two-to-four years,” says Graham.

“The cost to own is the same as a tenant, including water and sewer,” says Brit Vitalius, principal at Vitalius Real Estate Group in Portland. “Taxes and water and sewer are high in Portland, so it's hard to get ahead of accruing value on a property. They're doing it for future wealth planning.”

Vitalius says the multifamily market has been hot for the last year, and dramatically so in the spring. In early July, he perceived a slight slowdown, but said it was hard to know how much of that was attributable to higher mortgage interest rates or summertime. He says he sells a couple hundred residential multifamilies a year, about 20-30 per month, but only 10 commercial units annually.

“Portland is a small city where a handful of owners control most of the five-unit and up properties and they're not selling,” he says. “The rental market is so good.”

Sleepless nights

As many first-time landlords will quickly discover, having tenants isn't about just passively collecting rent checks. Rental property must be run like a business, with a budget and interactions with the tenants.

“They think they can make money on a multifamily while they sleep, but now that they're a landlord, they'll never sleep,” cautions Graham.

Just ask Alex Fabish, 29, office manager at Pension Professionals in Biddeford, who with his brother Ben, 25, also co-owns four properties in Saco and Biddeford that span the residential and commercial space.

“With a stock portfolio you read the statement once a month for five minutes,” Fabish says. “You don't get called in the middle of the night because a tenant is fighting with his wife.”

Fabish says he won't compromise on getting at least a 10 capitalization rate, which is the annual net operating revenue divided by the cost to buy the property. He and Ben own four properties: a three-unit, a four-unit, an eight-unit and a 16-unit. He bought two using regular residential loans and two with commercial loans. The down payments came from savings, help from people he knows and, in one case, money from the seller.

“I worked and saved money since I was young, so I had money for this,” says Fabish, who spends 30-40 hours a week managing the properties on top of his regular job. He's also frugal, living simply in a $400-a-month apartment.

“I like McDonald's. I like Budweiser. I find deals. I pay cash,” he says.

The income he pulls in goes far beyond expenses, he says. He's seeing an influx of renters tired of Portland's high prices moving to Saco-Biddeford.

For Fabish, the extra cash each month will go toward enjoying life later. “I make short films and am a musician, so I'd like to back out of work at some point and spend some time doing creative things, maybe travel,” he says.

Commercial rebounds

Like Fabish, Anthony Fratianne has not shied away from buying commercial properties, which along with more stringent bank loan requirements, also can be in rougher neighborhoods and in need of more repairs.

“I'm always looking for more,” says Fratianne, 37, who is general counsel and senior vice president at Liberty Cos., a real estate development company in Portland. He owns 33 multifamily units in five buildings. “I'm expanding into manufactured housing, because it's hard to get the type of properties I want anymore. I can't get them fast enough to buy them.”

Also like Fabish, he looks for a high return, and is getting a cap of 9 to 11. So for a property for $100,000 down, he expects cash flow of $15,000 a year. “If you had $100,000 to invest in a bank CD, the average return is 0.3%–0.4%,” Fratianne says. He finances the purchases through his savings, money from family and bank loans.

And lately, he's used a favorite vehicle of the commercial retail sector: the 1031 Exchange, which allows investors to defer capital gains taxes on the exchange of like-kind properties.

“One of my properties in the East End [of Portland] appreciated. So that $100,000 in equity would have had a $35,000 tax liability,” he explains. He'll defer that tax liability by selling the East End property and buying another through the 1031 Exchange.

Fratianne invests in commercial multifamilies in lieu of the stock market.

“I'm highly against buying retail stock. The odds are against you,” he says. “I'm a cash flow investor. I look for cash flow from Day One. My retirement fund is building up. I'm using passive income to build wealth.”

Comments