Low prices pose challenge to lobster's upscale image

It's not the kind of publicity lobster marketers necessarily would have wanted. During a June 7 airing of the radio show Boston Public Radio, hosts Jim Braude and Margery Eagen spent a good 10 minutes chuckling over the fact that a Walgreens store in Boston was selling live lobsters. The pairing of a drug store and live lobster was just too unappetizing for them, and they compared it to a Wisconsin taxidermist shop that sells cheese.

“Are you OK buying a live pound-and-a-halfer next to a display of foot powder?” Braude asked. Eagen wondered if you had to fess up to party guests about buying the lobster at a drug store. Boston Magazine also ran a tongue-in-cheek blogpost about the Walgreens lobster. Before the end of the month, Walgreens pulled the lobster from its Boston store, but it continues to sell live lobster in three locations in Portland and Ellsworth, according to a Walgreens spokesman.

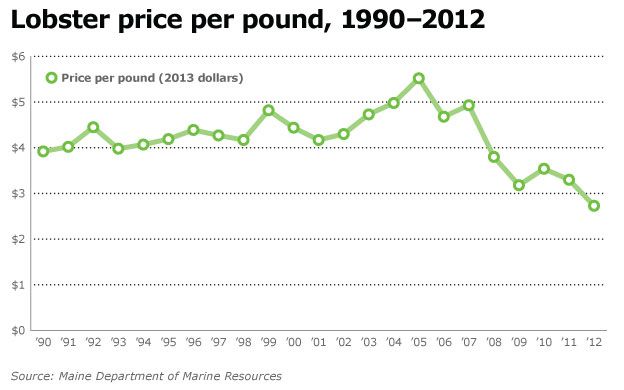

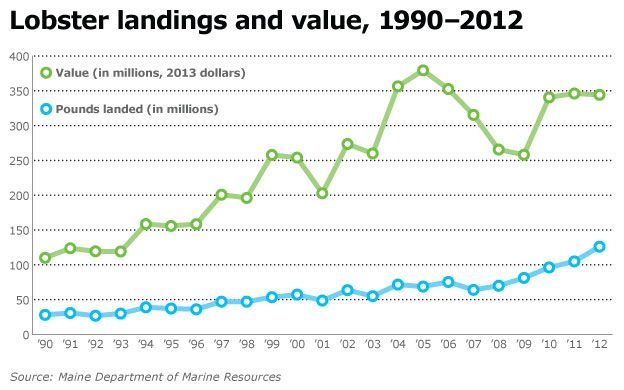

It may be an odd way for a drug store to branch out, but it's emblematic of the crossroads where the Maine lobster brand finds itself. Lobster landings are up, way up, from historic figures. Maine lobstermen caught 123.3 million pounds of lobster during the 2012 season, which represents a 15% increase from 2011 and an 88% increase from landings two decades ago, according to Maine Department of Marine Resources figures. The glut in the market has driven prices down to the lowest lobstermen have seen in 18 years. Meanwhile, warm water temperatures have caused lobsters to shed their shells much earlier than usual, meaning lobstermen have been catching soft-shelled lobsters, which don't ship well, before tourists arrive to eat them. There's a need to move a lot of lobster through the marketplace without devolving the lobster brand into a commodity, says Marianne LaCroix, acting executive director of the Maine Lobster Promotion Council.

“The challenge is that we have a premium brand product and there's a lot of it in the marketplace,” LaCroix says.

Lobster industry stakeholders agree that the future of lobster marketing will have to include an approach that expands the marketplace for Maine lobster while still maintaining its cache among culinary circles. That market expansion has taken on an improvisatory feel in the last couple of years, as lobstermen and lobster dealers have had to scramble to unload their swelled landings. In 2012, it was common to see lobstermen alongside the road selling their lobsters for $2.99 a pound from the back of pickup trucks. Coastal communities organized cash mobs to buy lobster at break-even prices from local lobstermen. Chain restaurants, from Panera to McDonald's to Papa Gino's, all began offering the now ubiquitous lobster roll. While there is some value in exposing more palettes to the taste of lobster and it was vital to find a market for all that extra lobster, there is a downside to marketing it in mass quantities, says Emily Lane, vice president of sales at the Calendar Islands Maine Lobster Co.

“There's a commodity side of it that doesn't do anything but diminish the value,” Lane says.

It may be hard to picture Maine lobster losing its prestige at a time of the year when lines of tourists are spilling out of restaurants that serve the state's most popular crustacean, but lobster's popularity has always ebbed and flowed, says Lou Greenstein, a New England culinary consultant and a food historian. In the second half of the 19th century, for example, lobster's value depended on where you lived. In Chicago, the rich paid premium prices to have lobster shipped by railroad car in wooden barrels packed with ice. Along the coast, the value of a lobster was much less.

“There was a great perception of value for the lobster in other communities,” Greenstein says. “But in Maine, the kids who lived on the coast, that was what they had to take for lunch every day because that was all they had.”

A marketing mindset

One problem has been that the Maine Lobster Promotion Board's budget, which ranges between $350,000 and $400,000, has been just big enough to market lobster locally, not nationally or internationally, says LaCroix. The 2012 season was one of several recent stress tests of the lobster industry's market readiness, and results found the industry lacking, wrote Patrice McCarron, executive director of the Maine Lobstermen's Association, in a September 2012 newsletter.

“It's become painfully clear that the Maine lobster industry has failed to adequately invest in building consumer demand for Maine lobster,” McCarron wrote. “We have failed to consider how to match our business and harvesting strategies with the realities of 21st century markets and a more-than-100-million pound fishery.”

Maine lobstermen, by and large, have come to agree that something new must be tried. In a series of meetings this past winter, lobstermen and lobster industry officials discussed new strategies. In the end, it came down to two options: limit the number of days at sea or invest in a new marketing push. Maine lobstermen elected to throw their weight behind legislation that would increase fees for fishing licenses to fund a more robust lobster marketing effort, said David Cousens, president of the Maine Lobstermen's Association.

“Hopefully, in three or four years, it will pay dividends. We look at it as an investment,” Cousens says. “It's the lesser of two evils.”

With lobstermen lending their support, the measure passed through the Maine Legislature and was signed into law this past month. The new law will dissolve the Maine Lobster Promotion Council and create a new entity, called the Maine Lobster Marketing Collaborative.

It's envisioned that the collaborative will become a professional marketing arm for the Maine lobster industry, and its budget will grow in phases to $2.25 million by 2015, funded through incremental fee increases. Such a marketing budget might pale in comparison to the Alaska Seafood Marketing Institute's $21 million budget, the nation's largest statewide seafood marketing arm, but it represents the largest collaborative marketing push in Maine's seafaring history.

Months before the law passed the Legislature, the lobster industry has been planning how to shape the new marketing strategy. The Maine Lobster Promotion Council hired the New York marketing firm Futureshift to study current perceptions of Maine lobster among industry stakeholders and end-users. Interviews with more than 180 chefs, processors and food managers already have yielded some surprises, says Jon Stamell, CEO of Futureshift. For example, common knowledge about Maine lobster isn't as common as we thought. Some chefs and food managers interviewed didn't know the difference between the Maine and Canadian lobster industries, or even the basics of hard-shell versus soft-shell lobster. Those gaps in knowledge could be filled in with a strong marketing narrative, says Stamell.

“There's a tremendous opportunity for the lobstermen to directly tell their stories to the end users who want to hear it,” Stamell says.

The way lobster is valued in culinary circles is also evolving, he says. Conventional wisdom says that hard-shell lobster is the prize and that soft-shell lobster meat is less desired, but many chefs report they were happy with the sweeter flavor that can be found with soft-shell lobster meat, Stamell says. That could be a very beneficial perception to cultivate if the shedding season continues to pull ahead of the tourist season.

“The opportunity Maine has is to redefine what quality lobster is,” Stamell says.

Futureshift and the promotion council soon hope to acquire the funding for the marketing firm to write recommendations for the next steps in boosting the Maine lobster marketplace. But recent trends suggest some possible avenues for growth.

Boosting the brand

Recently, the council and lobstering stakeholders collaborated to bring a small group of South Korean chefs over to learn more about Maine's lobster industry, says Lane. The chefs went out lobstering, attended workshops and cooking classes and toured lobster processing facilities. Asia and Central America are important emerging global markets for Maine lobster, and giving buyers a connection to the state's lobster fishery is invaluable, Lane says.

“We'd like to see more of this occurring, bringing the end users to Maine and educating them about lobster and about Maine,” she says.

Another way to boost Maine's lobstering brand is to accent its green credentials. That effort achieved a milestone in March when it was announced that the Maine lobster fishery had been certified as sustainable by the Marine Stewardship Council. Such distinctions matter for green consumers, and it's vital for Maine's lobster industry to be the first in line to establish its green credentials, says Harold Daniel, an associate marketing professor at the University of Maine in Orono.

“Whoever gets there first is probably going to be able to get those benefits,” Daniel says.

Another key to strengthening lobster in the marketplace is building up Maine's lobster processing capacity and the growth of value-added lobster product lines. In the last decade, several major lobster processors have come online in the state. This summer, the former Stinson cannery in Gouldsboro will become home to a new lobster-processing venture, Maine Fair Trade Lobster, run by two heavyweights in the seafood industry, Garbo Lobster and East Coast Seafood. Maine businesses like Calendar Islands have had success marketing frozen lobster products made with processed lobster meat, including creating innovative fare like lobster quiche, lobster ragu and lobster tails split for grilling. Finding new ways to capitalize on lobster meat from soft-shell lobsters can reduce the downward pressure on the marketplace. It also utilizes lobster meat that otherwise might be relegated to the scrap bin, says Greenstein.

“The further down the fish chain you can go and acquire revenue for each strata, that makes you successful,” Greenstein says.

Ultimately, Stamell believes, efforts to boost Maine lobster will need to pursue multiple avenues to boost sales while maintaining its iconic brand in the marketplace.

“I think the future of the Maine lobster industry is diversification,” Stamell says. “It's basically about more lobster going into more channels for more uses more often.”

Craig Idlebrook, a writer based in Massachusetts, can be reached at editorial@mainebiz.biz.

Comments