Wealth managers seek baby boomer clients

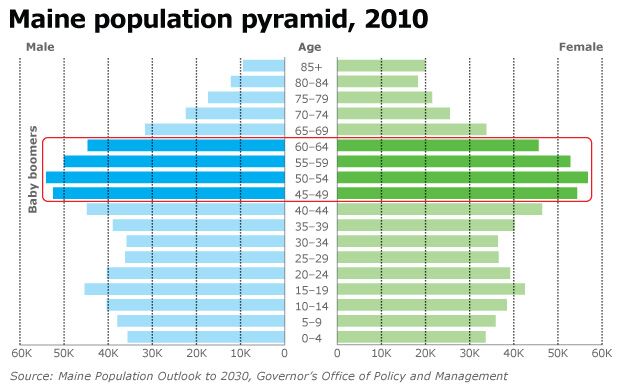

The baby boomer cohort of 390,000 Mainers is closing in on retirement with shaken confidence and a slew of complicated questions. Thanks to the Great Recession of 2008, the leading question of “When can I retire?” has become, for many, “Will I ever be able to retire?”

Even boomers who had been building retirement savings diligently through personal individual retirement accounts or company-sponsored 401(k) plans — and thought they were on track to retire comfortably within a few years — have had to reassess goals because of investment portfolios still recovering from recession losses. Risk management is coming more to the forefront for those closest to retirement age, tempering the return-based focus that guided their years of building retirement savings. The same holds true for questions about health care costs and long-term disability insurance, monetizing their home equity, providing for aging parents or paying off a portion of their children's college loans.

For Maine's banks, investment planners and other wealth management companies, those questions and the movement of almost 30% of Maine's 1.3 million people toward retirement create a business challenge that is also an opportunity for a long-term,trusted adviser-client relationship: As a white paper called “Mining the retirement income market” by the consulting firm Deloitte concludes, “Given that the average boomer may spend 25 to 30 years in retirement, planning will become more of an ongoing education process than a point-in-time event. The adviser will likely focus on assembling solutions to meet a broad array of needs, then adapt those solutions as client needs evolve through the various phases of retirement.”

Bangor Savings Bank, with $2.3 billion in trust, fiduciary and investment assets, has taken note of the emerging shift in boomers' perspectives from simple asset accumulation to asset payout. The bank has created a new business line devoted to fee-only financial planning that focuses on retirement goals such as meeting health care needs, budgeting, estate transfers and shifting the investment focus from growth to security.

Annette Lease, a bank vice president and senior financial planning officer, says the new fiduciary service provides financial advice based solely on a client's best interest and is not influenced by investment product options or commissions.

“It's scary,” Lease says of the financial challenges baby boomers face heading into retirement. “Accumulation of wealth is their comfort zone. As folks are retiring or looking to retire, their thinking begins to shift into the distribution-of-wealth mode. They have been self-directed for a while, but now they have a sense of needing expert advice. They want to share that burden with someone who lets them know what their options are and can knowledgably advise them on what they should do [to support their retirement goals].”

Before launching its fee-only wealth management service, Lease says the bank tested the concept in a pilot program with solicited clients and non-clients who agreed to participate in a five-week process designed to bring their finances into sharp focus. The participants were not charged, but knew from the start what the fees would have been so that they'd have a benchmark for judging the value of the service.

“We got invaluable feedback,” Lease says, noting the pilot group included retirees as well as people five to 10 years away from retirement.

Given the comprehensive nature of the fee-only financial planning service, Lease says the bank has built a team of planners based in Bangor and Portland who've achieved Certified Trust and Financial Advisors status from The Institute of Certified Bankers, a subsidiary of the American Bankers Association. The credential requires three years of wealth management experience, two weeks a year of offsite training with the ABA, passing an exam and earning 45 continuing education credits every three years to maintain the designation.

There's no minimum asset requirement for prospective clients, but Lease says the $150 hourly fee for 20 hours per year creates a $3,000 litmus test for the service. “Folks who are not comfortable with that won't sign up for it,” she says.

The financial advice covers a full array of retirement-related issues, including tax-efficient investment strategies and approaches to withdrawing assets; anticipated health care costs; Social Security, insurance and risk considerations; estate planning; and personal financial goals such as travel or relocation.

HeadInvest

Carl Gercke, chief investment officer of HeadInvest, a Portland investment counseling and wealth management firm founded in 1989, agrees with Lease that decisions become more complicated as baby boomers head into the distribution phase of their investment program.

“The market declines in 2008 were poorly timed for the baby boomers,” he says. “Your last 10 years of work are supposed to be your highest retirement investment phase. People's plans took a hit … they don't have enough time to recover their losses, to take the risk [with retirement looming]. It's a huge conundrum. Most often the response is 'I have to work longer.'”

Responding to the needs of boomers heading into retirement, HeadInvest's services have evolved in recent years to provide a broader array of advice than simply whether a particular stock or bond is likely to be a good investment. Like Bangor Savings Bank's new program, he says, those services are offered on a fee-only basis.

HeadInvest's typical clients are both “mass affluent” (having between $500,000 and $1 million of investable financial assets) and “high net worth” (with $1 million or more of investable financial assets). Gercke says boomers in the first group, as well as those who are still building assets to reach those levels, are more likely to be panicked about supporting their lifestyles in retirement, especially given the virtual disappearance of the pension plan among private sector employers. The latter group is more likely to be focused on legacy issues such as bequeathing their wealth to heirs or achieving specific philanthropic goals.

There's no question, he says, the competition is fierce among the different types of wealth managers, with the trend for each of them being toward more holistic financial advising. That, in turn, puts an even higher value on the expertise of the financial counselors and the confidence their clients have in the advice that's given.

“The idea of having a trusted adviser puts a premium on stability in our client relationships,” Gercke adds.

Although not directly tied to the mid-September announcement that HeadInvest's management team had purchased the firm from Androscoggin Bank in a transition to becoming an employee-owned firm, Gercke says that move gives him and the other financial advisers greater control over their destiny in a rapidly changing arena that also includes reaching out to the children of baby boomers.

“Most of our clients are older,” he says. “So it's in our business's best interest to develop relationships with their children to maximize the chances they will continue using our firm.”

H.M. Payson & Co.

Founded in 1854, H.M. Payson & Co. in Portland is an independent registered investment adviser and trust company with more than $2 billion in client assets. Its services are fiduciary and the majority of its accounts are high net worth clients, although in recent years the number of its mass affluent clients has grown. Prospective clients must have a minimum of $400,000 of investable financial assets to qualify for the firm's financial management services.

Most wealth management advice is a value-added service covered by the fee clients pay the firm for managing their account, says Thomas Pierce, H.M. Payson's managing director.

“Part of what we do is managing the money, part is acting as trustees, part is offering advice,” Pierce says.

John Beliveau, chairman of the Wealth Management Group and a principal of the company, says the time and resources devoted to the advice component has increased in recent years, driven in part by the boomer generation closing in on retirement. For many of them, he says, their financial investments in the last 12 to 13 years of their prime top-wage period of employment have not been as productive in earnings as they'd wished.

Even those with higher available assets to invest are finding “their spending expectations or needs are in excess of what their resources can provide for in retirement,” he says. “Their 'nest egg' is simply inadequate to provide for the lifestyle they had prior to retirement.”

Whatever the level of retirement savings, Beliveau says H.M. Payson's financial planning process begins with an analysis of the client's financial priorities and their respective costs, both short- and long-term, in relation to their retirement savings. Inevitably, the discussion enters the realm of tradeoffs — what priorities might have to be scrapped in order to achieve the top ones. Quite often, the tradeoff is deferring retirement a few more years in order to build up savings and delay the drawdown of those assets.

“We can't say 'Don't retire yet' without knowing those tradeoffs,” says Beliveau. “We show them the economic impacts of making those decisions, so that whatever direction they choose to go, their decisions are well informed.”

Chip Weickert, a managing director and chairman of the Portfolio Management Group, says retired boomers who've started drawing upon their retirement savings should resist the common impulse to immediately shift into a protective investing mode.

“We spend a lot of time educating our clients,” he says. “We think the mainstream conventional wisdom [of putting everything into low-risk, low-return investments upon retirement] is bad advice.”

H.M. Payson's approach, he says, is to differentiate the short- and longer-term needs and allocate investments accordingly, with higher-yield investments made to hedge paying for the long-term needs whose cost isn't always predictable.

The biggest risk boomers will face in their retirement years? “Too much spending,” says Beliveau. The second, he says, is making emotionally driven investment decisions — whether it's putting their children's needs before their own or being too fearful in making investments.

“This is where investment counsel becomes extremely important,” he says.

With the last of the baby boomers reaching age 65 in 2030, wealth managers have their work cut out for a good number of years to come.

Comments