Thermogen prepares to enter budding bio-coal market

As a startup company using a revolutionary microwave process to create bio-coal, Thermogen Industries LLC stands at the threshold of market viability.

To cross it, the company needs long-term contracts to launch itself into the renewable energy market, where other biomass-based fuels such as wood pellets have had a significant head start. It's a problem that John Hallé, president and CEO of the Portsmouth, N.H.-based Cate Street Capital, which owns Thermogen, is ready to tackle.

“The guarantee from FAME is really the catalyst that brings everyone to the table … this is a true public-private partnership,” he says of the $25 million loan approved by the Finance Authority of Maine on Oct. 17. That loan leverages the final equity investments needed to capitalize the $70 million torrefied wood manufacturing plant Thermogen plans to build in Millinocket.

If all goes according to schedule, Thermogen would begin delivering torrefied wood, also known as bio-coal, to industrial customers by the fourth quarter of 2014. The next phases of the $250 million project are expected to come online in the third quarters of 2015 and 2016.

“Millinocket will prove the market,” Hallé says of Thermogen's phased approach that includes a separate project in Eastport to build a bio-coal plant. The company hopes to begin construction of that $120 million facility by 2015.

The $370 million question, then, is who Thermogen's customers will be and whether the company will be able to deliver its bio-coal at prices and quality standards that are competitive in a marketplace that's been dominated by white pellet providers. The pellet industry has already cornered the market in Europe, and plans to open 14 new or expanded plants — primarily in the southeastern United States — to meet what it expects will be a growing demand for its proven and relatively cheap product. Conversely, Thermogen is still testing its premier product — Aurora Black bio-coal pellets — and won't have a price point until the product is ready for market.

There's no question, though, that the pellet market is growing: The North American wood pellet industry exported a record 3.2 million tons in 2012, according to the North American Wood Fiber Review. NAWFR reported pellet exports increased from an estimated $40 million in 2004 to almost $400 million in 2012. Much of that demand is driven by European countries' efforts to reduce their dependence on fossil fuels and CO2 emissions — a European Union program called “20-20-20,” which sets targets to reduce greenhouse gas emissions by 20%, increase consumption of renewable energy to 20% and improve energy efficiency by 20% by 2020.

Hallé says his conviction that Thermogen will succeed is based on those European trends, as well as emerging markets for environmentally friendly alternatives to coal in the United States, Canada and Asia. He says Thermogen's bio-coal pellets — which have an edge over wood pellets due to their higher BTU heat, durability, resistance to weather and interchangeability with coal — underscore his father's long-ago advice on how to succeed in business: “Find a need and fill it.”

Thermogen's marketing plan

The company's analysis of projected international demand for wood pellets as a coal substitute shows the market exceeding 20 million tons per year by 2017. To put that in perspective, at full buildout of its facilities in Millinocket and Eastport, Thermogen expects to produce 800,000 tons of bio-coal per year.

“We want competition, we need competition,” Hallé says, noting that the projected demand for wood pellets far exceeds the ability of any one manufacturer to fulfill. Bio-coal's penetration of that market depends on ever-greater quantities becoming available for testing and sale, which he believes will prove bio-coal's superiority over white pellets and drive even greater demand for Thermogen's products.

“The South has been putting out 2.2 million tons of white pellets the past few years,” he says. “I'm willing to bet 50% of them will convert to torrefied wood within five years.”

Significantly, the analysis identifies the U.S. utility market as having greater potential than Thermogen envisioned even a year ago. That's due to environmental regulations bringing the United States more in line with tougher carbon emissions rules in the United Kingdom, EU and Japan. Among them:

- New Environmental Protection Agency regulations on mercury and toxic substances in the air that require coal-fired utilities to significantly reduce mercury, chlorine and other emissions. Bio-coal burns like coal without producing harmful emissions.

- EPA rules, due in June 2014, that will impose carbon emission reduction requirements on coal plants, which is expected to provide extra incentives to use bio-coal as fuel.

- New EPA rules require future coal plants to include carbon capture and sequestration technology, which is expensive and likely to stop new plants from being developed.

Thermogen's market summary indicates several U.S. utilities have done lab tests of its Aurora Black bio-coal and have expressed interest in “conducting trial burns of thousands of tons of pellets as they become available.” Those utilities use 130 million tons of coal annually.

“The timeline for development of regulations that will provide the main driving force in this sector aligns very well with Thermogen's development timeline,” the summary states. “We expect to obtain orders for trial burns as the first Thermogen plant comes on line that can rapidly be turned into long-term … agreements.”

Another potential U.S. market envisioned by Thermogen is the 39 universities that burn approximately 2 million tons of coal per year for heat and power. Several are looking to use renewable sources to meet 100% of their energy needs. The summary says two major universities have tested Thermogen's pellet samples and “believe that torrefied pellets are an ideal substitute for coal.”

“Both have provided written 'expressions of intent' letters to pursue test burns of 500 tons in 2014, with greater volumes to follow,” the summary states.

In Canada, where national and provincial regulations are pushing utilities to significantly reduce or eliminate coal for electricity generation, the Canadian Wood Pellet Association projects the annual demand for bio-coal as a replacement fuel will exceed 5 million tons per year by 2015, increasing to 11 million tons per year by 2020. Thermogen has a letter of intent from at least one Canadian utility for a test burn of 30,000 tons of bio-coal at one of its plants. That particular utility projects a long-term need of 300,000 tons of bio-coal per year.

Successful test burn

In the UK, the University of Leeds completed a year-long evaluation of bio-coal at a South Wales power station last spring. The bio-coal used in those tests was made with the same Rotawave technology that Thermogen will use. A March 4 article in Renewable Energy News reported the tests showed “bio-coal can also be introduced as a co-firing fuel into coal-fired power plants with little or no need for the often costly modifications required by other biomass sources.”

Thermogen has met with several UK and EU utilities interested in converting their power stations to biomass fuel. The UK's Bioenergy Strategy, for example, expects that 80% of the biomass needed for its power plants will be imported.

“The nearest wood basket for Europe is the United States,” Hallé says. Additionally, Thermogen will use wood certified by the Forest Stewardship Council for its bio-coal, which helps EU utilities meet their sustainability and green-energy targets.

And finally, Thermogen has met with a Japanese multinational corporation as that country scrambles to create alternative power plants to replace its crippled nuclear power industry.

“Today, every day, our marketing effort is moving forward,” Hallé says. “We're making great headway. In the US alone, we have five RFPs for torrefied wood.”

Clearing the hurdles

Deloitte, the world's largest consulting firm, specializes in analyzing emerging business trends. Its 2012 report, “Is biomass the answer to 2020?” identifies five factors influencing the market for biomass fuel:

- Regulation: Government support for reducing carbon emissions and encouraging alternative fuel sources to coal is the key driver for an assured biomass market.

- Availability of fuel: In countries with limited supplies of domestic biomass fuel, Deloitte expects the majority will be imported, with North America being a prime source.

- Sustainability credentials: Deloitte says biomass fuel must be sustainably sourced and its overall carbon footprint sufficiently lower than coal and other fossil fuels for it to remain credible as an alternative.

- Supply chain: Investments in biomass handling, logistics, port and rail facilities will be critical.

- Financing: Conversion of existing coal-fired power stations requires considerable investment — notably in handling and storage facilities and boiler modifications.

Ned Dwyer, Cate Street Capital's point man for both of its investments in the Katahdin region, is a 26-year veteran of the paper industry who is president of both Great Northern Paper Co. in East Millinocket and Thermogen, located eight miles to the west in Millinocket. He says Thermogen is in a strong position in relation to the five factors identified in the Deloitte study … particularly those that are in the company's control.

Fuel availability is hardly a problem, he says, given Thermogen's location literally at the end of the 70-mile Golden Road, which offers easy access to a wood basket of 4.8 million acres. In Eastport, Thermogen will use wood waste and biomass from the woodbasket used by the Woodland Pulp mill in Baileyville. Access to two wood baskets is a big plus, says Hallé.

“No utility wants to buy from a single source,” he says. “It's important to have more than one facility. You also want to diversify your wood basket.”

Likewise, Dwyer says Thermogen easily meets EU sustainability credentials, since all the biomass and wood waste it will use will be certified by the Forest Stewardship Council. Bio-coal is considered carbon neutral, he says, as each tree captures the same amount of CO2 from the atmosphere that is released in the manufacture and combustion of the fuel.

The Millinocket site offers several supply chain advantages, he says, that will help lower manufacturing and transportation costs: low-cost electricity from the adjacent Brookfield 105MW hydropower plant; an onsite rail line with access to Searsport's deepwater port; and an existing chip pad and ramp capable of handling the 50 daily truckloads of biomass needed for the torrefaction process.

Besides proximity to a sustainable wood basket, the Eastport plant is expected to benefit from an automated bulk handling system at the port of Eastport and the port's efficiency in loading and offloading ships.

All these assets, Dwyer says, make Thermogen's Aurora Black pellets competitive in bio-coal markets. But he, too, acknowledges the key is securing those first long-term customer contracts.

“You get customers under contract, so you can anticipate with something more than a hope, what your demand will be in subsequent years,” he says. “It's all about hitting a single every day. Reliability, for utilities supplying electricity to a grid, is the No. 1 importance.”

Maine's stake

Tim Sklar, president and founder of Sklar & Associates, a South Carolina consulting firm whose portfolio includes advising emerging bio-fuels projects, knows firsthand the challenges Hallé and his Thermogen team face in commercializing bio-coal. A South Carolina torrefied wood project he's been advising remains stalled in the “chicken-or-egg” stage of development.

“I've been in project development my entire life, and this is the hardest project I've ever worked on,” he told Mainebiz.

Sklar, a frequent contributor to BioFuels Digest, says based on what he knows about the Thermogen project — especially its low-cost hydropower source — the company may be able to lower its initial capital costs enough to achieve a competitive price.

He also thinks lower shipping costs due to the plants' proximity to deepwater ports and the company's phased-in approach to development stand in Thermogen's favor.

As for Thermogen's chicken 'n' egg dilemma, Sklar says Thermogen must get the first plant “proven” at commercial scale and then get a commitment for the torrefied wood it plans to produce at a price that will support the project. Finally, he says Thermogen should only expand as the market develops and finance that expansion after the financial viability of its first plant is achieved.

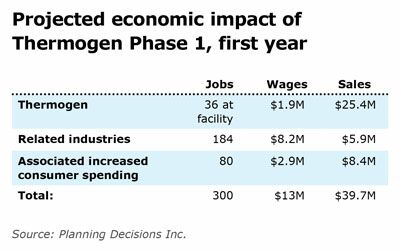

Sklar's caveats echo those raised by FAME staff in their analysis of Thermogen's $25 million guaranteed loan request. While the first phase's creation of 36 direct jobs and more than 200 indirect jobs would provide “significant public benefit,” the analysis cites three key risks:

- The industry is in its very early stage. This is a startup project for which there are no interim financials for the industry.

- The success of the project is based solely on attaining its projections.

- Thermogen does not have contracts that will actually tie the assumptions to the projections submitted.

Hallé acknowledges the concerns are valid, but says Gov. Paul LePage hit the nail on the head at FAME's Sept. 30 meeting when he pointed to the region's high unemployment rate and urged the board to “take the risk for the reward … [of being] a frontrunner in a new industry.”

“If you don't do anything, the risk is incredible,” Hallé says, citing the 21% local unemployment rate prior to Cate Street's purchase of the shuttered Katahdin Paper Co. mills in 2011. Since the fall of 2011, when Cate reopened the East Millinocket mill, the region's unemployment rate dropped by roughly half. The mill now employs 257.

Thermogen, which expects to directly employ 130 people at full capacity and create another 650 indirect jobs in commercial logging, rail and shipping and trucking services, would bring the unemployment rate down to the state's current 7% average, he says.

“At the end of the day, the risk the state is taking is a lot less than the risk I'm taking,” Hallé says. “It's a substantial and meaningful commitment we're making. There is a risk, but the rewards are fairly sizable.”

Correction: A previous version of this story incorrectly stated the status of the Woodland Pulp mill. The mill is in operation and is the largest employer in Washington County.

Comments