Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- September 22, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Farm Credit East merger seen as beneficial to Maine farmers, loggers, commercial fishermen

Photo / Courtesy Farm Credit East

Daniel Corey, an Aroostook potato farmer, says the Farm Credit System plays a key role in supporting Maine's natural resource-based industries.

Photo / Courtesy Farm Credit East

Daniel Corey, an Aroostook potato farmer, says the Farm Credit System plays a key role in supporting Maine's natural resource-based industries.

Photo / Amber Waterman

Jill Eyre, assistant vice president of Farm Credit East, says the merger brings opportunities for the two Maine offices to provide expertise not previously possible.

Photo / Amber Waterman

Jill Eyre, assistant vice president of Farm Credit East, says the merger brings opportunities for the two Maine offices to provide expertise not previously possible.

Daniel Corey planted his first crop of potatoes on a 52-acre farm in Aroostook County in 1986. He was a first-generation farmer, eager to make his living off the land and about to be married. He considers himself lucky that early on he found a financial partner in Farm Credit of Maine to help him navigate the unique business challenges he would face as a farmer, such as weather and volatile commodity markets, which are outside of his control, but nevertheless can determine whether his farming business will have a good year or bad.

“When I started out, I didn't know who to talk to,” he says. “With Farm Credit of Maine, I found a lender that understands my business.”

Corey acknowledges that Farm Credit of Maine — which merged with the much larger six-state Farm Credit East on Jan. 1 and assumed its name — is not well known outside of the agricultural, timber and logging and commercial fishing industries it serves as a lender and provider of financial services. Yet, with more than $633 million in loan commitments throughout the state, he says the customer-owned cooperative plays a key role in supporting Maine's natural-resource-based industries.

“When times are really good, banks are eager to loan you money,” he says. “But when times are really tough, banks tend to pull back. Farm Credit of Maine will help you get through them. They're not going to leave you … I've got to have that security, of knowing they'll stick with you through the ups and downs [of the potato industry].”

A 'seamless' merger

In a phone interview with Mainebiz from his office in Enfield, Conn., James Putnam II, executive vice president of Farm Credit East, says the merger with Farm Credit of Maine creates a financial institution with more than 70% market share of agriculture lending across seven Northeast states. It has more than 13,700 customers in the region, including 793 in Maine.

Farm Credit of Maine's 50 employees operate out of regional offices in Auburn and Presque Isle. By joining a six-state cooperative with 400 employees, 19 local offices and $930 million in capital reserves, Putnam says, the Maine co-op improves its lending capacity and will be able to offer its customers better rates through CoBank, the national cooperative bank that provides wholesale loans and other financial services to Farm Credit East and other affiliated Farm Credit associations. For Farm Credit East, Putnam says the merger adds diversity to its $5.57 billion loan portfolio and gives its members in the other six Northeastern states access to the expertise of Maine staffers, primarily in the forest products and potato-growing sectors.

It's now the 10th largest of the 80 Agricultural Credit Associations across the nation, he says.

Putnam says the merger was driven by the desire of both institutions to improve services, diversify their loan portfolios and generally achieve a stronger capital base that would be able to weather any major economic downturn. Each institution's board of directors, he says, began discussing the possibility of joining forces last summer, and by late August had reached a merger agreement. Following review and approval by the federal Farm Credit Administration last fall, stockholders of both cooperatives approved the merger on Nov. 22.

“Both of our associations were doing very well,” he says, noting that the 13,000-member Farm Credit East ended the 2013 fiscal year with record earnings of $116.6 million, while the 800-member Farm Credit of Maine closed the year with $6.78 million in earnings.

Assistant Vice President Jill Eyre, who's worked at Farm Credit of Maine for 19 years, says the merger has been “basically seamless.”

“Everyone kept their jobs,” she says. “Our customers are dealing with the same loan officers. Our branch locations are the same.”

Adds Putnam, “We made sure that customer service wouldn't suffer as a result of the merger.”

Eyre says the merger opens up greater opportunities for Farm Credit East's customers in Maine, including access to financial services such as payroll, tax management and business consulting, estate planning, financial benchmarking, grant-writing, appraisals and crop insurance. “Being a smaller association we wore many hats,” she says. “There's a lot of excitement about having those resources being available in Maine … There are opportunities for us to make loans and provide expertise that we didn't have before.”

A unique mandate

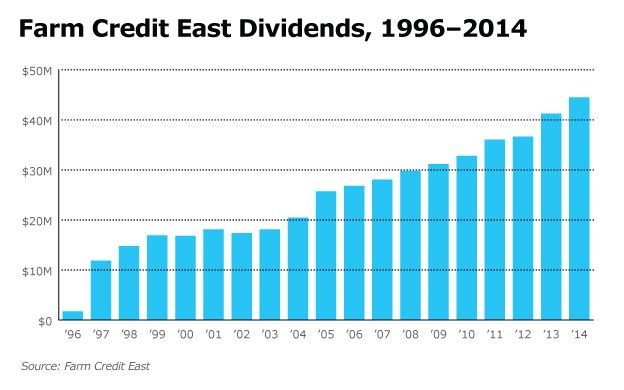

Created in 1916 as a government-sponsored entity with a mandate to serve agricultural borrowers, the Farm Credit System is a network of financial cooperatives that are owned and operated by the farmers, loggers, fishermen and rural customers it serves. Unlike banks and credit unions, whose assets are built by deposits and interest on loans, the Farm Credit System's loans are financed solely by the sale of debt securities and bonds. Earnings on those loans are either retained for additional lending or returned to the cooperative's member borrowers through what are called “patronage” dividends. In 2013 Farm Credit East returned $42 million in dividends to borrowers, while Farm Credit of Maine returned $2.5 million.

“The people who borrow from us own us,” Putnam says. “Like any dividend, it's not a guarantee. It's one of the benefits of being a member of a cooperative. If things have gone well for the cooperative, members get to share in that success.”

New borrowers who qualify for a loan pay a $1,000 fee to become a member, which gives them a share in the Farm Credit East cooperative. “It's a one-time once-in-a-lifetime deal,” he says, adding that with membership comes the right to vote on candidates for the board of directors and on issues that might come up.

Farm Credit East's yearly patronage payments show steady growth from $10 million in 1998 to $42 million in 2013, which Putnam says is an indication that the Northeast's agriculture, timber and other natural resource sectors are generally doing well despite a weak economy following the 2008 recession.

Having a long-term perspective is very much a part of Farm Credit East's approach, Putnam says, citing the struggles of the Northeast dairy industry in 2009, when the price of milk dropped by almost one-third in a month's time. He says 90% to 95% of dairy farmers were “under water.”

“Both of our associations continued to lend funds to dairy farmers during that time to help them out,” he says. “We got through it by continuing to provide the loans and increase the lines of credit. In 2010, the dairy industry turned around and it was all paid back.”

Challenges and opportunities

Roughly half of Farm Credit Maine's loan portfolio is devoted to timber management, logging and other forest product companies. That's not surprisingly, given the forest industry's prominence in Maine — with a total economic impact of $8 billion and direct employment of 17,075 workers, according to a 2013 study by University of Maine economist Todd Gabe.

“Owning and managing timberland is a very capital-intensive business,” says Donald White, a board member and shareholder of Prentiss & Carlisle, a Bangor-based forest products company that manages more than 1.5 million acres of timberland throughout the United States and Canada and is a Farm Credit customer. “Timberland transactions go very, very quickly. You have to have the ability to commit very quickly … Over the last 28 or 30 years there's been no one else in their league.”

White, a Farm Credit of Maine board member who now serves on Farm Credit East's board, says there's a distinct advantage to being limited by federal charter to making loans only to natural resources industries such as farming and logging: It forces Farm Credit's loan officers to know those businesses exceedingly well. And that translates into quick decisions, he says, as well as expert advice on weathering downturns in the forest products industry.

“I've spent more time schooling up loan officers at commercial banks about our needs than you can imagine,” he says. “There's almost a bank on every street corner, but what makes Farm Credit special is that they know you and in very short order you can get a loan approved. With Farm Credit, I can be pretty sure the loan officer I call today is the same guy I've dealt with for years.”

Hank McPherson, owner of McPherson Timberlands Inc. in Hermon, agrees. His company handles acquisitions for larger companies, buys timberland for resale and manages its forest holdings as a resource with multiple uses. He's been a customer of Farm Credit of Maine since the late 1980s, was chairman of its board just before the merger and is now one of three Maine members of Farm Credit East's board.

“We work on revolving lines of credit,” he says, noting that the timber and logging industries have been challenged in recent years by sluggish housing starts and reduced production volumes at paper mills. Those conditions are part of the cyclical nature of the forest products industry, he says, and sometimes result in periods when the return on investment might be low or nonexistent.

Farm Credit's loan officers and directors understand those economics, he says. Of Farm Credit of Maine's borrowers, 98% are at the “acceptable” risk level [the best of five categories], and 2% are in the “substandard” level. Only $2.5 million of the association's loan portfolio of $633 million in 2013 was deemed as “high risk.”

“If you look at the industries we serve, none of them are 'high margin' industries,” acknowledges Farm Credit East's Putnam.

In 2014, Putnam says housing starts are picking up, interest rates remain low and more balanced fuel and feed costs should help dairy farmers. He expects the farming, forestry and fishing sectors in the Northeast will continue to diversify into global markets — noting, for example, that Northeast dairy farmers anticipate exporting 15% of their products to China this year.

Aroostook potato grower Corey, the third Maine representative on Farm Credit East's 18-member board of directors, shares Putnam's optimism about the long-term outlook for Northeast farmers.

Twenty-eight years after his start on a 52-acre farm, he now produces 1,000 acres of early-generation seed potatoes and another 2,500 acres of oats, wheat or barley. He also owns and operates Seed Pro Inc., a tissue culture facility and greenhouse in Island Falls for producing nuclear potato seeds under controlled conditions, and is president of Corey Equipment, a seller of containers, trucks and farm equipment. He sells seed potatoes throughout the Eastern Seaboard. In 2007, he became the first U.S. potato farmer to export seed potatoes to Brazil, an international venture that has expanded to include Uruguay and Egypt as well.

With two sons in college studying agriculture and a 2012 college graduate daughter who was named 2013 Young Farmer of the Year by the Maine Potato Board, his thoughts increasingly are turning toward sustainability and making sure his family's second-generation farmers will be able to build upon his legacy.

“You have a trustworthy financial partner who will stick with you through the ups and downs you face as an agricultural business,” he says. “That's what helps you sleep at night.”

Read more

Cooperation proves a winning strategy for Maine credit unions

FAME's new CEO Bruce Wagner sees room for more financing programs in improving economy

Cooperation proves a winning strategy for Maine credit unions

FAME's new CEO Bruce Wagner sees room for more financing programs in improving economy

Farm Credit East 'By the numbers'

• 13,700 customers in seven states, including 793 customers in Maine

• More than 70% market share of farm lending across seven Northeast states

• Largest lender to agriculture in the Northeast, with $5.57 billion in loan commitments, including $633 million in Maine

• 454 agricultural specialists, including 50 in Maine

• More than $493 million in patronage dividends distributed over the past 18 years to its customers/owners

• $116.6 million in earnings in 2013, with Farm Credit of Maine reporting $6.78 million in its FY 2013 earnings

Source: Farm Credit East

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Comments