Michael Kors joins upscale newcomers to Portland

Michael Kors, designer fashions. Microsoft Store, software and games. Hyatt Place and Courtyard Marriott, hotels. Munjoy Heights and 118 on Munjoy Hill, upscale condominiums. Maine magazine's new Portland-focused Old Port magazine.

These national brands and upscale developments represent the new Portland, a city that has transformed itself over the past five years to now be recognized by developers, retailers, hoteliers, tourists and restaurateurs as a prized destination for quality of life, tourism and top-notch restaurants. Indeed, Business Insider magazine recently named Portland as a Top 14 travel destination for 2014, one of only two U.S. cities to get that honor, writing, “America's other Portland has been gaining a reputation as a funky low-key destination that prizes quality food and cutting-edge art.” The magazine noted the 500 new hotel rooms expected to open in the next two years.

And in his January “state of the city” address, Portland Mayor Michael Brennan cited the $250 million worth of commercial and residential development in progress.

“I've heard of well-known stores that are now looking at the mall or downtown,” says Craig Gorris, general manager of The Maine Mall in South Portland, which is close to 100% occupancy compared to 85% three years ago. “You're saying, 'Wow, they're thinking of coming here.'” The Maine Mall itself is full of “coming soon” signs for a flurry of newcomers over the summer, including Michael Kors, Linda Bean's Lobster Café, French beauty store L'Occitane and high-end furniture seller Lovesac, joining relative newcomers J. Crew, LUSH and The Bon-Ton Stores.

Adds Susan Morris, one of the developers of the upscale 118 on Munjoy Hill, condos soon to be built at 118 Congress St. and targeted at well-heeled baby boomers, “As life progresses, we want to be in a very livable city. Portland seems to be the hub of what we're involved in.”

Morris and Chip Newell, her husband and co-developer, initially tried to buy a condo in Portland, but didn't find what they wanted and decided to build their own condo complex, which also will have two commercial spaces. “We had an idea of the kind of things we wanted, like indoor parking,” she says. “Call me a princess, but I just want my car in an indoor garage. I don't like shoveling snow.”

Flush with cash

In the past three years, Portland has absorbed just shy of $400 million in public/private investment going toward projects that are either built or under construction, with another $138 million in the planning stage, according to the November 2013 Economic Growth Highlights report by Portland's Economic Development Department. That includes the $17.5 million Courtyard by Marriott (131 rooms and 14 high-end apartments/condos) and the $14 million Hyatt Place Hotel (123 rooms), which will be called the Canal Plaza Hotel, and the $10 million boutique Press Hotel (110 rooms) in the former Portland Press Herald building. The Press Hotel is to be completed in April 2015, and the other two hotels are due to open in May. The Westin Portland Harborview (on the former Eastland Park Hotel site) opened last December.

“I'm really excited about the Press Herald redevelopment,” says Justin Lamontagne, a broker with The Dunham Group, a commercial real estate company in Portland. “It takes an old empty office building that we had on the market for several years and reuses it for hospitality. It will bring some real vitality and life to upper Exchange and Congress streets.” He adds that large, empty buildings can cast a pall on a neighborhood.

Lamontagne has seen positive activity in Portland's industrial real estate market that is continuing into the second quarter of this year. While there aren't many businesses coming from out of state or abroad, there is a tenant “shuffle,” he says, with local businesses moving into new spaces.

One example is furniture store Ethan Allen, which moved from its location near the Maine Mall to downtown Portland last fall. “It moved to a space where customers can experience their furniture,” says Lamontagne. The company's Commercial Street space is about half that of its previous location.

One issue with retailers wishing to locate in downtown Portland is the low vacancy rate, he says. “There's [little] opportunity for retailers to relocate,” Lamontagne explains. Restaurants compose the bulk of the retail deals.

Those that do squeeze in, however, can do business more affordably than in Boston or New York City, he adds, plus the way of life in Maine is attractive to them.

That lower cost may not apply to residential real estate. “It's a hot, exciting city,” he says. “And people are paying a premium to live here. Look at all the high-end condos springing up.”

High entry fees

For those seeking a piece of Munjoy Hill, the minimum for a condo at 118 on Munjoy Hill is $600,000. The condos come with a view of Casco Bay or the Portland skyline. An example on the website of the development, scheduled to break ground in May, shows one of four available floor plans with about 1,900 square feet, two bedrooms, a bonus room, a deck and two-and-a-half bathrooms. Living is on one level, and there is indoor parking.

So far, four of the 12 units are sold, and Morris says she hopes all owners will be in by next March or April. The building caters to people who are downsizing from the suburbs or who have a second home in Florida, and people who work out of their homes and need extra space.

“I didn't come to Maine to develop,” says Morris, who with her husband developed hundreds of condos in Washington, D.C. The couple now lives in Boothbay Harbor, but spends a lot of time in Portland. “Last June we decided we wanted a place in Portland for lifestyle reasons,” she says. “We love the art and culture, and a walkable downtown.” She also is involved in 11 nonprofits in Maine, most in greater Portland.

When she and her husband were developers in Washington, they wanted nationally recognized stores to draw people who otherwise would not have come to the neighborhood. Still, she believes there's a place for both those large stores and the small stores for which Portland is known.

“We have a Starbucks in Portland, yet we also have independent coffee shops like Coffee by Design,” she says. “Sometimes you want to go to something you know. I hope the existence of a national chain store doesn't preclude or squash a small store.”

People like us

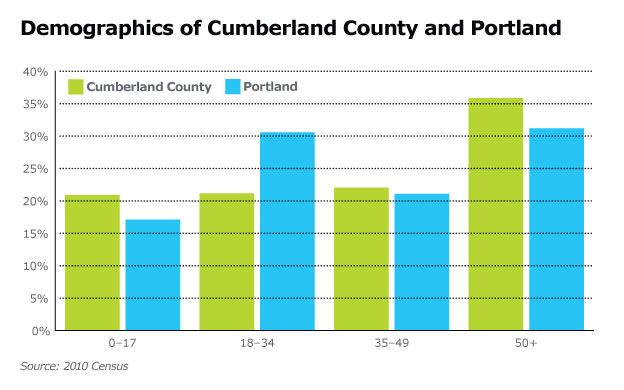

Though some of the businesses moving into Portland aim to attract baby boomers wanting to be close to services and in a walkable city, others cater to the millennials and other younger people. Of Portland's population of around 66,200, 30% are 18-34 years old and another 30% are 50+ years old, according to U.S. Census Bureau data from 2010, the most recent year it was available.

Gorris says he sees both groups in the mall and shopping in downtown Portland. And he says he wouldn't categorize some of the new, higher end stores as the gentrification of Portland, as the mall's customer base and stores are broad-based.

A big draw for national chains, says Gorris, is co-tenancy — being near other stores that cater to your customers. The influx of national brands in the past few years has come about, he says, because retailers like J. Crew, LUSH, Apple, White House Black Market and J. Jill are more selective about the malls where they locate; they are looking for other tenants they are typically near in a retail setting.

Take Bon-Ton, for example, which has 273 department stores in 24 states. Last fall it took over the 120,800 square-foot-space, vacant since Filene's left in 2006. It became the fourth full-line department store in the mall, along with Sears, Macy's and JCPenney.

“We believe our niche is in small- to mid-size markets,” Mary Kerr, a spokesperson for Bon-Ton, wrote in an email to Mainebiz. “Portland is an ideal extension of our Bon-Ton stores. It is our first store in Maine, but not in the New England area as we have stores in Connecticut, Massachusetts, Vermont and New Hampshire, so it was natural for us to look to Maine.”

Gorris explains that The Maine Mall's parent, General Growth Properties, has a research department that measures productivity at various locations as part of its pitch to prospective retailers like Bon-Ton.

“They have a store in [General Growth's] Lancaster, Pa., location. We showed Bon-Ton that the Portland market is similar to that [Lancaster],” he says.

Bon-Ton brought The Maine Mall to nearly 100% occupancy, which is up over the 85% three years ago, says Gorris, who adds that there is constant turnover, especially when leases expire every January.

“Bon-Ton took some 120,000 square feet of our total of 1 million square feet in the mall,” he says. “That affected occupancy by 12%.” The mall has 110 stores.

He says such large brand names can help bring other big retailers to Maine. Designer Michael Kors will open a 3,000-square-foot store in The Maine Mall this summer, along with Soma intimate apparel, Lovesac furniture, L'Occitane beauty and Microsoft. Linda Bean's Lobster Café is slated to open in May as a kiosk with a replica of a lobster boat at the mall's Center Court.

“You wouldn't have seen Michael Kors here five years ago,” says Gorris. “There's been a transformation [of the mall] that started two to two-and-a-half years ago. Maine is a region that was in a lot of ways underdeveloped from a retail point of view in terms of bridge and high-end stores.”

Tourist dollars

While a majority of The Maine Mall's customers are local, Gorris is quick to point out that tourism is a big part of the mall's business.

“In June, July and August we have more business as a percentage of sales than we do in November and December,” he says.

There are several reasons. Among them, Maine has the largest percentage of second-home housing stock in the nation, around 16%, according to the 2010 census.

In 2011, The Maine Mall surveyed people in the parking lot coming into the mall one Saturday in the summer. Gorris says 25% were from out of market. They were from more than 25 different states and 9% were from Canada.

“We use this information to 'sell' Portland,” to prospective tenants, Gorris says.

Both tourists and visiting businesspeople are having a big impact on hotels as well.

“The fact that the hotel brands are moving into downtown bodes well for Portland as a destination and suggests the market is a strong and attractive destination for corporate and leisure travels. The brands believe the demand is there to support the business,” says Matthew Arrants, executive vice president of hospitality consulting company Pinnacle Advisory Group in Falmouth.

The direct economic impact of the new hotels in the works is huge, Arrants says. It includes the revenue paid to the developer, the money lent by a local bank, occupancy taxes, as well as new jobs. The ripple effect spreads to food, beverage, tours and other local shops and businesses.

Arrants says he doesn't expect to see any additional big name hotels enter the Portland market until the impact of the current influx of new rooms shakes out. He expects potential hoteliers to watch and wait over the next 18 to 24 months before considering new hotels.

“I think the new supply will decrease the occupancy and room rates,” he says. “The question is by how much, and how long it will take to recover.”

Read more

Comments