Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 15, 2025

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Harvard Pilgrim joins Anthem, Maine Community Health Options in state's ACA exchange

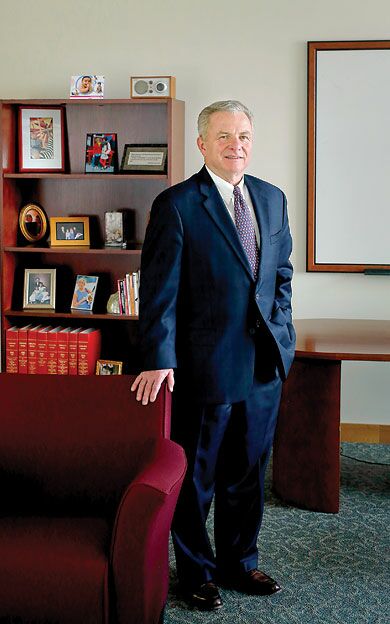

PHOTo / Tim Greenway

Edward Kane, vice president of Maine operations at Harvard Pilgrim Health Care, in his Portland office.

PHOTo / Tim Greenway

Edward Kane, vice president of Maine operations at Harvard Pilgrim Health Care, in his Portland office.

After being on the sidelines during this year's rollout of the Affordable Care Act's health insurance exchange in Maine, nonprofit Harvard Pilgrim Health Care is joining for-profit Anthem Blue Cross/Blue Shield and nonprofit Maine Community Health Options as a provider in the state's federally run exchange starting on Jan. 1.

Maine's Bureau of Insurance has completed its review of Harvard Pilgrim's four individual plans for the state's 2015 health insurance exchange, as well as plans submitted by Anthem and MCHO, and has told the federal government that they all meet the relevant insurance laws. Barring an unlikely denial by the Centers for Medicaid and Medicare Services, which has the final say on plans offered on the health insurance exchange (also known as the Marketplace), those plans will be available when the open enrollment season begins on Nov. 15.

“I think 'continuing experiment' is a very good way of stating it,” Edward Kane, Harvard Pilgrim Health Care's vice president in Maine, says about the ACA exchange, which offers federally subsidized health insurance for uninsured individuals and families whose earnings are between 100% and 400% of the federal poverty level and don't have access to employer-based insurance. “Our goal is to serve the people of Maine, and we want to do that in a complete way. The exchange is going to be an important way for many people to secure health insurance for themselves and their families.”

Harvard Pilgrim had originally wanted to participate in Maine's exchange this year, he says. But after close examination of the information technology requirements of the Healthcare.gov online marketplace, the insurer decided “it was technologically not feasible for us to do so in a way that we thought was likely to succeed.” Instead, he says, the company took advantage of the extra time — in addition to lessons learned from being a provider in Massachusetts' state-run exchange since its start in 2006 — to make sure it would be ready to hit the ground running in the Maine and New Hampshire federally facilitated exchanges starting in 2015.

“It's a substantial investment for anyone who wants to be in the exchange,” he says. “A good many of the regulations are there to protect the consumer and to ensure fairness. We understand those goals and we have no doubt we'll be coming into the exchange at the right time and with the right products suitably approved.”

Kane says Harvard Pilgrim has 1.3 million customers in the three New England states where its health insurance plans have been offered — with 100,000 being in Maine, 150,000 in New Hampshire and the rest in Massachusetts. It also received its license this spring to operate in Connecticut, where it began offering coverage starting on July 1 and is tentatively planning to join that state's ACA exchange in 2016.

In addition to offering individual plans on Maine's exchange in 2015, Kane says Harvard Pilgrim plans to offer plans in the Small Business Health Options Program when that federal marketplace opens in Maine.

SHOP exchanges — which are intended to provide affordable health insurance for employers with 50 or fewer full-time equivalent employees starting out and eventually expand to up to 100 FTEs — were supposed to open nationwide at the same time as exchanges offering health insurance for individuals. But the nationwide SHOP launch was delayed due to last fall's problems in inititiating the exchanges for individuals, and Maine is among the states where its rollout date remains uncertain.

“I do think it's a little early to say,” Kane says regarding just when the SHOP exchange will open in Maine. “I think it's laudable, though, that the Affordable Care Act took into consideration the needs of small businesses with SHOP, and what kinds of incentives and disincentives the act will provide to encourage small businesses to consider that option.”

Breaking into Maine's Marketplace

Kane acknowledges that Harvard Pilgrim will be playing catch up to Anthem, which enrolled 7,410 Mainers, and MCHO, which enrolled 36,848 (or than 80%), out of the 44,000 Mainers who signed up for coverage on the exchange during the six-month enrollment period that ended on March 31, according to the Maine Bureau of Insurance. But he's also confident his company's extensive provider network in Maine, along with its 10-year run as the No. 1 private health insurance plan according to the annual nationwide ranking of plans by the National Committee for Quality Assurance, will help it compete successfully in Maine's emerging exchange marketplace.

“We have successfully grown our market share in Maine over the last five years,” he says, referring to the insurer's off-Marketplace plans. “So we are confident about our ability to do that in the Marketplace.”

He also believes Harvard Pilgrim's recent experience in running the DirigoChoice program, a state-supported health plan created by former Gov. John Baldacci that ended with the launch of the federally run exchange in Maine, is a big plus. That's because that program was designed for Maine businesses with 50 or fewer employees, the self-employed and individuals — the very same groups that the exchange's individual and SHOP plans have in mind.

With the exchange's first-year enrollment of 44,000 Mainers representing roughly only one-third of the 133,000 who are uninsured in Maine (according to U.S. Census in 2011), there's still a significant opportunity for the three participating insurers to pick up additional customers.

Track record in Maine

In addition to its established provider networks covering the entire state, Kane says Harvard Pilgrim has been participating in a number of pilot programs related to quality care and innovative pay-for-performance arrangements in Maine. Among them:

• The Maine patient-centered medical home pilot in partnership with Maine Quality Counts, which began in 2011 to assist 25 physician practices across the state achieve greater coordination of care and has now grown to more than 75 practices.

• Accountable Care Organization with MaineHealth, through Maine Medical Center's Physician-Hospital Organization, which since 2012 has reduced the overall cost of care by 7-8%. Emergency room visits have been reduced by 7-9% and inpatient hospital admissions by 14%.

• Maine Heart Center: A bundle payment pilot for coronary artery bypass grafts since April 2013. The pilot is designed to improve quality through better coordination of care, as well as make expenses predictable by removing duplication and waste from the procedure.

• A “quality grant” to Maine Medical Center to integrate behavioral health into primary care, including screening of patients for mental health issues that might adversely affect their care and overall health.

Kane says Harvard Pilgrim also has focused on childhood obesity, providing a three-year $1.5 million grant to MaineHealth to expand programs promoting healthier lifestyles as well as ongoing financial support of the Let's Go! program that has been teaching kids in Maine since 2006 the 5-2-1-0 mantra of eating five or more fruits or vegetables, spending no more than two hours of screen time, being physically active for one or more hours and avoiding sugary drinks. That program has since expanded into New Hampshire and Massachusetts.

“Childhood obesity is a very serious problem,” Kane says. “People become, tragically, increasingly disabled due to obesity. That's been a real calling for us.”

All of those initiatives and its participation in Maine's 2015 exchange, Kane says, are part of Harvard Pilgrim's engagement in the ACA's efforts to tackle the complex challenge of insuring as many people as possible without putting insurance companies at undue risk of experiencing unexpectedly high losses or allowing them to cherry pick the healthiest customers to achieve high profits.

“A lot of people are working very hard trying to figure out how the Three R's are going to work,” Kane says, referring to the “risk adjustment, reinsurance and risk corridors” that are the three legs of the ACA's efforts to fairly spread risks, expand coverage and control yearly premium increases. “There's a lot of heavy lifting going on. I think all of us here in Maine — the providers, consumers, employers and insurers — are going to have to be a little patient with each other.”

Read more

Anthem, EMHS partner for new health program

Lewiston insurer continues rapid growth

Anthem data breach impacts Maine consumers

Harvard Pilgrim Health Care

Headquarters: Wellesley, Mass.

Maine office: 1 Market St., Portland

President and CEO: Eric Schultz

Employees in Maine: 25

Customers: 1.3 million, with 100,000 in Maine, 150,000 in New Hampshire and slightly more than 1 million in Massachusetts

Financials: Operating income of $1.2 million and net income of $19.8 million on revenue of $2.6 billion for the year ended Dec. 31, 2013

Contact: 207-756-6304

ACA Marketplace spurs lower premiums, greater choice

In its first year of offering health insurance plans on the state's federally run Marketplace, the Affordable Care Act is spurring premium affordability, competition and choice in Maine and the nation, according to several national studies.

A new study from the Kaiser Family Foundation, based on the largest cities in 15 states and the District of Columbia where information from rate filings is available, shows that average premiums for the benchmark Affordable Care Act Marketplace plans are set to decline slightly in 2015. The study, released on Sept. 5, is based on the benchmark silver plan, the one upon which federal financial help under the ACA to consumer is based. In Portland, the Kaiser foundation reports the silver premium will fall 4.4% in 2015.

Kaiser's study shows an average decline of 0.8% in premiums, with rates decreasing in 7 of the 16 areas studied. They range from a decline of 15.6% in Denver, Colo., to an increase of 8.7% in Nashville, Tenn.

“That's really great news,” says Mitchell Stein, an independent health policy consultant and the former policy director of the Maine Consumers for Affordable Health Care. “It gives the lie to all the critics who said premiums would explode in the second year of the ACA.”

Stein also says Harvard Pilgrim's decision to join Anthem Blue Cross/Blue Shield and Maine Community Health Options in offering plans in the Maine's federally run marketplace is another indicator that the ACA is accomplishing another of its goals, giving consumers more choice in their health care coverage. Likewise, the enrollment of 44,000 previously uninsured Mainers in 2014, which exceeded the federal government's original projections for the first year, is another encouraging sign the ACA is working.

A good percentage of the remaining people in Maine who are uninsured, Stein says, are the estimated 77,000 people who would qualify for expanded Medicaid coverage, a political decision that Gov. Paul LePage has successfully blocked with three vetoes that weren't overturned in the last Legislative session.

Finally, he worries that many people who plan to reenroll in the second year of the Marketplace may not realize that they need to update their financial information in order to ensure they receive the correct federal subsidies. “It's important to update that information, even if they're happy with their plan,” he says.

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Comments