Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- October 6, 2025

- September 22, 2025

- September 8, 2025

- August 25, 2025

- August 11, 2025

- July 28, 2025

- + More

Special Editions

- Lists

- Viewpoints

- Our Events

- Calendar

- Biz Marketplace

Cerahelix's $200K only Q2 Maine venture deal; will seek up to $5M Series A round later

Biotechnology company Cerahelix Inc. raised $200,000 in venture funding, a new study found, with the financing coming from the Maine Venture Fund along with Portland and Bangor angel investors in the second quarter of 2015. It was the only venture capital deal The Money Tree study cited in Maine in the second quarter.

Susan MacKay, CEO and founder of the Orono-based maker of ceramic water filters, characterized the money as bridge funding toward a $5 million Series A fund raise that she’s hopes will close in the third quarter.

Cerahelix had filed a Form D with the U.S. Securities and Exchange Commission on March 12 to raise $500,000 in debt or other promissory notes, and to date has raised $275,000 of that, including the $200,000 cited in the study. All of it is in the form of convertible notes that will turn into equity when the Series A round closes, she told Mainebiz. The company makes a nano-ceramic, fast filtration system to clean water for commercial users, and is initially targeting production in the oil and gas industries.

“We will use the money for validating a commercial-scale pilot project in Alberta, in the tar sands,” she said of the bridge and Series A fund raises. She said the company is scaling up its smaller pilot project to have the commercial version for the Alberta pilot done in six to nine months.

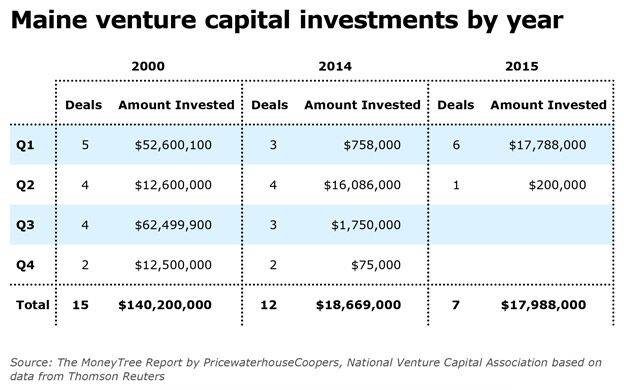

The $200,000 raised in Maine is much less than the bountiful $17.8 million raised in the first quarter by six Maine companies, including CashStar Inc., which led the pack with $9.5 million from undisclosed investors, according to The Money Tree Report released Friday by PricewaterhouseCoopers and the National Venture Capital Association. The report is based on data from Thomson Reuters.

In the second quarter of 2014, two companies raised $16,086,000. The total for the first half of the year is $17,988,000, including companies in information technology services, software, telecommunications, biotechnology and consumer products, telecommunications and services.

A new heyday?

Nationally, venture capitalists raised $17.5 billion in 1,189 deals in the second quarter.

That’s the first time since the fourth quarter of 2000 that venture investing topped $17 billion. And that translates into a 30% rise in dollars and 13% increase in the number of deals compared to the first quarter, when $13.5 billion was invested in 1,048 deals.

Maine also hit a high point in 2000, with $140.2 million raised in 15 deals.

A separate study by Dow Jones VentureSource published Wednesday by The Wall Street Journal found a similar spike in nationwide financings nearing 2000’s highs, with 1,034 financings from April to June worth $19.19 billion.

The second quarter also had 26 megadeals valued at $100 million or higher nationwide, according to Tom Ciccolella, U.S. Venture Capital Leader at PwC.

One of the deals, Airbnb, alone was valued at $1.5 billion. Ciccolella told Mainebiz the number of deals nationally has remained fairly consistent over recent years, but more money is going into the deals.

Asked whether the current funding rate is sustainable, he said he’s not sure, but venture fundraising is at a good clip. The current pace of investing puts venture investing on track to top the total of $50 billion invested in all of 2014.

He said there’s no clear trend driving the deals in Maine, where the number and value of deals has gone up and down without a pattern over the years. In 2014, there were 12 deals worth $18.67 million, while 2013 had six deals worth $29.69 million, 2012 had six deals worth $12.79 million and 2011 had five deals worth $39.63 million.

“After the spike in 2000, when the dot.com bubble created crazy valuations, it’s pretty staggering to think that those kinds of numbers are here now,” John Burns, managing director of the Maine Venture Fund, told Mainebiz, about the national trend. MVF invested less than half of the funding for Cerahelix, according to MacKay.

Small state, small numbers

Burns said Maine has a small number of companies raising money in a small market, and some who do raise money may not report it.

“There truly aren’t that many sizeable equity deals in Maine,” he said. Burns added that the local market for deals does feel a little stronger lately, as reflected in the Greenlight Maine, Top Gun and Gorham Savings entrepreneur competitions. “Many [companies] have not yet gone to the market to get money, but some will,” he added.

The $52.3 million raised by Direct Vet Marketing and featured in Mainebiz Thursday isn’t counted in the PwC/NVCA figures.

Cerahelix and Zeomatrix (founded by MacKay but now a separate company run by Emma Wilson) both are semifinalists in the Greenlight Maine Competition, where entrepreneurs contend to win a minimum of $100,000.

MacKay, a Mainebiz Woman to Watch in 2010 for her work at Zeomatrix, in April was named by Google as a finalist in the technology giant's "Solve for X," a worldwide competition aimed at solving global issues.

She also spoke in early April at the 2015 Mainebiz Women to Watch Leadership Forum on how to bring an entrepreneur’s mindset to any business.

Adding the numbers

According to PwC, MoneyTree deals are a subset of the overall Thomson Reuters database and follow specific criteria. They measure cash-for-equity investments by the professional venture capital community in private emerging companies in the United States. Investee companies must be domiciled in one of the 50 U.S. states or the District of Columbia, even if substantial portions of their activities are outside the United States

The MoneyTree results exclude non-U.S. companies, non-cash investment, buyouts and other forms of non-venture private equity investments. Angel Investment and direct investment by corporations are also excluded unless they are co-investments in an otherwise qualifying round or follow a qualifying venture capital round.

Once a company has been public or has had a buyout-related round (excluding acquisition for expansion), all subsequent rounds no longer qualify to be included in the report.

The MoneyTree research focuses on cash received by the company. Therefore, tranches rather than term sheets determine whether they are included.

After a company has received a qualifying venture capital financing round, all subsequent equity financing rounds are included, regardless of whether the round involved a venture capital firm.

Read more

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Comments