Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

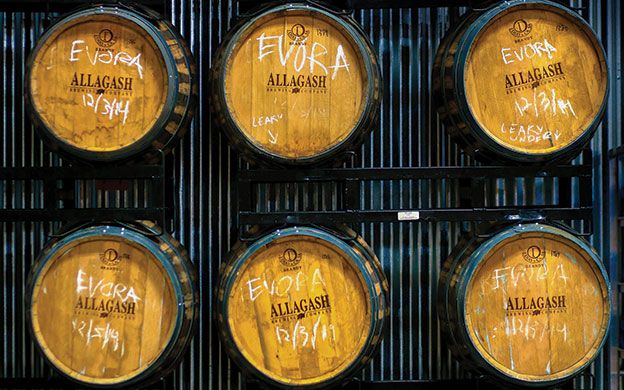

As craft beer industry grows, other firms expand with it

With 64 craft breweries already in the state and the Maine Brewers' Guild predicting upwards of 80 by the end of 2016, an ecosystem of support services and products is growing up around the industry, which is capital-intensive and subject to legal restrictions and liabilities.

“Our industry is providing jobs and work for brewers, law firms, plumbers and others,” says Rob Tod, who founded Portland-based Allagash Brewing Co. Inc., in 1994. “We have a vibrant craft beer movement, and our company is contributing a lot to the economy.”

Early in his company's 21-year history, Tod consulted with Portland law firm Verrill Dana, which recently formalized its breweries, distilleries and wineries group with eight attorneys across disciplines in the firm who provide legal guidance to Allagash, Maine Mead Works and others on intellectual property, real estate, labor, employment issues, special regulatory and compliance issues.

“I think someone is nuts to start a business without basic due diligence from a law firm,” says Tod. “It's a required expense. I'm a believer in unnecessary risk aversion.”

Maine's breweries sold $92.6 million worth of beer in 2013 and employed nearly 1,500 workers, according to a May 2014 Maine Brewers' Guild economic impact study. Directly and indirectly, sales of Maine craft beer created $189 million in annual statewide economic impact, which compares to $340 million for Maine's lobster catch in 2012 and to $69 million for the wild blueberry harvest.

The study also noted that Maine's brewers plan to increase production by 200% by 2018. However, it included only the 35 breweries in operation in 2013; there are almost double that number today, notes Sean Sullivan, executive director of the nonprofit guild.

In addition to brewers, the guild has about 28 “allied” members, those that provide products and services to the craft beer industry, including malt houses, graphics companies, glass providers, beer tours, insurers, an Occupational Safety and Health Administration consultant, banks, lawyers and compressed gas providers.

The national Brewers Association in Boulder, Colo., defines craft brewers as small, independent and traditional. While it is not a legally binding definition, small means annual production of 6 million barrels of beer or less. Independent means that less than 25% of the craft brewery is owned or controlled by an alcoholic beverage industry member that is not a craft brewer. Traditional means a majority of the brewer's total beverage alcohol volume is in beers flavored with traditional or innovative brewing ingredients and their fermentation. Flavored malt beverages, for example, are not considered beers.

Despite the skyrocketing growth in breweries, Sullivan doesn't see them getting to the point of oversaturation any time soon, as beer consumers aren't just Mainers. “We're bringing a lot of young people to visit the state and to stay for jobs,” Sullivan says. “With the impact of tourists, we support more of an industry than our state's population would suggest.”

He adds that with craft beers, it's unusual to see a consumer order the same beer at a bar twice in a row. “This allows for new entries to the market.”

“In Maine, it's a lifestyle business,” he adds, pointing to guild President Heather Sanborn, who practiced law before starting Portland-based Rising Tide Brewing Co. with her husband.

The ecosystem around craft brewers seems to be growing almost daily. Ed Lutjens, a Maine woodworker and blacksmith, said at the end of August that he is bringing back a 4,000-year-old art form — coopering — for small batch distillers. He claims his Portland Barrel Co. is among the first to perform “tight” coopering for aging of spirits rather than for display barrels.

Also recently, Acadia Insurance launched a new program targeted at small- and mid-sized breweries. The insurance program offers all major lines of coverage for a brewery operation, including property and equipment, general liability, worker's compensation, commercial auto and umbrella liability.

“We insure the walls of the building and all the equipment for brewing the beer,” says David LeBlanc, chief underwriting and marketing officer at Acadia's headquarters in Westbrook. “But if a craft brewer loses a key employee, we also provide insurance to help replace that person.”

Better safe than sorry

Starting a brewery involves expensive purchases of brew kettles, plumbing, ingredients and other items. Many early-stage brewers spring out of home hobbies and use family money to scale their operations. So it may seem a luxury to spend money on legal advice and insurance. But those in the business caution that it's critical early on to take care of intellectual property and other matters to protect the business and the individuals in it.

Tod says at times Allagash and a competitor inadvertently used the same name for a beer brand. “Usually it's an honest mistake,” he says, adding there are a number of ways to solve the issue. “But good fences make good neighbors. If you come up with a name, protect it federally.” He's referring to trademarking beer brands.

That's becoming more important with the growth of craft breweries nationwide, he says, from well under 1,000 breweries, each with about five beer brands, when he started 21 years ago, to 3,500 or so breweries now, each with 10 beers or more. “That's tens of thousands of beer names,” he says. Finding a unique name to trademark requires due diligence and professional help, he adds.

Some basic considerations for new brewers include the best form of business entity, legal obligations to employees, trademarks and intellectual property protection, compliance with alcohol regulations, space to expand and succession planning if something happens to you, notes Marianna “Molly” Putnam Liddell, a partner at Pierce Atwood LLP.

She is among the eight attorneys who work with all types of brewers, including the Craft Brew Alliance Inc., Miller Brewing Co., Maine Beer Co. LLC, Downeast Cider House and Sunday River Brewing Co. Liddell says Pierce Atwood hasn't formalized its craft beer practice like Verrill Dana, but its team takes a multidisciplinary approach to craft brewery and concentrates on speaking the language of the clients.

“I represent owners in an individual capacity and protect their personal interests, their business and their family,” she says. “You are potentially sitting on a gold mine. What if there is a catastrophe?” Her firm also handles real estate, recycling of barley and oats, energy and other issues.

Other law firms with brewery experts include Drummond Woodsum, Bernstein Shur and Eaton Peabody.

John Moran, an attorney at Eaton Peabody in Portland, started the craftcounsel.us law blog in March to help guide craft breweries, distilleries and others with general information on industry-specific federal, state or local legal challenges.

“Most startup breweries are focused on their craft and legal issues come in second, so I created easily accessible resources where entrepreneurs can go and get a sense of what is required,” Moran says of the Craft Counsel blog. “It is a resource, a show of good will and it shows we have depth in this area.”

Understanding trademarks

“Trademark, almost more than any other area of law, is underappreciated by breweries because it is misunderstood,” says Dan Kleben, co-owner of Maine Beer and an attorney who had practiced at Pierce Atwood before starting his brewery in 2009. He says it costs $500 to $1,000 per trademarked brand or company name, including the U.S. Patent and Trademark Office and legal fees.

“There is a whole cottage industry that has sprung up in reaction to the craft beer industry in Maine and around the country,” he says. “The regulatory side is unique by definition. We're highly regulated at the state and federal level. Our company sells in 10 to 15 states, so we need to know the regulations in each state.” He adds that the company also has confidentiality agreement to protect its recipes and production.

Maine's largest craft brewer, Shipyard Brewing Co., actually has its own in-house lawyer. “I am the only in-house counsel [at a brewery] that I'm aware of in Maine,” says Branden Mazer, Shipyard's general counsel.

Large brewers take notice

The growth of and energy around craft brewers isn't lost on the big brewers. Craft brewers produced 22.2 million barrels in 2014, up 18% in volume and more than 22% in retail value to $19.6 billion, according to the Brewers Association. That's the first time craft brewers reached a double-digit volume market share, at 11%.

The total beer market was up only 0.5% in 2014, indicating that craft brewers are gaining share while large brewers aren't. The Brewers Association said craft beer makers are aiming for a 20% market share by 2020.

On Sept. 16, Anheuser-Busch InBev said it plans to merge with SABMiller, which would combine the world's two largest brewers to make a $276 billion “super brewery.” On Sept. 8, the Dutch company Heineken bought 50% of Petaluma, Ca.-based craft brewer Lagunitas Brewing Co. for an undisclosed amount.

“What is going on in this industry isn't lost on the [big] beer companies,” says Tod of Allagash. “The beer consumer wants these flavored beers. And there's value to the customer to know where the beer comes from.”

Investments like Heineken's 50% bring up questions about whether Lagunitas still qualifies as a craft brewer. “It's up to the customers to decide,” says Tod. “There's more blurring of the lines as bigger producers buy craft breweries. It could potentially change the landscape.”

Alan MacEwan, partner and chair of Verrill Dana's business and corporate group, says craft beer valuations are running at 10 to 13 times earnings before interest, taxes, depreciation and amortization, or EBITDA. A good range is seven to nine times, he says, so craft beer company valuations are high.

“We're just seeing the beginning of merger and acquisition activity,” he says.

Adds Moran of Eaton Peabody, “Contributing to that are large macro breweries that want to regain market share, so they'll pay a premium.”

Courtney Sparks White, a partner with the business valuation and forensic accounting group at Clarus Partners in Columbus, Ohio, says it's difficult to place a valuation on craft breweries, but her company looks mostly at a combination of market-based multiples of EBITA as well as income, including current and projected earnings.

“It's all about asking the right questions,” she says, adding that purchases like Heineken's are heating up valuations.

On a smaller scale, some local breweries are attracting attention from independent investors like Ayres Stockly of Cumberland, who put a small but unspecified amount into Oxbow Brewing Co. of Newcastle.

“A lot of it comes down to personally knowing the people. I immediately liked the two people who started Oxbow,” says Stockly. “I took a leap of faith based on the personality of the guys, their experience, their philosophy and their passion for their product.”

Tim Adams co-owner and master brewer of Oxbow, says Stockly was part of the company's startup capital from private investment from friends, family and friends once removed, plus lines of credit and loans from Bath Savings.

Oxbow itself has started a business to help support its craft brewery. Says Adams, “We have an Airbnb that we rent out for beer tours.”

Read more

Six Maine companies receive Good Food Awards

New brewery under construction in Brewer

Nine Maine restaurants, brewers and chefs among James Beard semifinalists

Comments