Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

-

- Lists

-

Viewpoints

-

Our Events

-

Award Honorees

- 2025 Business Leaders of the Year

- 2025 Outstanding Women in Business

- 2024 Women to Watch Honorees

- 2024 Business Leaders of the Year

- 2023 NextUp: 40 Under 40 Honorees

- 2023 Women to Watch Honorees

- 2023 Business Leaders of the Year

- 2022 NextUp: 40 Under 40 Honorees

- 2022 Women to Watch Honorees

- 2022 Business Leaders of the Year

-

-

Calendar

-

Biz Marketplace

- News

- Editions

- Lists

- Viewpoints

-

Our Events

Event Info

- View all Events

- Outstanding Women in Business Reception 2025

- On The Road with Mainebiz in Bath

- 60 Ideas in 60 Minutes Portland 2025

- 40 Under 40 Awards Reception 2025

- On The Road with Mainebiz in Lewiston / Auburn

- + More

Award Honorees

- 2025 Business Leaders of the Year

- 2025 Outstanding Women in Business

- 2024 Women to Watch Honorees

- 2024 Business Leaders of the Year

- 2023 NextUp: 40 Under 40 Honorees

- 2023 Women to Watch Honorees

- + More

- 2023 Business Leaders of the Year

- 2022 NextUp: 40 Under 40 Honorees

- 2022 Women to Watch Honorees

- 2022 Business Leaders of the Year

- Nomination Forms

- Calendar

- Biz Marketplace

Three Maine venture capital deals in Q3 top $67.8M

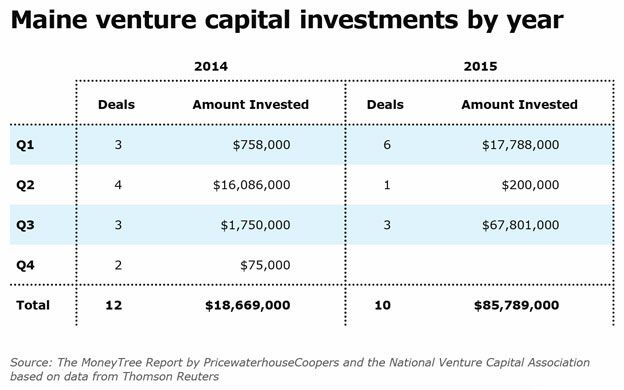

Venture capitalists pumped $67.8 million into three deals in Maine in the third quarter of 2015, up significantly from $1.75 million for three deals in the same quarter last year.

Figures released today showed that Direct Vet Marketing Inc., a Portland-based veterinary services company that does business as Vets First Choice, pulled in the most at $52.3 million in its seventh round of fundraising.

The information is part of the quarterly MoneyTree Report from PricewaterhouseCoopers and the National Venture Capital Association based on data from Thomson Reuters.

Clayton, Dubilier & Rice, a New York private investment firm, led the Vets First Choice round, which involved 33 total investors including existing investors Borealis, M. Gemi, Polaris and HLM Venture Partners.

Prepaid card company CashStar Inc., also of Portland, raised $15 million in its fifth round, which was led by FTV Capital.

Social media tool company Local Yokel Media LLC raised $500,000 in its third round of fundraising from an undisclosed firm, according to the report.

For the first three quarters of 2015, Maine companies raised $85.79 million in 10 deals compared to $18.75 million in 12 deals for all four quarters of 2014, according to the MoneyTree Report. The most deals year to date — five — were in the IT services sector.

Overall, New England companies raised $4.97 billion in 2015 so far, compared to almost $5 billion for all of 2014.

Nationally, venture capitalists invested $16.3 billion in 1,070 deals in the third quarter, which marks the seventh consecutive quarter that more than $10 billion of venture capital was invested in a single quarter.

More than half of all investment deals are now going to seed or early-stage companies, according to Bobby Franklin, president and CEO of the NVCA.

“If there’s anything we learned this quarter, it’s that despite the recent turbulence in the financial markets, venture capitalists remain undeterred and are confident investing in truly innovative companies across all sectors of our economy,” Franklin said in a prepared statement.

Comments