Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- September 22, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

IDEXX founder David Shaw on his investment philosophy

Photo / Tim Greenway

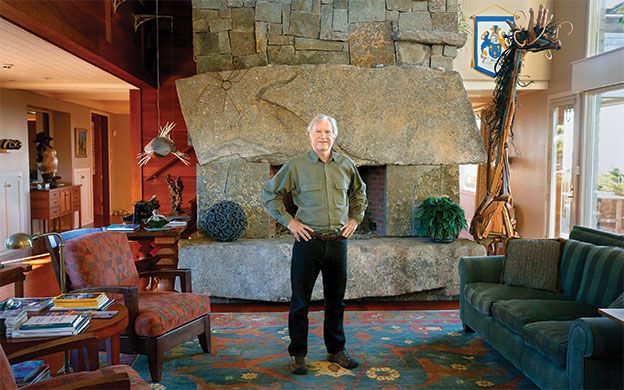

David Shaw in his Prouts Neck home.

Photo / Tim Greenway

David Shaw in his Prouts Neck home.

Photo / Tim Greenway

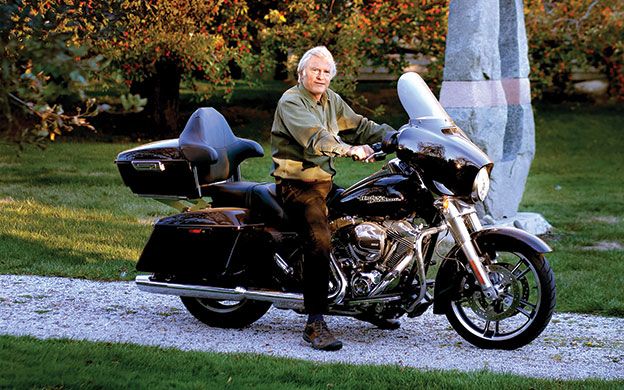

David Shaw on his Harley-Davidson at his Prouts Neck home. Shaw has been riding motorcycles since he was a teenager.

Photo / Tim Greenway

David Shaw on his Harley-Davidson at his Prouts Neck home. Shaw has been riding motorcycles since he was a teenager.

Toward the end of his time at IDEXX Laboratories Inc. (NASDAQ: IDXX), the Westbrook-based animal health diagnostics and IT solutions company, founder David Shaw set up Black Point Group LLC in Portland as a vehicle to invest in other companies. That was in 2000. Now, the investment firm has a portfolio with some 20 companies throughout the United States. The handful of people working there include son Benjamin Shaw, who also is cofounder and CEO of Vets First Choice, in which Black Point was a lead investor.

David Shaw also serves as treasurer of the American Association for the Advancement of Science. He has chaired many organizations, including The Jackson Laboratory and Sargasso Sea Alliance, and is a director of the National Parks Foundation, where he is helping lead the strategy for the parks' centennial celebration next year.

The Shaws recently talked to Mainebiz about Black Point's investment strategy. David, who is managing partner of Black Point, also reminisced about the early days of entrepreneurship at IDEXX. An edited transcript follows.

Mainebiz: Did you always know you'd become an entrepreneur?

David Shaw: I didn't think anyone would ever offer me a job, so I had to create my own. However, my first meaningful job in Maine was working for Gov. James Longley in the executive department. I had budget and policy responsibility for marine resources, agriculture and conservation. It was a real eye opener for me to see how government and public policy influenced businesses. I found that interesting, but I got to a certain point where I wanted to do something versus talking about it. Being the change seemed interesting to me.

MB: How did IDEXX get started?

DS: I rented a little building down on the Portland waterfront. I thought it would be more interesting — if we're interested in great jobs and exporting products and economic development and entrepreneurship — to do something versus talk about it. I rented space for IDEXX at 58 Fore St. at the Portland Co. The funny story is that no one could tell if it was hooked up to a sewer. And there was a code issue in Portland. So people from the city showed up with what looked like a pirate's map. It was all folded and everything. And they were saying, 'Yes, this line looks like it,' and someone else would say, 'I think that's just a fold in the piece of paper.'

No one could decide whether it was occupiable. They decided to flush dye down all the toilets to see where it went. Four or five city of Portland workers went out and took a manhole cover off, looked down it with flashlights and said, 'Yes, I think I see a little bit of dye there, I think it's all good.' Meanwhile, I was looking at a huge amount of dye spreading out into the bay. I was thinking to myself, 'Should I say anything?' As they went back to their cars somebody said, 'Wait a second, what's happened to Casco Bay?' This is the early stages of entrepreneurship. We had to get $6,000 to connect to the sewer. It looked like it was going to be a deal breaker, but we did it.

MB: Did you have a mentor?

DS: Not exactly. But E. Robert Kinney, who was a Jackson Lab trustee, helped at a later stage of IDEXX. One of the crucial issues in a business is that if you are riding a big wave or megatrend, you're going to be hearing caution every day. If one thing goes wrong, it would be over. At the same time there's another debate going on saying, 'Let's go for it.' Those are some of the most important debates you have in an entrepreneurial company. If it's a big idea you have to be fast and bold and great. But you also can't make mistakes that are fatal. It was helpful to me to have Bob Kinney on the board because he had a perspective on that. I was 28 years old at the time and he'd say, 'Here's what I think we should do.' He wasn't a big investor in the company, but the venture capitalists would listen to him because he had this kind of Obi-Wan Kenobi look about him.

MB: Early on you met Venrock Associates venture capitalist Peter Crisp. How did that help you?

DS: I didn't know much about venture capitalists, but I called him. He picked me up in his station wagon on a sidewalk in Manhattan and I told him about my idea for IDEXX in the 20 to 30 minutes it took to get to LaGuardia Airport. I was surprised when I got out of the car and he said, 'You know, I think we're interested.' This was in the days before the Internet, so I didn't know if he was an accountant or what he was. So I later find out he's on the board of Apple Computer and he's a legendary venture capitalist.

So they did in fact invest. And then I'd go to their meetings. This is sort of a story about being in Maine. It was important for me to get capital not from Maine, because I was worried about the syndrome in Maine where you're not thinking about being a global leader and you're not maybe thinking big enough and bold enough. So at the first meeting with Venrock I was sitting with Apple Computer, McDonnell Douglas, Eastern Airlines and others. I learned to ask myself a question early on, which is, 'What does great look like?' It was really important for me to have a frame of reference to understand what truly great looks like in the business you're involved in. So that you don't find out, as I like to say, that 'good is the enemy of great.' In the state of Maine, if you're trying to get the very best people and be the very best in the world at what you do, everything has to be internally consistent with that. You have to have great directors, great sources of capital, great products. And if you're a little bit short of that it changes your destiny.

MB: What types of companies does Black Point invest in?

DS: The focus of our business for a while has been value creation through public and private entrepreneurship. Entrepreneurship is by definition very much about exploration and discovery. Black Point looks for interesting opportunities where you can create value by riding a big wave, by game-changing technology or by game-changing trends like the genetics revolution, new generations of medical devices or the Internet.

MB: Can you give an example?

DS: Well, my first one actually was IDEXX. In the late '70s and early '80s medical device technology was starting to create new opportunities for monitoring disease and testing for things. The testing traditionally happened in big laboratories where you'd send samples and get the test results a few days later. So the ability to create devices that could do those tests closer to the consumer in professional offices or in the field was the megatrend that IDEXX rode.

I also was a founder of Cytyc Corp., which makes tests for cervical cancer [and was bought by Hologic Inc. in 2007]. Cytotechnologists traditionally looked through a microscope at maybe 100,000 cells for an abnormality. The question was, is there a better way to do that because it's such a tedious and inaccurate procedure? Cytyc created a way to look at a monolayer of cells that a digital reader system could look at and show you the least normal cells. The cytotechnologist could then look at that and make the diagnosis, but improve the accuracy.

MB: Where does Black Point get its capital?

DS: It's mostly family capital.

MB: Will you talk about how much it is?

DS: No.

Benjamin Shaw: There's a few of us, we use mostly our own capital, and there are a few other individuals that we've had projects with.

MB: What's your ideal investment profile?

DS: We like megatrends that offer opportunities to do great things in the world. Vets First Choice is an Internet-based pharmacy management company in the veterinary space. We like that. There's clearly an opportunity to be proven that there's an ability to use new technology to offer great value to veterinarians and their clients. Physion Consulting is a scientific data management company that you can think of as being a bit like iTunes for scientific data. We all hear a lot about big data and huge data sets and the vast need to have computing and analytical power and understand the big data. It's based in Boston.

We just invested in a company called MyTaskit, which manages relationships between service providers and consumers. Their first target market is marinas to mediate the relationship between boat owners and service providers in marinas. But their business model applies to many different services. There are 3 million of the kind of service providers we're talking about in the United States.

Often we know the people pretty well, like in the case of MyTaskit, the CEO is someone we knew from the pharmacy business, a guy named Kevin Hutchinson. So we have a lot of confidence in his ability to build something.

MB: How do you vet prospective investments?

DS: Absolutely no ventures start by just coming in over email from people we don't know. It's almost always a derivative of a relationship. I was a partner at Venrock [the venture capital arm of the Rockefeller family] for a while so some leads come in that way.

Rather than managing a fund with a lot of outside capital, we club up with other people. We just did that with a financing here at Vets First Choice. And we did that in MyTaskit and Physion recently.

And NanoMech [Fayetteville, Ark.] makes nanotech lubricants for the auto industry. We like and we know that nanotechnology is going to change the world. And it is in everything from medicine to energy to consumer products. Friends of ours invested and invited us into it.

One of the investors that got us involved with NanoMech is the head of CuriosityStream and the founder of Discovery Communications, John Hendricks. He and Chris Galvin of the Motorola family, who is a friend of mine, asked if we'd like to come into this and we did. We're not usually out prospecting.

MB: Are you usually the lead investor when you go in with a group of investors?

BS: It's situational. We're a supporting investor with NanoMech, but were the lead with Vets First Choice.

MB: Why are you so interested in materials science investments?

DS: Materials science is a really fascinating part in what's happened in the world of physics and biology. We funded a company called Modern Meadow in Brooklyn, N.Y., with other investors, including some from China. It is creating an application in the biofabrication of food and leather with no animal slaughter and lower use of land, water and energy. It takes eight to 10 pounds of grain to make a pound of beef, for example, and when you look at it from a food security or a leather point of view, there are a lot of people who would like to see leather for fashion or furniture where you don't have to kill animals to get it.

Another example is Sapphire Energy Inc. [San Diego, Calif.], which is growing crude oil ponds in New Mexico at experimental levels quite efficiently. The world's most efficient photosynthetic organism is algae. And that's where all of the crude oil and fossil fuels and hydrocarbons on the planet came from, from algae blooms millions of years ago. Sapphire uses a different treatment process so you can grow protein in the same process as growing crude oil. You can also grow it in brackish water, so if you're in Qatar, Abu Dhabi or Saudi Arabia it might be attractive to think of this as a food source.

MB: Are you looking for companies at a certain phase of development?

DS: If we think the idea is really intriguing and we think it's successful and we like them that's the most important thing. I had a brain injury and I'm a little reluctant to light the fuse of startup ventures right now in my life. I would prefer to put my energies now into someone who has operated some pretty big companies.

Read more

Black Point Group companies

Vets First Choice, Portland, a provider of e-commerce and marketing solutions for veterinary hospitals and pet owners. CEO is Benjamin Shaw.

IDEXX Laboratories Inc. (NASDAQ: IDXX), Westbrook, a worldwide leader in veterinary diagnostics and tests for animal milk and water. David Shaw founded the company in 1983 and was CEO and chairman for nearly 20 years.

Ikaria Holdings, Hampton, N.J., is a critical care pharmaceutical company focusing on life-saving drugs. Ikaria was sold to Madison Dearborn December 2013 and then to Mallinckrodt Pharmaceuticals in 2015. Black Point Group remains an investor in biotheraprutics spin-off Bellepheron, also of Hampton.

Venrock, New York City, is a premier venture capital firm with which Black Point Group is a limited partner.

Ironwood Pharmaceuticals (NASDAQ: IRWD), Cambridge, Mass., focuses on irritable bowel syndrome with constipation and other treatments.

Cytyc Corp., Marlborough, Mass., makes novel products to detect cervical cancer. The company was acquired by Hologic Inc. in 2007 for $6.2 billion.

Sapphire Energy Inc., San Diego, Calif., is developing renewable fuel from algae.

Itaconix Corp., Stratham, N.H., produces chemical polymers from itaconic acid. Its product is sold to consumer and industrial detergent formulators to replace phosphates, EDTA, citric acid and petroleum-based chemicals.

Modern Meadow, Brooklyn, N.Y., applies bioprinting and tissue engineering to develop novel biomaterials such as cultured leather and meat.

Cyteir Therapeutics, Cambridge, Mass., is building a therapeutic platform for oncology and other applications.

Physion Consulting, Cambridge, Mass., is developing cloud-based data management tools broad scientific applications.

Sirna Therapeutics, San Francisco, created RNAi- based therapies. Black Point co-founded Skinetics Biosciences in 2004 to develop RNAi technologies in the dermatology market. That company was acquired by Sirna, which in turn was bought by Merck & Co. Inc. in 2006 for $1.1 billion.

Cornerstone Brands Inc., West Chester, Ohio, direct markets fine home, leisure and casual brands including Frontgate and Garnet Hill. Cornerstone was sold to IAC/InterActiveCorp in 2004.

FetchDog Enterprises LLC, Portland, was a catalog and website serving passionate dog owners. It was bought by PotPourri Group in 2012.

MyTaskit, West Palm Beach, Fla., focuses on managing relationships between service providers and consumers in marinas.

NanoMech, Fayetteville, Ark., focuses on nanotechnology-based lubricants.

Source: Black Point Group

Mainebiz web partners

Related Content

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Comments