It's a good time for craft brewers to raise money

With the rapid growth of the craft beer industry, venture capitalists, angel investors, the Small Business Administration and others in the funding chain said this is a good time for craft brewers to seek funding.

In Maine alone, there are 70 breweries — double the number three years ago, according to Dick Cantwell, co-founder of Elysian Brewing Co. and now “quality ambassador” at the Boulder, Colo.-based Brewers Association. In its annual report on the industry, the association estimated the economic impact of Maine’s breweries to be $432 million, based on 52 breweries.

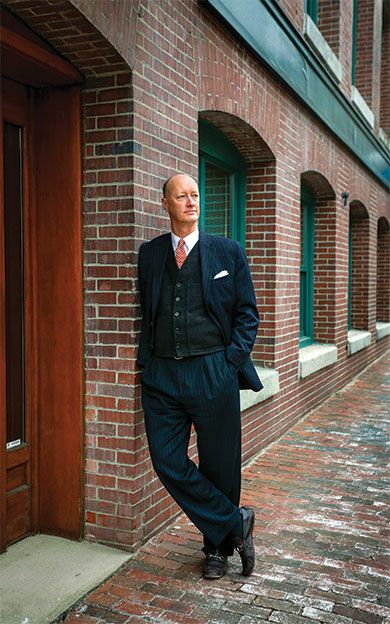

“This is about as good a time as there’s been to finance this industry,” Greg Fryer, a partner at Verrill Dana, said during a financing discussion at last Friday’s New England Craft Brew Summit.

The summit, held at the University of Southern Maine in Portland, drew about 450 attendees from 13 states, including brewers, hops growers, maltsters, equipment fabricators and application developers, according to its sponsors.

“There’s a big demand for capital to start up,” said Sam Adams of Corporate Finance Associates of Portland. He noted that nationwide, 650 new craft brewers started nationwide between 2014 and 2015. “And not a lot of craft breweries are failing.”

Craft brewers frequently start their business with their own funds or money from family and friends, But once they are ready to expand, they have to decide whether to take on debt via a loan, give up equity in exchange for money from angel or venture capital investors, crowdfund or use other means.

Fryer says the most efficient source for financing is from angel investors because of two U.S. Securities and Exchange commission exemptions. Also, the SEC allows small public offerings of $1 million to $5 million under Regulation A, Fryer said.

Fryer, who was among those who drafted Maine’s crowdfunding law that issues securities for investments up to $1 million a year, predicted the state will see its first craft brew crowdfunding. “There are none in Maine yet, but if you look across the country you’ll see a majority of state crowdfundings have been breweries,” he said.

Fryer also said that how a craft brewery sets itself up could give it some benefits: for example, rather than setting up an LLC, a C Corp could provide more options under Section 1202 of the tax code, especially when tied in with Maine’s seed capital tax credit, which is not available in New Hampshire. “A C Corp gives a 100% exclusion for capital gains with the seed capital tax credit, and that could put a potential investor in the mood to move,” Fryer said.

Luke Takatsu, a commercial loan officer at Northeast Bank, said if brewers choose debt (a loan), they need something tangible to attach it to as collateral.

Brewers also need to keep solid business records. Diane Sturgeon, deputy district director of the Small Business Administration’s Maine District Office, said she looks at three years of sales projections plus a couple years of tax returns.

“People need to show cash flow to be able to pay the bank back,” she said. Unlike a bank, the SBA primarily guarantees loans that banks make.

Overall new and growing breweries have to have a business mindset. Adams said they need to make projections on a list that also includes milestones and goals.

“For investors you need to frankly and openly state what the risks are and your plan to deal with them,” he said.

Read more

Craft brewers ferment more than beer as they aim to revive neighborhoods

Portland Brew Bus tour expanding to Beantown

Crisis averted: Byrnes will be open for St. Patrick's Day following flood

Maine home to four James Beard finalists

Portland’s smallest brewery to open this summer

Sebago Brewing, Liquid Riot spark 'Bonfire Spirit' whiskey-style beer

Birding meets beer tours with Birds on Tap

Craft brewers soak up locally sourced and processed grains

Fed crowdfunding law takes effect: What does it mean for Maine?

Blue Hill Co-op steps up to the plate as first Fund-ME business

Morning Dew Farm turns to crowdfunding in hopes of 68-acre purchase

#MBNext16: As craft brewing evolves, Sean Sullivan aims to keep Maine at its forefront

Comments