Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- September 22, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Fact or Fiction: How do energy costs in Maine stack up to the nation?

Maine's electricity supply costs are determined by the New England wholesale market prices, which generally track the cost of power generated by natural gas. The chart below is based on the U.S. Energy Information Administration's most recent monthly update, which shows Maine having the lowest costs in New England for residential, commercial and industrial ratepayers. Four southern states are included for comparison, since they are where Bath Iron Works' chief competitors are located. Prices reflect supply, distribution, transmission and stranded costs.

Maine's electricity supply costs are determined by the New England wholesale market prices, which generally track the cost of power generated by natural gas. The chart below is based on the U.S. Energy Information Administration's most recent monthly update, which shows Maine having the lowest costs in New England for residential, commercial and industrial ratepayers. Four southern states are included for comparison, since they are where Bath Iron Works' chief competitors are located. Prices reflect supply, distribution, transmission and stranded costs.

Maine has the lowest electricity costs in New England. So why are they so often cited as a problem for businesses both large and small?

The simple answer is that many of them compete against companies in regions of the United States where electricity prices are even lower than those in Maine.

“It is an advantage that we have the lowest electricity costs in New England,” says Patrick Woodcock, director of the Governor's Energy Office. “However, there are significant limitations on what that advantage means in a global economy.” The businesses that are most exposed are those that compete nationally or globally against companies in states with much lower electricity costs. Rarely is their competition limited to only the New England states, he says.

Woodcock also points out that Maine employers owned by national companies — for example, Verso Corp., which has paper mills located in Minnesota, Wisconsin, Michigan, Kentucky and Maryland in addition to its mill in Jay — are often flagged by the corporate office whenever their costs stray outside the average. Electricity and heating costs are the obvious red flags.

But Woodcock readily acknowledges the solutions are by no means simple, and they often reflect radically different views about the best short- and long-term pathways for achieving clean, reliable and lower-cost electricity for both residents and businesses in Maine.

Here's just one example: Both Woodcock and Gov. Paul LePage so far have failed to persuade lawmakers to lift the 100-megawatt cap on power generators seeking a renewable resource designation in order to tap what they believe would be lower-cost electricity from Hydro Quebec in Canada. Opponents, which include the Maine Renewable Energy Association, say lifting the 2009 ban would do little to supply Maine with lower-cost power — arguing that Hydro Quebec's export sales to the United States are more likely to be at a premium price. They also say it would discourage continued investment in renewable power within Maine by creating a glut in the Renewable Energy Certificate market that in-state renewable power companies depend on for sales revenues.

And so, the idea remains in limbo — but it's likely to come up again when the new Legislature convenes in January.

Benchmarking electricity costs

For Bath Iron Works — which employs 6,100 and is competing against two southern shipyards for a contract to build 25 new U.S. Coast Guard offshore patrol cutters that could be worth an estimated $12.1 billion — achieving lower electricity costs is vital to its continued success.

“Multiple electricity Independent System Operators (ISOs) in the United States indicate that electricity costs in New England are some of the highest in the nation. Higher electricity costs do contribute to a competitive disadvantage versus southern-based shipyards, particularly when combined with other operational expenses that are lower in those shipbuilding regions,” BIW says in a company statement provided by spokesman Matt Wickenheiser in response to written questions from Mainebiz.

Since energy costs are a significant element of shipbuilding, BIW continuously benchmarks and analyzes the cost structures of its competitors. That analysis shows Maine's electricity cost per kilowatt hour for large industrial users — averaging $.08/Kwh, as reported by www.electricitylocal.com — to be 20% higher than the national average.

BIW's chief competitors in Mississippi, Alabama and Louisiana are 6% to 29% lower than the national average — giving them an even greater cost advantage. “These southern states also have more sources available for the generation of electricity, such as nuclear and coal, and are within close proximity to abundant and cheap resources such as natural gas and oil for use within shipyards,” the company states.

Sappi North America, which employs 1,160 at its Westbrook and Somerset mills and has 1,325 employees in Maine, also benchmarks its electricity and energy costs. Bob Dorko, Sappi's utilities and recovery manager who works at the Somerset Mill in Skowhegan, reports that in the company's most recent analysis Maine had the highest cost among all key paper mill states. Although it's a red flag, both Maine mills are high performers in their respective markets, with Westbrook making specialty release papers used by suppliers to the fashion, textiles, automobile and household industries and Somerset making coated papers.

“The Sappi Somerset Mill in Skowhegan, the facility where I work, is the largest manufacturer of coated free sheet paper in the U.S.,” Dorko says. “Our plant is the seventh largest of its kind in the world. It isn't feasible to pack everything up and move to a lower cost electrical service territory. Instead we optimize and reduce costs wherever we can in order to remain competitive.”

“In general we work on efficiency of use of fuel and power, as well as process improvement investments, to make step changes to reduce cost,” he adds. “We have developed and implemented numerous steam or power use reduction projects. We install the most efficient equipment we can when processes are upgraded.”

Investing in energy efficiency

Both BIW and Sappi report that they have worked closely with Efficiency Maine to find ways to conserve energy and lower their costs. Steps taken by the Bath shipyard include investing in energy management software and modern equipment that uses less energy, installing energy efficient lighting, improving insulation in its production buildings and designing all new manufacturing plants, such as the new blast and paint facility that opened last year, to be energy efficient. It also switched from oil to natural gas in 2011, dramatically lowering its carbon footprint and reducing its winter heating costs.

“The beauty of energy-saving projects is that they deliver 24/7 during their operation,” adds Dorko. “Additionally, when we invest and build projects, our suppliers benefit from all the work and materials that are purchased as the work is done.”

Woodcock agrees, noting that investing in energy efficiency is, in his words, “by far” the most effective way a company of any size can lower its electricity costs.

Industrial projects receiving partial funding by Efficiency Maine in recent years include:

- $300,000 to Maine Wild Blueberry Co. to leverage a $900,000 investment in an energy-efficient refrigeration system that helped the Machias-based company save approximately 1.4 million Kwh in electricity, for an annual savings of $171,000, yielding a 3.5-year payback on the investment.

- $45,874 to Hancock Lumber to install more efficient lighting, implement new production strategies and switch to variable frequency drives for its air compressor, fans and water pumps at its Bethel sawmill. Combined with a $32,960 U.S. Department of Agriculture grant, the project paid back in less than four months and reduced electricity costs by more than 25%.

- $59,532 to Franklin Community Health Network to install: high-performance lighting in the main hospital and an office building; energy-efficient HVAC systems; and variable frequency drives for water pumps and other motors. The project paid back in less than half a year and resulted in a $45,576 annual reduction in electricity costs.

Although Sappi's Dorko recognizes Efficiency Maine can't fund 100% of the projects seeking help, he suggests the state could help Maine businesses reduce electricity costs even more by raising the program's funding cap or allowing a larger percentage of project funding to be rebated. “We have some energy-saving projects with three-to-five-year returns that would benefit from additional help, which could move them up on the priority list,” he says.

More jobs, R&D, and investment?

Lisa Martin, executive director of Manufacturers Association of Maine, says high energy costs have been a top concern of her member companies for several years running. At the trade group's annual manufacturing summit held earlier this month, she says her members were asked this question: If your annual energy costs could be reduced by 50% what would you do with the savings? They also were told they could pick more than one option.

Martin says 47% replied that they would spend it on capital investments to improve their business, 41% would spend it on research and development and 35% said they would hire additional employees.

“It was pretty telling,” she says, noting that the total economic impact of the 1,775 companies in Maine's manufacturing sector is $5.1 billion, accounting for approximately 9% of the state's gross domestic product and total employment of 55,000 people.

The association is pulling together those survey results, she says, with a goal of adding specifics to the general comments so that they could be used to inform lawmakers in the next legislative session about how critical lowering electricity costs is to leveraging company investments that will add jobs and strengthen the state's economy.

Woodcock welcomes their input, noting that in his keynote address at the manufacturers' summit he emphasized just how important it is for employers to become involved in the political arena where so many energy-related decisions are made. “These are important issues,” he says. “Engagement with legislators is paramount.”

ISO New England forecast

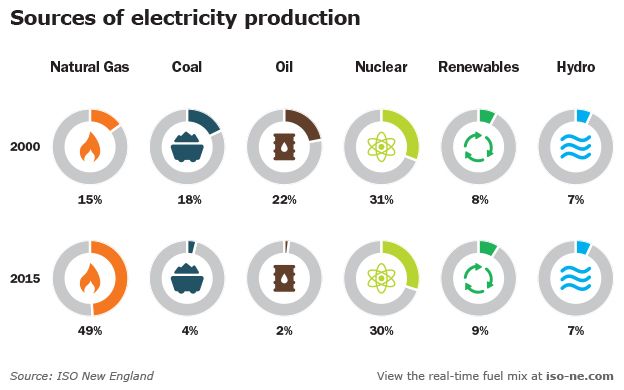

ISO New England, the not-for-profit corporation responsible for keeping electricity flowing across the six-state New England region, employs a team of power system engineers, economists, computer scientists and other professionals to analyze markets and trends to ensure the region has reliable, competitively priced wholesale electricity today and into the future.

In his introduction to the 2016 regional outlook, published in January, ISO New England President and CEO Gordon van Welie describes the region's grid as being in transition, with natural-gas-fired generation rapidly displacing older coal, oil and nuclear plants that have closed or are closing.

“Our region's natural-gas-fired power resources are among the newest, most efficient, and lowest-emitting plants in the country,” he says. “When their access to low-priced gas from the Marcellus shale is unrestricted, New England has reliable, low-priced electricity.” In its annual markets report, released on May 26, ISO New England reports that the average real-time price for wholesale electricity fell by 35% in 2015, which roughly parallels a 41% drop in the average price of natural gas last year.

That's the good news that Woodcock says he also conveyed during his recent presentation at the Maine manufacturers' summit. As new natural gas pipelines get built and increase the supply for the region, he says, that should continue to drive wholesale prices for electricity downward.

Although he thinks it's unrealistic to think that Maine or New England will ever have the lowest electricity costs in the country — noting, for example, we don't have the benefit of massive federal power projects like the Tennessee Valley Authority — Woodcock does think it's feasible to chase other leading paper mill states like Wisconsin, Minnesota, Michigan and North Carolina.

“Those are the states, from a wood products standpoint, that are our chief competition,” he says. “It's an easier goal to attain, because we're at least in the ballpark [of catching those states].”

The key, he says, will involve striking a balance between the rapid advances in renewable energy, and new grid management approaches such as GridSolar's pilot project in the Boothbay region, with the overarching goal of having the lowest electricity costs possible for all ratepayers.

Bath Iron Works and other large employers like Sappi are keeping close tabs on that balancing act as well.

“When exploring ways to assist solar, biomass or other forms of generation, it is important to consider that passing the stranded costs or increased costs on ratepayers has a disproportionate impact on large energy users,” BIW states in its written response to a list of Mainebiz questions. “In BIW's case, those increased costs are unanticipated and negatively impact bids that have already been submitted and awarded many years into the future, which have not taken into account cost increases that come along with policy decisions to pass costs off on industrial consumers.”

Read more

Maine’s largest solar farm could come to Farmington, but where?

Industry insiders, lawmakers meet to chart future of biomass in Maine

Why did the Coast Guard bypass BIW for cutter contract?

PUC on the hot seat over proposed solar 'net metering' rules

Head of Governor's Energy Office stepping down

Mainebiz web partners

Related Content

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Comments