Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

-

- Lists

-

Viewpoints

-

Our Events

-

Event Info

- On the Road with Mainebiz in Bethel

- Health Care Forum 2025

- On The Road with Mainebiz in Greenville

- On The Road with Mainebiz in Waterville

- Small Business Forum 2025

- Outstanding Women in Business Reception 2025

- On The Road with Mainebiz in Bath

- 60 Ideas in 60 Minutes Portland 2025

- 40 Under 40 Awards Reception 2025

- On The Road with Mainebiz in Lewiston / Auburn

- 60 Ideas in 60 Minutes Bangor 2025

Award Honorees

- 2025 Business Leaders of the Year

- 2024 Women to Watch Honorees

- 2024 Business Leaders of the Year

- 2023 NextUp: 40 Under 40 Honorees

- 2023 Women to Watch Honorees

- 2023 Business Leaders of the Year

- 2022 NextUp: 40 Under 40 Honorees

- 2022 Women to Watch Honorees

- 2022 Business Leaders of the Year

-

-

Calendar

-

Biz Marketplace

- News

- Editions

- Lists

- Viewpoints

-

Our Events

Event Info

- View all Events

- On the Road with Mainebiz in Bethel

- Health Care Forum 2025

- On The Road with Mainebiz in Greenville

- On The Road with Mainebiz in Waterville

- Small Business Forum 2025

- + More

Award Honorees

- 2025 Business Leaders of the Year

- 2024 Women to Watch Honorees

- 2024 Business Leaders of the Year

- 2023 NextUp: 40 Under 40 Honorees

- 2023 Women to Watch Honorees

- 2023 Business Leaders of the Year

- + More

- 2022 NextUp: 40 Under 40 Honorees

- 2022 Women to Watch Honorees

- 2022 Business Leaders of the Year

- Nomination Forms

- Calendar

- Biz Marketplace

Venture capital deals not as soft as believed; Maine sees 5 deals in Q2

Counter to the well-reported lull in venture capital deals recently, venture capitalists invested $15.3 billion in 961 deals in the second quarter of 2016, up 20% in dollars from the first quarter and down 5% in the number of deals.

That makes the second quarter the tenth consecutive one in which venture capitalists invested more than $10 billion, according to The MoneyTree Report released Friday by PriceWaterhouseCoopers and the National Venture Capital Association based on data from Thomson Reuters.

“We continue to see things we have never seen before, including megadeals, investments of $100 million or more,” Tom Ciccolella, PwC’s U.S. Venture Capital Market leader, said in a statement. Those large deals made up 39% of the deal value in the second quarter.

The decline in deal numbers in the face of the rise in dollar value translates into a high concentration of dollars invested into a handful of late-stage companies, said NVCA President and CEO Bobby Franklin. One deal alone totaled $3.5 billion from a non-traditional investor, he said.

Maine deals still strong

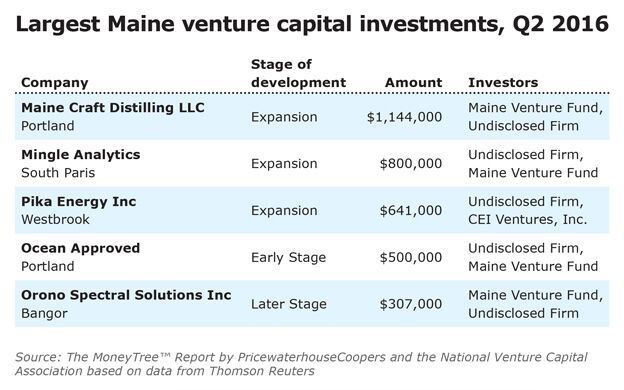

Venture capitalists, primarily the Maine Venture Fund, put a total of $3,392,000 into five deals, up from the $3,838,000 into three deals in the first quarter.

“This is one of the biggest quarters we’ve seen in Maine in terms of the number of the deals in recent quarters,” Ciccolella told Mainebiz in an interview. He added that Maine typically has from one to three deals in a quarter, but since the numbers are so low compared to other states it’s difficult to extrapolate trends.

The second quarter deals were:

Maine Craft Distilling LLC, Portland, a $1,144,000 expansion deal funded by the Maine Venture Fund and an undisclosed firm;

Mingle Analytics, South Paris, an $800,000 expansion deal funded by the MVF and an undisclosed firm;

Pika Energy, Westbrook, a $641,000 expansion deal funded by CRI Ventures and an undisclosed firm;

Ocean Approved, Portland, a $500,000 early-stage deal funded by MVF and an undisclosed firm; and

Orono Spectral Solutions, Bangor, a $307,000 later-stage deal funded by MVF and an undisclosed firm.

By stage of deal, there were no seed deals so far this year in Maine, two early-stage deals across the two quarters, five expansion-stage ones and one later-stage deal. The biggest deals were in computers and peripherals and in electronics and instrumentation.

New England amasses funding

The six New England states still pulled in strong funding, though the number of deals dipped to 97 in the second quarter from 124 in the first quarter, and the total amount invested just topped $1 billion in the recent quarter, down from $1.6 billion in the first quarter.

By state, Massachusetts led in New England and was third nationwide behind California and New York in both number and value of deals. The state had 76 deals in the second quarter worth $973.8 million in the second quarter. Connecticut followed in value with $89.1 million for 20 deals, then Vermont with almost $4.5 million for two deals, Maine, New Hampshire with $3.7 million for two deals and finally Rhode Island with $2.1 million for five deals.

Read more

Comments