Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- September 22, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Maine among top states in inventory of foreclosed homes

Courtesy of CoreLogic

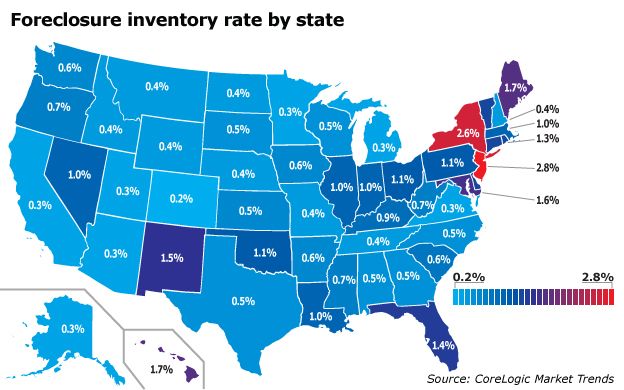

Map showing the November foreclosure inventory rate, with Maine being one of the four highest states, along with the District of Columbia.

Courtesy of CoreLogic

Map showing the November foreclosure inventory rate, with Maine being one of the four highest states, along with the District of Columbia.

Maine is among the states with the highest percentage of foreclosure inventory on its mortgaged homes, according to a foreclosure report released on Jan. 10.

CoreLogic (NYSE: CLGX) reported that Maine’s foreclosure inventory in November was 1.7%, the same as Hawaii, but was lower than New Jersey (2.8%) and New York (2.6%), which had the highest inventories for the month. The District of Columbia had the fifth-highest inventory at 1.6%.

By contrast, CoreLogic reported these five states with the lowest foreclosure inventory as a percentage of mortgaged homes: Colorado, 0.2%; Arizona, 0.3%; California, 0.3%; Minnesota, 0.3%; Utah, 0.3%.

Maine’s foreclosure inventory percentage was 11.2% lower than the same period a year ago, CoreLogic reported.

Completed foreclosures in Maine for the year ending in November stood at 895. The rate of properties in “serious delinquency” was 3.7%.

National overview

Nationwide, CoreLogic reported there were 26,000 completed foreclosures nationally through November 2016, down 25.9% from 35,000 reported in the previous year. The 2.5% national average for the seriously delinquent rate is the lowest level since August 2007.

Approximately 333,000 homes in the United States were in some stage of foreclosure in November, compared to 465,000 the previous year.

“The decline in serious delinquency has been substantial, but the default rate remains high in select markets,” said Frank Nothaft, chief economist at CoreLogic. “Serious delinquency rates were the highest in New Jersey and New York at 5.6% and 5% respectively. In contrast, the lowest delinquency rate occurred in Colorado at 0.9% where a strong job market and home-price growth have enabled more homeowners to stay current.”

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Comments