Affordable housing a challenge in Portland's hot market

Portland is on the map, nationally and internationally, as a great place to live, says Vitalius Real Estate Group principal Brit Vitalius.

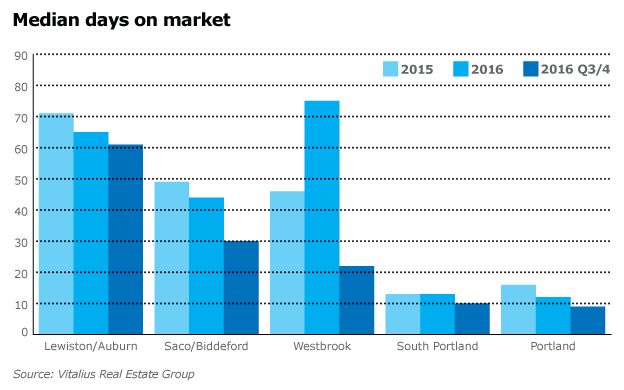

That's resulted in the new-housing boom but also tightens up residential availability nearly to the vanishing point. New units are selling quickly. Existing units that become available, whether for sale or rent, typically attract numerous inquiries within a day or two.

In just one recent day, Vitalius had four requests from new buyers, both locals and out-of-state.

“I have to call them back and say, 'It doesn't exist. Be patient,'” he says.

The rental market has also been challenging for several years. Typical renters include professionals who are transferred to Portland, can pay more, and want to live in town.

“It's different from the past because more affluent professionals didn't necessarily want to live downtown 20 years ago, maybe even 10 years ago,” says Vitalius. “And now they're willing to pay a premium to live in town.”

Rental rates may have hit a plateau: The average rent for a one-bedroom in 2015 was $1,100, but last year dipped to $950 to $1,100. For a three-bedroom, renters in 2015 paid an average $1,550 in 2015 and $1,500 to $1,700 in 2016.

Yet some argue that rents are still too high for many of Portland's residents.

“We consider housing to be affordable when people pay no more than 30% of their income on housing,” says Dana Totman, president of Avesta Housing, one of the largest nonprofit developers of affordable housing in New England. Avesta has about 700 units in Portland.

What qualifies as 'affordable'?

Avesta focuses on people who earn $49,200 a year, or 80% of Portland's area median income. Portland's AMI was $61,500 in 2016, according to the U.S. Department of Housing and Urban Development.

Half of Portland's population earns less than that, Totman says. Among renters, the median income is $33,081; By Avesta's 30%-of-income standard, they could afford to pay $827 per month.

“There's a huge affordable housing problem in the greater Portland area,” says Totman. “So we need to do one of two things — increase everyone's income or decrease the rent down by $600.”

So how do Portland's lower-income residents deal with the situation?

“They double up with other people. Or they're paying 50% to 60% of their income on their housing and don't have enough money to pay for a car or health insurance or food. Or they're homeless or living in substandard housing,” says Totman. “Some people are moving to the outskirts. That tends to happen when an area becomes expensive: People move to less expensive areas, but often they increase their travel costs to get where the job is.”

Then there are collateral challenges.

“When employers can't find employees because employees can't find places to live, it's a huge economic problem,” says Totman. “I think there are restaurants and stores that are struggling to find workers because they cannot afford to live in Portland.”

Affordable housing as an economic driver

While the top end of the residential market in Portland has seen significant additions, the city is working to address the shortage of new affordable housing.

“You get people who are priced out of Portland, or people who want to take a first job as a young professional but can't afford to live here on an entry-level salary. So we're concerned about that as an economic development issue,” says Jeff Levine, Portland's director of Planning and Urban Development.

“We want to attract young professionals and make sure they have housing choices,” he adds.

A 2015 report on workforce housing found that, generally, the housing production rate is adequate, but doesn't always meet the needs of average households. The median price of new construction is beyond the reach of the middle class. Still, a proportion of new homes is affordable.

From 2010-14, 384 new condominiums and single-family homes were permitted in Portland, the report says. The percentage of units sold or marketed for sale at an affordable price was 7%. During the same period, 746 new rental units were permitted. The percentage of units marketed for rent at an affordable price was 41%.

In 2015, Portland City Council adopted so-called inclusionary zoning that would require new developments of 10 units or more to set aside 10% to be offered at an affordable rate.

“Nothing's perfect,” says Levine. “But the idea is that our neighborhood should include a variety of types of people and a variety of income levels. That includes making sure the market gets what it needs and also making sure the city has what it needs for the public interest.”

Inclusionary zoning in action

Real estate developers Susan Morris and Chip Newell, principals of the NewHeight Group in Portland, developed the 12-unit 118 on Munjoy Hill, at 118 Congress St., in spring 2015. They occupied one of the units and sold the other 11 at rates starting at $600,000. “Like so many people, we were more and more attracted to what was going on in Portland — its small-city lifestyle, walkable neighborhoods — and we wanted to be a part of it,” says Morris.

Now, their current project, the Luminato, which is under construction at 167 Newbury St., will be Portland's first project to conform to the new inclusionary zoning ordinance.

One-bedroom units at Luminato are priced at $260,000 to $300,0000, while three-bedrooms units are listed at around $1 million. Shared amenities include a guestroom, lounge, fitness center and roof deck. Completion is expected this August.

The 24-unit project already has 20 buyers. Morris has done an informal analysis, and finds buyers range in age from their 20s to 50-plus. Some own or work for Maine companies. Others live and work outside of Maine but have bought a condo as a second home. They also include multi-generational Mainers, families, singles, downsizers and first-time home-buyers.

The inclusionary zoning offers three avenues for developers to provide workforce housing: Either price 10% of their for-sale units, located on-site or off-site, so they're affordable to buyers with incomes at or below 120% of the area median income, which is $61,500. Or rent 10% of their apartments to households with incomes at or below 100% of AMI. Or contribute a fee to the city's affordable housing trust.

To satisfy the requirement, NewHeight Group worked out a mechanism for Community Housing of Maine, a nonprofit affordable housing developer, to acquire a building from Luminato at a discount, providing CHOM with equity in the project that allowed it to use bank financing for purchase and rehabilitation of the building. The three-story, three-unit building is located at 42 Hampshire St., around the corner from Luminato. Monthly rent for a two-bedroom unit in that building is capped at $1,400 per month, which represents 30% of income for a household of two people earning 100% of Portland's AMI. This compares to $1,950 to $2,500 per month for similar two-bedroom units with no cap.

“The intent is to make sure we're not pricing working people out of the housing market in Portland,” says CHOM Development Director Erin Cooperrider, who partnered with Luminato in order to handle the initiative's income qualification and compliance requirements. “The new zoning is another tool to help maintain a continuum of housing choice in increasingly expensive locations.”

Comments