How to: Navigate the new minimum wage law

There has been a lot of concern expressed lately about the effect of Maine's new minimum wage law on tipped service employees and employers in the restaurant and hospitality industries. Wait staff are worried that they actually will earn less as the tip credit disappears and customers reduce, or stop making, tips. Employers are concerned that they won't be able to stay in business as the minimum wage increases and they no longer can rely on the tip credit to compensate workers.

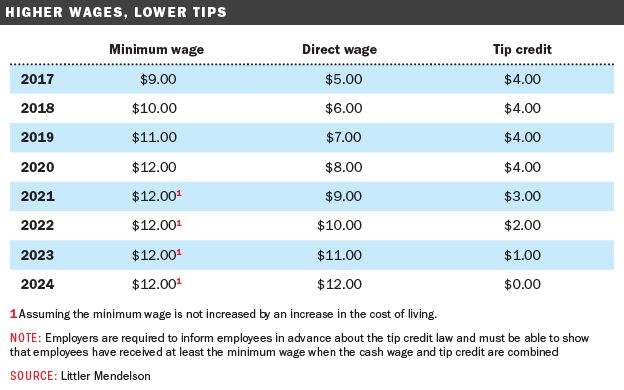

While it currently faces challenges in the state Legislature, on Jan. 7 Maine's minimum wage increased from $7.50 an hour to $9 an hour, and it is scheduled to increase by $1 each year until it hits $12 an hour in 2020. After 2020, Maine's minimum wage will increase each year by the amount of the increase in the cost of living that year, calculated according to the Consumer Price Index and rounded to the nearest multiple of 5 cents.

Currently, an employer can consider tips as part of the minimum hourly wage that it pays to a tipped service employee, but this “tip credit” cannot exceed 50% of the effective minimum wage. The minimum direct cash wage for tipped service employees is $5 per hour, which means that employers must pay service workers at least $5 per hour, and the employer may count up to $4 per hour in tips toward satisfaction of the $9 minimum wage. If the employee does not make the equivalent of at least $4 per hour in tips, the employer must pay the employee the difference to ensure payment of minimum wage.

The new law also requires the minimum cash wage to increase each year, starting on Jan. 1, 2018, and each Jan. 1 thereafter, by $1 per hour until it reaches the same amount as the annually adjusted minimum wage, sometime in 2024 or thereafter. At that point, the tip credit will be eliminated under the law as it now stands, and employers will have to pay their service employees the full minimum wage.

What happens during this transition? Will customers stop paying tips? Will employers prohibit tips? Will employers in the affected industries be able to afford to pay the minimum wage without passing on the additional costs to consumers?

Many interested parties have expressed concern about the elimination of the tip credit, arguing that restaurant owners will be forced to increase prices or terminate service workers, and that customers will be confused about tipping and may drastically reduce tips. The elimination of the tip credit represents a substantial change in the way affected employers do business and a substantial change in the way service employees are paid. It's no wonder many employers and industry groups are lobbying for a repeal of the direct cash-wage increases and the eventual elimination of the tip credit.

You should also note that in Portland the current minimum wage is $10.68 per hour. Employers in Portland have the added difficulty of navigating both the city ordinance and the new state minimum wage law. Unfortunately, the Portland ordinance and the state law are not entirely consistent with their treatment of the tip credit, and employers in Portland should seek the advice of employment counsel to establish the proper tip credit level for their employees.

Eric Uhl is a shareholder and employment law attorney at the Portland office of Littler Mendelson. He can be reached at euhl@littler.com

Alison Tozier, an associate at Littler Mendelson, specializes in workplace and employment issues. She can be reached at atozier@littler.com

Comments