'Repeal and replace' drives uncertainty about key Obamacare provisions

Uncertainty about whether “repeal and replace” legislation by the Republican-led Congress ultimately will help or hurt the Affordable Care Act’s health insurance markets already is having an impact in Maine and nationwide.

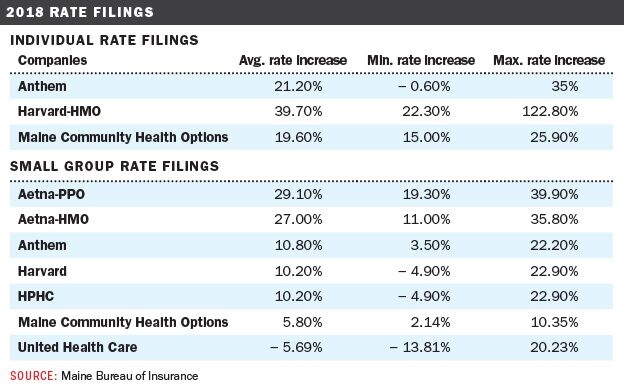

Community Health Options and the two other insurers offering plans in Maine’s federal ACA individual marketplace recently filed with Maine’s Bureau of Insurance double-digit rate hike proposals for individual health insurance plans in 2018. Harvard Pilgrim Health Care is seeking the largest rate increase, proposing an average proposed hike of 39.7%, followed by Anthem Blue Cross and Blue Shield with 21.2% and CHO with 19.6%.

Early filings in other states, according to a May 10 article in Modern Healthcare, indicate that other insurers also are seeking double-digit hikes, in some cases exceeding 50%. Like the Maine insurers, they've stated that a big driver of those rate hikes are the uncertainties about whether ACA repeal-and-replace efforts will retain two key provisions of Obamacare: the individual mandate penalty that’s intended to make sure healthier people stay enrolled in coverage and the cost-sharing reduction subsidies that help low-income members afford the coverage.

The U.S. House of Representatives already has passed its version of an Obamacare replacement bill, which the nonpartisan Congressional Budget Office reported after the bill’s passage would leave 23 million more Americans uninsured by 2026 compared with the current health care system.

CNN reported today Senate Majority Leader Mitch McConnell announced Tuesday a “discussion draft” of the Senate bill that would repeal and replace Obamacare — which has so far been kept closely under wraps — will be released this Thursday in order for a vote to take place on June 29. The potential impact and cost of bill won’t be known until the CBO is able to conduct its analysis after the bill is released.

In today's segment of our five-day series of interviews with Kevin Lewis, CEO of the Lewiston-based insurer Community Health Options, Mainebiz asked him about Obamacare replacement bill called the American Health Care Act, which the U.S. House of Representatives narrowly passed on May 4 by a 217-213 vote . The following is from an edited transcript.

Mainebiz: You’ve shared a number of examples of how your insured members benefited from their Affordable Care Act coverage. But the political debate going on in Washington, D.C., tends to describe the ACA solely in negative terms. Do you sometimes feel the political debate overlooks evidence that real people have benefited from Obamacare?

Kevin Lewis: Yes, definitely. Over a decade ago there were studies showing that coverage matters. Whether it’s New England Journal of Medicine or some other credible source, they’ve all reached the same conclusion: “Coverage is vital to better health results.”

The ACA has succeeded on at least this level, in that it has produced higher rates of coverage in a market that previously had much higher deductibles. Recall that many individuals prior to the ACA were going without any health care coverage. The Maine individual market nearly tripled from 2013 to 2016 due to the advances of the ACA.

MB: Nationwide it’s more than 20 million Americans, if not more, that gained coverage through the ACA.

KL: Yes. There are two components to that number: The marketplace [13 million enrolled nationwide] and the Medicaid expansion [7 million].

MB: The U.S. House of Representatives narrowly approved the American Health Care Act on May 4 by a 217-213 vote. Based on what you’ve seen in that, and the fact that now the Congressional Budget Office has come out with its analysis of that bill, what are your impressions about the AHCA?

KL: I think the challenges are to the market. We’ve seen a tripling of the market in Maine, which has meant coverage opportunities for tens of thousands of people who previously had no health insurance. The combination of less subsidies and abandonment of the individual mandate in the AHCA will reduce participation in the market.

Uncertainty in the individual market

MB: And those points are pretty much borne out in the CBO score?

KL: Yes. Twenty-three million fewer people would be covered under the AHCA. There really is reduced incentive for the healthier segments of the risk pool to be involved under the proposed structure.

MB: What are the elements of the AHCA that will be of most concern to insurers?

KL: I can only speak for Community Health Options, but a significant concern is the loss of sufficient premium supports for meaningful coverage. The AHCA will drive up premiums for older and low-income consumers. While premiums for younger and healthier individuals interested in the “skinnier” plans envisioned by the AHCA might arguably be less than premiums for today’s plans with essential health benefits, the value for those plans will also be dramatically reduced. The problem of increasing numbers of uninsured and underinsured will rekindle greater cost-shifting onto those with employer-sponsored coverage.

MB: The House passed the AHCA before it was scored. Did that concern you, and why?

KL: Yes, of course. The AHCA removes key consumer protections and premium supports, including cost-sharing reductions. The AHCA framework will diminish the individual market from its current size, and there is the potential that escalating premiums will precipitate further flight from the individual market.

MB: Is there even going to be a federal ACA marketplace in 2018? What’s your understanding?

KL: Everything points to there being a marketplace in 2018. What we have to operate on, and what everybody is keying on, is the latest CMS guidance and payment parameters bulletin. CMS rules and regulations point to 2018 proceeding with minor modifications to the actuarial values limits.

MB: Doesn’t that create a great deal of uncertainty as you put together your rate proposals for 2018?

KL: Yes, it creates uncertainty with regard to the impacts on the future market.

MB: How do you proceed when so much is in flux?

KL: You have to fix your assumptions at a certain point and go from there. There is always going to be some level of uncertainty.

MB: Do you think the general public understands that, at the very least, in 2018, there’s going to be a federal marketplace?

KL: You make a good point. I think there is a lot of confusion. Understandably so. The messaging has been all over the board.

The amount of uncertainty confronting the market is already driving steep rate increases being proposed for 2018. Nevertheless, we remain committed to both individual and group markets and continuing our growth as a relatively young, non-profit mission based insurer based in Maine.

Regardless of what happens with the ACA, we’re still going to be around.

Series at a glance

Here’s the schedule of what’s already run, and what’s in store for the week ahead:

Monday: Getting through a challenging year

Tuesday: Helping people improve their health

Wednesday: 'Repeal and replace' driving uncertainty about key Obamacare provisions

Thursday: Thoughts on Sen. Susan Collins’ co-sponsored replacement bill

Friday: What lies ahead for CHO?

DOWNLOAD PDFs

Read more

Community Health Options sues federal government for $5.7M

Comments