Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

CMP ready to flow: New England Clean Energy Connect bid includes 1,000 MW of power from Hydro-Quebec

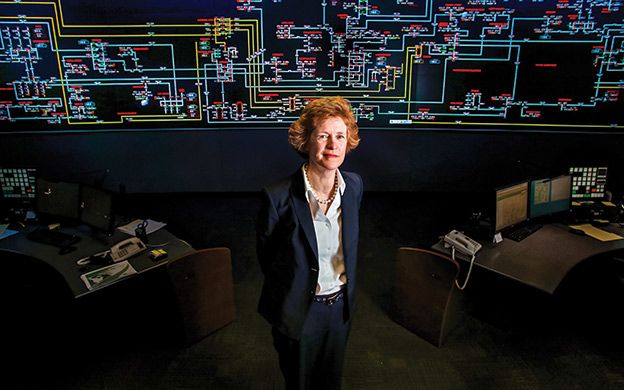

File photo / Tim Greenway

Sara Burns, CMP president and CEO, in the energy control center in Augusta, where CMP monitors and controls its high-voltage electric grid.

File photo / Tim Greenway

Sara Burns, CMP president and CEO, in the energy control center in Augusta, where CMP monitors and controls its high-voltage electric grid.

For the second time in as many years, southern New England's ambitious renewable energy goals are driving a slew of proposals from wind, solar and hydropower projects — many of them with ties to Maine.

This time it's Massachusetts that put out an RFP on March 31 seeking bids for approximately 1,200 megawatts of clean energy. Almost 50 bids were submitted, with at least 14 involving projects located in or passing through Maine.

The Massachusetts Clean Energy RFP, issued by Massachusetts utilities and the Department of Energy Resources, calls for 20-year power purchase agreements for delivered renewable energy to meet the state's ambitious clean energy goals. Projects are expected to be selected in January 2018.

Central Maine Power, whose bids in the earlier New England Clean Power RFP were passed over, is taking a different tack this time: Instead of linking its proposal primarily to wind power, CMP submitted several proposals — in effect, offering a “cafeteria plan” of options that could include wind, solar and, significantly, hydroelectric power from Hydro-Quebec.

Mainebiz sat down with CMP President and CEO Sara Burns to discuss CMP's New England Clean Energy Connect proposals. The following is an edited transcript.

Mainebiz: Tell us about the proposals you've submitted in response to an RFP from Massachusetts. What's behind the state's RFP for clean energy? How might that impact Maine?

Sara Burns: ISO-New England's dependence on natural gas is of concern to all ratepayers in New England. One of the issues that people don't pay attention to is that we're one common market. We're not a 'Maine' market and a 'Rhode Island' market, etc. We're one common market. So natural gas is the fuel that's being used predominantly to produce electricity in this market as we speak: It's right now at 55% for natural gas and 29% nuclear.

MB: And we know Vermont Yankee has shut down, leaving only Seabrook, Millstone and Pilgrim nuclear power plants for New England's market.

SB: You're going right to my point. All of those nuclear power units have a life cycle. Seabrook has a long life cycle, but Pilgrim already announced it will shut down by mid-2019. So I think for all of us, as we look at the challenge of our current fuel mix, with natural gas being more than half, the question becomes: Does this make you feel comfortable over the long term?

MB: In effect, if the fuel mix continues the trend of relying even more heavily on natural gas, we'd be putting all our eggs in one basket?

SB: Exactly right. And if the price of natural gas goes up there's going to be a great sucking sound out of New England's pocketbooks. It will raise the cost of electricity. So I think what Massachusetts and the governor of Massachusetts are doing is taking a responsible, longer-term look at this challenge.

MB: In other words, diversify the mix?

SB: Yes. And they have a particular interest in clean energy.

If you do a little research you can go back and look at what the grid's fuel mix was in 2000, compared to, say, 2016. In 2000, natural gas was 15%. And in 2016 it was 49%. In 2000, nuclear was 31%, and in 2016 it was 31%. In 2000, hydro was 7% and in 2016 it was 7%. Coal in 2000 was 18% and in 2016 it was 2% and oil was 2% and it's now 1%.

What becomes evident is that the coal and oil percentages have moved over to natural gas. But the one that is most interesting to me is that in 2000 renewables were 8% and today they're 10%.

So even though we've talked about it enormously over the past decade we've moved renewable energy only 2 percentage points since 2000.

MB: CMP's role, as a transmission provider, is to get that clean power to the market?

SB: Exactly right. There were a lot of ideas renewable companies presented to us, some of them far more thought out than others. We ended up choosing two partners and we've put in two bids: One with Hydro-Quebec and one with NextEra, which is the parent company of Florida Power and Light.

Part of our strategy was based on the observation that if you look at a map of the transmission system in Maine, you'll notice that there are two major lines into New Brunswick, and we've had them there for a long time, but none into Quebec.

About three years ago we started strategically to buy a right-of-way up to the Quebec border. We did it quietly, we did it with our engineers looking at what would be the most efficient way to get there, we had our environmental team looking at what route would have the least impact. And we had our financial team looking at price. We acquired about a 54-mile right-of-way from what we already owned and we did it with four landowners.

We did it thinking that if you look long-term we would need a line into Quebec one day. So we are positioned now to do that.

MB: Hydro-Quebec is also part of other proposals to Massachusetts' RFP, isn't it?

SB: Hydro-Quebec is bidding with three partners in this RFP: They're bidding through Maine with us, through New Hampshire with EverSource and through Vermont with TDI New England.

MB: Are they mutually exclusive bids?

SB: Yes.

MB: So it will be one of you three, if Massachusetts sees Hydro-Quebec as the way to go.

SB: Correct.

Our Hydro-Quebec bid consists of two parts: We did one pure hydro bid of about 1,090 megawatts of power and we did a second bid that was 700 megawatts of hydro and 300 megawatts of wind.

We did that because we want to offer Massachusetts choices. We did the same thing with NextEra.

MB: Tell us about the NextEra bid.

SB: The NextEra bid actually has three parts: The first bid was for 450 megawatts of wind. The second bid adds to that 150 megawatts of solar and two battery storage projects: One will be at the solar farm and one will be at the wind farm, and each will be 25 megawatts. The third bid, and again this is a building block bid: The third bid is to take all of that and on top of that we've partnered with a Canadian wind developer that's literally parked right on the other side of the border, and that is another 450 megawatts of wind.

And again, we did this in the spirit of saying to Massachusetts: These are the two best partners that we could choose and we give you a group of ideas that you can choose from.

MB: NextEra's wind projects are roughly located in western Maine?

SB: Yes.

MB: Can you share your thoughts on how CMP's bids might compare to the other proposals?

SB: I can. In order to give you a perspective of what we're competing against:

- There are three Hydro-Quebec bids and we're one of them.

- There are six other large bids, one of which is ours with NextEra. Some combine wind with hydro, or wind with solar.

- There are two very small hydro bids.

- There are 19 solar bids.

- There are six single, smaller wind bids.

- And one offshore wind bid.

That's the competition.

The good news for ratepayers is: This is the future of trying to get them the best energy source at the lowest cost, and Massachusetts has received a robust response.

Here's how we see our proposal in relation to the competition:

- It's the shortest transmission route under control. We're not out acquiring anything to make our proposal happen.

- I think one of the biggest messages in our favor is that we're using what ratepayers have already paid for. Up to this new 54-mile acquisition, we're in an existing right-of-way and we're going to use it. We're going to deliver into Larrabee Road, which is part of the Maine Power Reliability Project that New England ratepayers have already paid for. So we're using what's already been built and paid for.

- We're not underground, we're not sub-sea.

- We are the only group that can say, 'We recently delivered a major transmission project on time and under budget.' So when you ask the question, 'Can you get it done?' We can answer, 'Just in 2015, we finished a $1.4 billion upgrade. There are not a lot of other big transmission projects that can make that claim they completed the job on schedule and under budget.' We have the team that can do it.

MB: Can you comment on your proposal's cost and power pricing?

SB: No. When you submit bids to an RFP, no one is talking about their price. We're not speaking to our price and that's because here's one scenario we think could develop: The decision is supposed to be made in January. They could get down to two major projects and come back to us and say, 'You are the two we're looking at. Give us your best and final price.'

So I don't want to be out telling people what our bid is. But I believe, based on what I know about all these projects, that we are the lowest-priced project.

I would also say that our parent company, Iberdrola, had a huge impact. As we went out to price this, we used an Iberdrola sourcing team, an experienced team. The scale of Iberdrola's capital spend and their power in the market is reflected in our price.

MB: If your bid is accepted what are the next steps for CMP?

SB: Massachusetts starts a negotiation process to lock it down. I think they put in June 2018 as the deadline for that stage of the process.

So, right after I clap and say, 'Hurrah' for our team,' then you've got to get on these schedules. You are committing to a time-frame. On the Hydro-Quebec project, we're committing to 2022. On the NextEra project, we've have put forward three different time-frames and they would be saying which one they would buy. But if you are the winner, you've got a schedule on which you must deliver what you've said you would.

MB: If you are successful, it's obviously a project that will benefit Maine's economy. Can you talk to what kind of work would be part of this?

SB: We took the project and we gave it to Daymark Energy Advisors and they put it through their economic modeling. Right now they're saying it has about $40 million per year for Maine in annual electricity cost savings to ratepayers over the 20-year forecast period (2023-42).

The other benefit is that a firm load of hydropower reduces our dependence on natural gas. Our dependence on natural gas is a risk, and the risk is that the price will go up.

The third benefit for all of New England is that it lowers greenhouse gas emissions. I think New England number is 3 million metric tons annually. So that's a benefit for all of us.

Now, in Maine, we'll get the construction jobs — with total number of jobs averaging 1,700 per year during project development and construction and more than 3,000 jobs supported by the project during the peak years of construction.

I think the project has a great benefit for both Maine and New England.

There are two other interesting benefits to Maine in terms of reliability. If we win and we build this line, there are two major portions of this project: We have to put the line in and then there are all the upgrades we have to do with the new system to move the energy out of Maine. All of those upgrades make the Maine system more reliable. So Maine gets a stronger, more reliable grid.

The other point I'd like to make is this: If we want to deal with Hydro-Quebec, there's no better way than to do it through an RFP. They are bidding three different times [i.e. CMP's New England Clean Energy Connect, Northern Pass and New England Clean Power Link.] I'm sure they could figure out that this was going to be a robust response to Massachusetts' RFP. So if you want to be the winner you've got to come in with the best price.

Other Maine-related bids submitted to Massachusetts' Clean Energy RFP

1. Blue Falcon Solar: 50MW solar facility (Greenbush, Penobscot County). Bidder: Torch Clean Energy LLC.

2. Brookfield Hydro Conversion: 20.8MW resulting from repowering five generators at two hydroelectric stations on the Penobscot River (Three units at Millinocket Station, two units at Dolby Station, Penobscot County. Bidder: Brookfield Energy Marketing LP/Great Lakes Hydro America.

3. Bryant Mountain Wind: Details redacted (Oxford County. Bidder: EverPower Maine LLC.

4. County Line Wind: 630MW wind project involving 150 wind turbines (between Penobscot and Aroostook counties). Bidder: Joint venture of Maine Power Express LLC and Con Edison Transmission Inc.

5. Downeast Wind LLC: Wind project, details redacted (Columbia and the Unorganized Territory of T-18, Washington County). Bidder: Apex Clean Energy Holdings LLC.

6. Long Mountain Wind Project: 44.85MW wind project, with option of adding up to 20MW of battery storage (Greenwood, Oxford County). Bidder: Calpine Wind Holdings, LLC.

7. Maine Clean Power Connection: 450MW power generated in Maine and Province of Quebec. Quebec locations: Haute-Chaudiere Wind Project, 149MW; St-Theophile Wind Project, 149MW. Maine locations: Timberline Wind Project, 149MW; EDF RE Storage Project, 20MW (Details about the Maine projects are redacted, other than to say they are in “western Maine.”) Bidder: EDF Renewable Energy Co., a wholly owned controlled affiliate of EDF Energies Nouvelle S.A.

8. NextEra CMP: Wind project, (megawatt and location details redacted). Bidder: NextEra Energy Resources Acquisitions LLC with Penobscot Wind LLC, Moose Wind LLC.

9. NextEra Solar: Several utility scale solar projects in New England: 25MW (Farmington); 50MW (Hinsdale, N.H.); 75MW Dawn Land Solar, 20MW Kennebec Solar, 150MW Lone Pine Solar (locations redacted). Bidder: NextEra.

10. Nine Kings Wind: Two wind proposals submitted, one for 350MW and the other for 1,200 MW. Heavily redacted documents hide details about the locations and particulars of the wind projects.(Locations redacted, although one document was signed by a representative of Number Nine Wind Farm LLC and gave its location as Penobscot County.). Bidder: EDP Renewables North America LLC and Pattern Renewable Development Company 2 LLC.

11. Silver Maple Wind Energy Project: 20MW wind facility (Clifton, Penobscot county. Site is adjacent to Pisgah Mountain Wind Project). Bidder: SWEB Development USA.

12. Somerset Wind: 93.6MW wind facility to be connected to grid via Maine Clean Power Connection proposal (Somerset County in western Maine). Bidder: Somerset Wind LLC (NRG Energy Inc. subsidiary).

13. Weaver Wind: 75.9MW wind facility (Location details redacted). Bidder: Longroad Energy.

Source: Bid documents filed with Massachusetts Clean Energy RFP

Read more

CMP President and CEO Sara Burns to retire by year's end

CMP touts $950M bid as best deal among clean energy bidders

CMP names new president/CEO to succeed Sara Burns

Three companies seek to block CMP's Hydro Quebec transmission project

Comments