LePage and Grohman team up on $50M bond to lower student debt

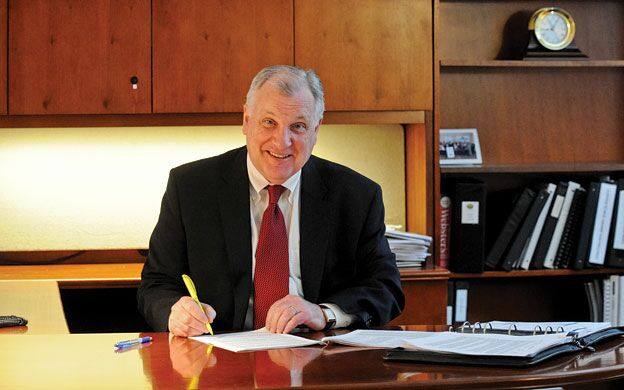

Photo / Amber Waterman

Bruce Wagner, CEO of the Finance Authority of Maine. A bill proposed by Gov. Paul LePage and Rep. Martin Grohman, I-Biddeford, calls for a $50 million general obligation bond to offer no-interest student loans as well as loan refinancing that would be administered by FAME. The intent of the legislation is to encourage more young people to live and work in Maine by lowering their student loan costs.

Photo / Amber Waterman

Bruce Wagner, CEO of the Finance Authority of Maine. A bill proposed by Gov. Paul LePage and Rep. Martin Grohman, I-Biddeford, calls for a $50 million general obligation bond to offer no-interest student loans as well as loan refinancing that would be administered by FAME. The intent of the legislation is to encourage more young people to live and work in Maine by lowering their student loan costs.

Advocates at a public hearing on Thursday voiced strong support for a proposal by Gov. Paul LePage and Rep. Martin Grohman, I-Biddeford, to create a $50 million general obligation bond to offer no-interest student loans as well as loan refinancing.

LD 1834, “An Act To Authorize a General Fund Bond Issue To Provide for Student Loan Debt Relief,” would create a $50 million fund overseen by the Finance Authority of Maine for zero-interest student loans and loan consolidation or refinancing interest rate reductions for Maine residents who agree to live and work in Maine for at least five years.

Of the 14 written comments submitted to Joint Standing Committee on Appropriations and Financial Affairs for Thursday’s hearing, 13 supported the bill and the remaining one was “neither for nor against” it.

Under the Maine Student Loan Debt Relief Program program, zero-interest loans up to $10,000 per year for a maximum of five years would be made available to Maine residents who study at qualified in-state institutions of higher education and agree to live and work in Maine for at least five years following graduation.

Loans bearing an annual interest rate of the prime rate of interest plus 2% would be made available to those who do not live and work in the state upon graduation.

The bill also proposes allowing FAME to provide interest rate reduction payments to residents who use the authority's existing loan consolidation and refinancing program. This option would be available to individuals who studied in Maine or outside of Maine and agree to live and work in Maine for at least five years. The bill exempts from Maine income tax any benefits received under the program to the extent included in federal-adjusted gross income and would prohibit individuals who have received benefits under the program from receiving the Maine educational opportunity tax credit.

'A critical problem' that's getting worse

In a news release about the bill he introduced with LePage, Grohman said it is intended to provide significant debt relief for students and would go a long way towards retaining young people in Maine.

“This approach would give Maine businesses a powerful tool to attract and retain in the state recent college graduates,” he said.

According to the Project on Student Debt, the average student loan indebtedness for a Mainer is $31,295. This ranks Maine as eighth-highest in the nation.

“This is a critical problem and it’s getting worse,” Grohman said. “That’s why, together with Gov. Paul LePage, I am proposing legislation that would authorize a $50 million general obligation bond to offer 0% student loans, as well as loan refinancing. This is not loan forgiveness, and eligibility would be tied to living and working in Maine.”

Grohman added that students from another state who move to Maine to live and work here would be eligible for the loan consolidation-refinancing portion of the plan. “I look forward to working with my colleagues in a bipartisan manner to implement this bold plan as soon as possible,” he said.

Support voiced at public hearing

In his written testimony supporting the bill, LePage told members of the Joint Standing Committee on Appropriations and Financial Affairs that the University of Maine estimates that nearly 80% of in-state students who graduate from UMaine and enter the workforce stay in Maine for their first job. Citing the demographic winter Maine faces as the state with the oldest average age (44.6 years in 2016), LePage said it was critical to find ways to attract more young people to live and work in the state.

“This is a smart investment because it’s much cheaper for the state to borrow than those individuals to borrow,” LePage wrote. “Interest rates on federal student loans can start at the 4.5%, with Stafford loans at 6.8% and other private loans running as high as 8%, 9% and over 10%. Some graduates who haven’t been able to refinance are carrying historic amounts of student debt with astronomical interest rates. This hurts their ability to invest in buying a home and starting a family. The state’s rate to borrow is much cheaper. Offering the opportunity to consolidate loans at a much lower rate is an important tool for employers to recruit out-of-state candidates for jobs in Maine.”

James Myall, a policy analyst at the Maine Center for Economic Policy, described the bill “as a promising initiative to start addressing these economic problems.”

“Of the approximately 33,000 Mainers who leave the state each year, almost half (48%) are either college students or college graduates,” he wrote. “And while some do return to the state (Maine actually has a slight net inflow of college graduates), it's at a later stage in their life. The average age of college students and graduates leaving the state is 28, but the average age of a returning graduate is 38.6. That means Maine is missing out on a decade of productivity and tax revenue from these college graduates. LD 1834 could reduce this out ow of human capital, and encourage it to return sooner.”

Comments