Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 15, 2025

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

Bootstrapping 101: Financing a startup is about more than just money

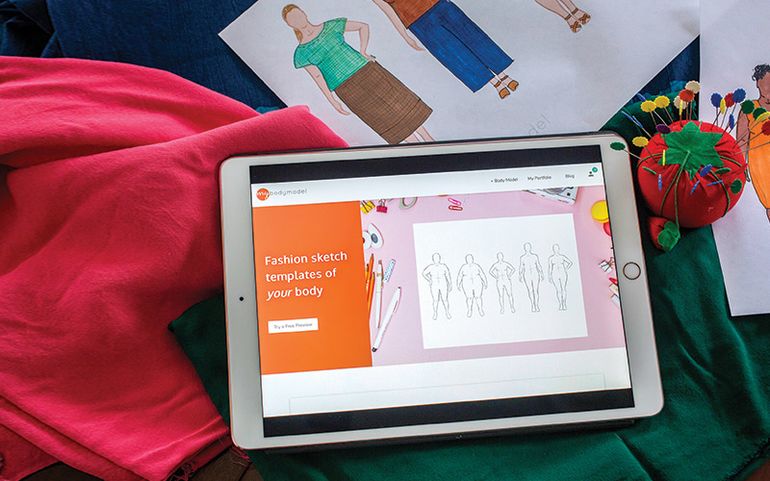

Photo / Tim Greenway

Erica Schmitz with her app, Mybodymodel, in her home office in Portland. She has raised startup capital through Kickstarter and small grants.

Photo / Tim Greenway

Erica Schmitz with her app, Mybodymodel, in her home office in Portland. She has raised startup capital through Kickstarter and small grants.

Photo / Tim Greenway

Photo / Tim Greenway

Erica Schmitz began making her own clothes five years ago, but soon came across a frustration — the online templates had body images that were great for fashion models, but not for everyone else.

She soon found out that she wasn't alone, it was a global issue.

Schmitz, of Portland, is a consultant with an Augusta public health nonprofit, not an inventor. But, armed with an aging iPad and a desire to solve a problem, she did what entrepreneurs have been doing since someone looked at a rock and said, “Gee, if I make this round so it can roll, maybe it will help me get places faster.”

She's been developing her startup for more than a year. Financing has included grants, investments from friends and family, a successful Kickstarter campaign and a lot of hard work.

“So far I've been bootstrapping it,” Schmitz says.

She hopes to launch Mybodymodel, an app that will allow sewing hobbyists and clothes designers to create a custom body sketch, this fall.

Across Maine, entrepreneurs, many armed with no more than an idea and a dream to succeed, struggle to find a way to get financing to make it happen.

Schmitz's first boost was a $5,000 TechStart matching grant from Maine Technology Institute in February 2017.

A $25,000 seed grant in June from MTI also had to be matched, which she was able to do with her Kickstarter campaign.

She acknowledges that it's taken longer than she expected.

“Since I decided to do it, I've been working every weekend, every holiday every vacation,” says Schmitz, 43, who is married and has a 10-year-old daughter.

No free money

“Anyone with a good idea will follow the same path [as Schmitz],” says Nancy Strojny, chair of the SCORE Portland chapter, which mentors entrepreneurs and small-business owners. She said many give up because they don't know how to go about it or aren't prepared to do the work. Strojny was Schmitz's SCORE mentor.

“Most money from startups comes from friends and family,” she says. “Most people don't want to hear that ... There's this misconception, people think that there's free money out there. It doesn't really work that way.”

While conventional bank funding isn't impossible for a startup, it's also difficult to get.

“You have to have a credit score, collateral, business projections — it's not closed to everyone, but it's generally closed if you don't have [those things],” Strojny says. “If it was easy, everyone would do it and they'd all have successful businesses.”

Gorham Savings Bank, which sponsors the annual Launchpad competition, with a $50,000 grand prize, also traditionally finances startups, says Julie Viola, vice president and business banking manager.

Businesses have to show how they'll generate capital and how the bank will be repaid.

“Our expectation is to be repaid,” says Viola. “We're not risk-takers.”

Each customer has different needs, but they have one thing in common. “It's about understanding what they're doing and about asking the right questions.”

Kim Donnelly, senior vice president of business lending at the bank, says cash flow, collateral and fallbacks are all considerations. Is there a spouse with an income who can support the entrepreneur in the early stages? Is the entrepreneur keeping her day job?

Viola and Donnelly say lack of preparation and not knowing what's involved are common issues.

People often come to the bank with “really cool ideas,” Viola says, but no business plan. “They haven't done their due diligence.”

“It's a great idea,” Donnelly adds, “but they don't know how to execute it on paper. It doesn't matter if it's a startup, it doesn't matter what it is. It needs revenue projections.”

Strojny sees the same thing at SCORE.

“People fall in love with an idea, and they think everyone's going to want it. But you have to find a market that's not being met and fill it,” Strojny says.

Until that's worked out, the plan isn't ready for financing.

“What's the target market?” Strojny says. “How are you going to reach it? What problem are you solving? Those are all things they have to answer first.”

Donnelly puts it this way: Entrepreneurs who want a business loan have to be able to tell the bank a story with a beginning, middle and end.

“It's their story and they need to be able to tell it,” she says.

'Get your ducks in a row'

When Schmitz started sewing her own clothes in 2013, “It frustrated me that there were no fashion design tools that look like me, there was no option to customize it to my own body. One of the reasons people sew their own clothes is to make clothes that fit.”

Reaching out to the online sewing and design community planted the seed for Mybodymodel.

“It's a very body-positive community,” she says. “I found out I wasn't the only one, many women would be very excited and willing to pay for their own body model.”

Shortly after she decided to develop an app that would do just that, she got the TechStart grant. Some of the required match could be her own time, rather than cash. Schmitz used grant money to partner with Big Room Studios, a Portland software designer. “I wanted to know what it would take to make it happen,” she says.

She also hired Janet Antich at the-ink-spot in Portland to create prototype sample illustrations, recruiting friends to be models.

She did online market research. “I wanted to make sure this was a product people wanted,” she says.

Technical assistance came from Sarah Guerette at the Women's Business Center at CEI.

She used Survey Monkey, she talked to mentors at SCORE, including Strojny.

“I used a lot of free resources,” she says. “In Maine we're lucky to have so many resources.”

Schmitz partnered with Z Fabrics in Portland, recruiting people for focus groups, and used gift cards as incentive, funded by the grant.

“A startup costs a tremendous amount of work and money, and you really want to make sure it's something people want,” she says. “If they don't, you want to find out sooner rather than later.”

That validation came with the Kickstarter campaign, which she created on an aging iPad with no memory.

When she had to make a video, “It just about did me in, I had to learn how to make a video, and I found out making video is a lot of work.”

That campaign, with a goal of $20,000, raised more than $26,000 over three weeks in August.

“The success of Kickstarter is all in the preparation, and all in the work, before you launch it,” she says. She researched other campaigns. She found out what day of the week was good to launch, how long to do it, what kind of rewards to give donors.

“Even what time of year. You shouldn't do one in July. No one is online in July,” Schmitz says, laughing.

“The best advice I saw in multiple places online was really to get your ducks in a row before launching, build an email list, line up influencers on social media, people who can connect with the audience you want to reach.”

Risk and reward

Strojny says there is money available from a variety of sources. There are pitch contests, from big ones like Launchpad, to small ones across the state. There are micro-lenders and angel investors. Municipalities have economic development funds that may offer grants to businesses that will help the community.

She adds, though, entrepreneurs should take advantage of knowledge and counseling that's offered, too.

Fledgling startups can find plenty, including from SCORE.

At Gorham Savings, too, lenders will counsel those who aren't ready for financing, helping them understand what their next steps are.

“We don't want to be the bank of 'absolutely not,'” Viola says.

Donnelly and Viola say the entrepreneur the bank helps with advice is a potential future customer. “We absolutely see success stories,” Donnelly says.

And people should be prepared to contribute to their own cause.

Donnelly says that “99% of the time, they have to pledge their own assets.”

Strojny agrees — no matter how entrepreneurs are seeking financing, they have to be prepared to be an active part.

“They want you to show you have some skin in the game,” Strojny says. “It's puzzling to me, you think I'd put money in your business, but you won't? It's all about risk and reward.”

Schmitz knew from the beginning that she'd have to find nontraditional financing.

“Maybe going forward in the future, but I also need to demonstrate revenues, and have collateral. When you're first starting out with a seed of an idea, that's not something you have,” she says.

The work over the past year or more was about more than raising money. The Kickstarter campaign also determined if people would pay for her product.

“The focus groups were nice. People wanted to be nice,” she says. “But it's really hard to gauge if people will pay for it. Kickstarter and crowdfunding is a way to really measure if people are willing to. It's an opportunity to put it out there.”

As rewards for donating, she offered credit for the app once it's online. The amount of money raised “was hugely validating and so exciting and so intense.”

Schmitz says crowdfunding is also a way to build community. “All these people are rooting for you. [The process] can be discouraging, especially when you're doing it on your own, but it makes a big difference and helps you push through those difficult times,” she says.

The successful campaign also validated her belief the business would be successful and gave her the confidence to reduce the hours at her job to 30 a week in Octomber, though the money itself was used for research and development. But she still works nights, holidays and weekends on mybodymodel to get it from prototype to reality.

She's a member of this year's Top Gun Portland group, which provides mentoring and a chance at a $25,000 grand prize. She's building an email list at her website, mybodymodel.com, for newsletter mailings. She plans to launch a beta version of the website this summer.

Schmitz has 18 sewing and knitting bloggers and vloggers testing the app now.

“They are a beautifully diverse team of testers,” she says. She said they're also encouraging and supportive.

“Everything always takes longer than expected to,” she says. “There are days you never think it's going to happen, but you push through.”

Launch of the website is planned for this fall.

It's possible there will be business-to-business applications in the future, but for now she hopes hobbyists, fashion and costume designers will be excited about it, and that it'll be a success.

Schmitz is inspired by her testers, a community she's now a part of. They are from around the world, all shapes and sizes.

After 18 months of work, she can tell the story Gorham Bank's Donnelly says financial institutions have to hear. But Schmitz's ending is about more than profits.

“I really hope it would change expectations about what beauty is,” she says. “Change people's perceptions of body shapes and what is beautiful.”

Read more

A sea change is happening in opportunities for women in Maine's banking industry

As Maine agriculture evolves, farm financers aim to keep up

A sea change is happening in opportunities for women in Maine's banking industry

As Maine agriculture evolves, farm financers aim to keep up

Portland startup wins $25K prize in Thursday's Top Gun Showcase finals

An entrepreneur's timeline

Options for Startups

What avenues are open to entrepreneurs who aren't qualified to get traditional bank finance to bring their startup from idea to reality? Here are some of the resources in Maine.

...

Maine Institute of Technology: 8 Venture Ave., Brunswick Landing / www.mainetechnology.org

What: Publicly funded nonprofit that offers early-stage capital and commercialization assistance for research, development and application of technologies that create new products, processes and services.

Options: Monthly $5,000 TechStart grant; rolling $5,000 Phase 0 grants; Maine Technology Asset Fund; up to $25,000 tri-annual seed grants; up to $50,000 accelerator grants; $500,000 development loans; $200,000 equity capital; Cluster Initiative Program of up to $50,000 planning/profit/feasibility awards and up to $500,000 implementation awards.

By the numbers: Since 1999, $230 million investment; 2,300 projects; $950 million private sector matching investment. In 2017 alone, $6.89 million investment; 140 projects; $13 million private sector matching.

...

SCORE: Augusta, Auburn, Bangor, Ellsworth, Portland, South Paris / www.scoremaine.org

What: Resource partner of the Small Business Administration, volunteers offer support, advice, mentoring and resources.

Options: Free mentoring, workshops, templates and tools for help with business plans, taxes, financing and help with SBA financing.

By the numbers: In 2017, 121 Maine mentors provided services; more than 3,100 clients counseled; assisted 386 new business, with 578 jobs created; 169 workshops with 3,200 attendees.

...

Finance Authority of Maine: 5 Community Drive, Augusta / www.famemaine.com

What: Supports start-up, expansion and growth plans of businesses by working with lenders to improve access to capital and fill gaps in the capital delivery system.

Options: 4 agriculture loan programs; 10 business loan programs; commercial bonds, commercial loan insurance and four equity capital programs; 16 education funding programs and other higher-education financing assistance.

...

OTHER RESOURCES:

Municipal economic development: Many municipalities have economic development loans and grants available to residents, as does the state. Information can be found at the state's Department of Economic Development website, www.maine.gov/decd, or at local or regional economic development offices.

Startup and pitch contests: These have gained popularity over the last several years. Some of the most prominent statewide ones are:

• Gorham Savings Banks's Launchpad: $50,000 grand prize; $10,000 with a matching amount in in-kind services to Emerging Idea Winner. Deadline is April 15 launchpad.gorhamsavingsbank.com

• Top Gun entrepreneur acceleration program by Maine Center for Entrepreneurs: February through June program pairs groups with mentors, holds weekly training; six picked for pitch to panel of potential investors, business leaders and press. www.mced.biz/programs-services/top-gun-program

• Greenlight Maine television show: Entrepreneurs pitch their ideas to a panel on the weekly show, which airs on WCSH Channel 6 from January to June. All participants get mentoring and advice, winner gets $100,000. greenlightmaine.com

Mainebiz web partners

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Comments