Maine makes top 5 in states with highest tax burden

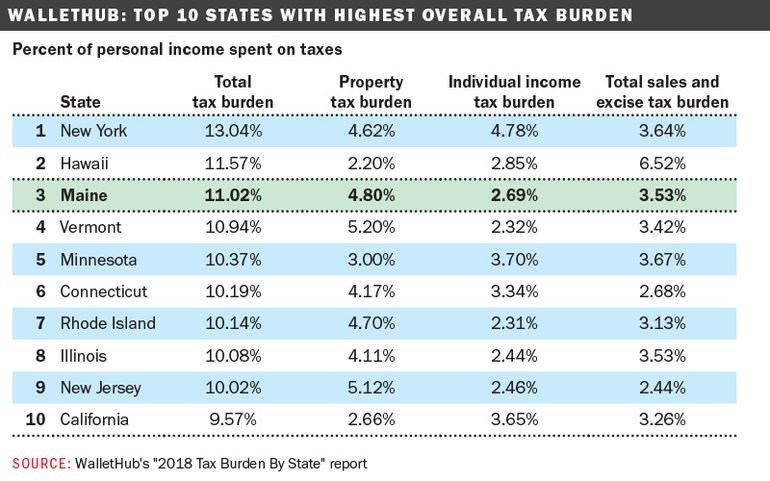

A report released today by the personal-finance website WalletHub shows Maine as having the third highest overall tax burden of the 50 states.

WalletHub’s 2018 Tax Burden by State report compared the 50 states according to their property taxes, individual taxes and sales and excise taxes as a share of total personal income. Unlike tax rates, which vary widely based on an individual’s circumstances, tax burden measures the proportion of total personal income that residents pay toward state and local taxes.

Here’s how Maine ranked in those tax burden comparisons (1=Highest, 25=Average):

- 3rd — Overall tax burden (11.02%)

- 4th — Property tax burden (4.80%)

- 15th — Individual income tax burden (2.69%)

- 24th — Total sales and excise tax burden (3.53%).

New York has the highest overall tax burden at 13.04%, while Alaska, at 4.94%, had the lowest, according to WalletHub’s report.

Only New Hampshire (1), Vermont (2) and New Jersey (3) ranked higher than Maine in the property tax burden comparison.

Comments