Midcoast Maine emerges as hub for launching land-based salmon-farm sector

Two of the world's largest land-based Atlantic salmon farms are slated for construction in Maine's midcoast region.

Nordic Aquafarms Inc., based in Norway, plans its operation on 54 acres in Belfast. Whole Oceans, in Portland, plans an operation on 108 acres in Bucksport. Both are moving through the permitting process for phased buildout. Their combined yearly production at full build-out is expected to be 80,000 tons of salmon — capturing nearly one-fifth of the domestic import market.

Their arrivals at the same time is coincidental, but both see the same advantages in Maine — things like pristine seawater, abundant groundwater, coastal access, and existing maritime research, academic and workforce development resources. Both plan to deploy cutting-edge technology at a scale never seen before in the land-based fish farming sector.

And company leaders say the time is right to develop domestic production of Atlantic salmon, thanks to today's scalable land-based farming technology and what they say are its numerous advantages.

“The U.S. is the largest single market for Atlantic salmon in the world,” says Nordic Aquafarms President Erik Heim. “That creates a business case for increasing production in the U.S.”

“We believe that, with Whole Oceans and Nordic Aquafarms, Maine can lead the United States with land-based aquaculture,” says Ben Willauer, Whole Oceans' chief development officer.

Technology tipping point

According to information provided by Whole Oceans, more than two million metric tons of Atlantic salmon were produced globally in 2017, generating $10 billion in sales. A metric ton is 2,200 pounds.

Of that, U.S. consumers eat 500,000 metric tons annually, spending $2 billion per year.

Virtually all Atlantic salmon consumed in the U.S. is farmed. But more than 95% percent of U.S. consumption is imported from foreign salmon farms.

Nordic's planned output, when fully built out, would be 7% of current U.S. consumption and Whole Oceans 10%.

Both companies expect U.S. consumption to grow.

Key to their plans is a technique called “recirculating aquaculture systems.” RAS occurs indoors using large tanks and continuously circulating water treatment systems. It's used in land-based hatcheries globally to grow eggs to a juvenile size robust enough to transfer to net pens in the sea, where grow-out continues until fish reach market size. Maine's Atlantic salmon sea farming sector uses RAS hatcheries.

By contrast, Nordic and Whole Oceans plan to deploy RAS for the entire life cycle, from egg to market-size. Indoor facilities provide a controlled environment with filtration, waste treatment, controlled feeding protocols and independence from environmental variables, all designed to minimize potential pollution, disease and parasite impacts on the environment and fish alike, says Heim.

“The technology is not new,” says Heim. “We're taking it one step further, to harvest size. The difference is in some of the logistics of handling bigger fish. But the technology, in many ways, is the same, although it's rapidly developing in the industry as a whole.”

“Certainly the scale of the two proposed operations is new and different — and it's new and different for anywhere in the world,” says Sebastian Belle, executive director of the Maine Aquaculture Association. “There are many smaller operations in many different countries. But we're now seeing the next generation of RAS projects that are on a much large scale.”

According to a report commissioned by the city of Belfast from global business consultant Deloitte, there's a trend growing toward land-based salmon farming for the complete life cycle. “This could have several advantages, like removing geographical limitations, keeping the fish in a controlled environment and moving the production closer to end consumer,” the report says. “Land-based farming is currently moving from an experimental pioneer phase to industrialization and commercialization. Previously, land-based salmon farming for full-grown fish has been seen as a less cost-efficient option, with high initial investment. Significant increase in production cost for traditional salmon farming leads to more businesses looking to land-based salmon farming because it may be commercially viable.”

Some in the industry are skeptical of the prospects for land-farming through the entire life cycle. According to the International Salmon Farmers Association's 2016 report on land-based Atlantic salmon farms, RAS is best suited to early life stages due to challenges like energy costs and quantities of water needed to hold the fish as they grow.

But Willauer and Heim say emerging technology has made the concept feasible and affordable.

“Land-based aquaculture has long been pooh-poohed as something that isn't viable by members of the industry,” says Willauer. “But folks who are interested in the sustainability aspects of land-based aquaculture disagree.”

“Land-based aquaculture has a lot of advantages, and that seems to be where the industry is heading and where the investment money is heading,” says Heim. (Nordic, established in 2014, has deployed similar technology for a yellowtail kingfish operation in Denmark, and has an Atlantic salmon facility in Norway scheduled to go into production at the end of 2018.)

Peter DelGreco, president and CEO of Maine & Co., which helped both companies at various points of plan development, says the projects put Maine on the cutting-edge of this type of technology.

“These are the types of projects that states are dying to have,” says DelGreco. “And they chose Maine to build out this technology. We'll have scientists from all over the world watching what happens in Maine, coming to Maine to work on these new ideas. They're looking at Maine as a place where that stuff happens. That, in and of itself, will grab additional attention of companies looking to build on this. So it's not only the people who will be hired; it's the downstream ripple effects that happen because of these investments.”

Looming opposition

Not that the plans haven't generated concern from local residents.

Nordic's project in particular is viewed skeptically by many Belfast residents.

Concerns include the project's industrial scale, proximity to residential properties, potential impact on the district's water supply of millions of gallons of freshwater used annually, wastewater discharge into the bay and potential effects on the ecosystem and wild marine organisms, potential odor and the foreign company's use of Maine resources. Also cited is lack of transparency during deliberations between the city, water district and Nordic regarding zoning changes and property purchase. Opposition has prompted three write-in candidacies to the city council, organized protest by the group Local Citizens for Smart Growth, and a lawsuit against the city charging it didn't follow proper zoning amendment procedures.

“My run has to do with a lack of process in opening the door to this industry,” says Eleanor Daniels, a Belfast business owner, one of the write-in candidates and a plaintiff in the lawsuit. Daniels says there's been “a real upwelling of public concern and a request to slow the process down so we can study this particular industry and particularly its scale.” She adds, “There are a lot of questions and concerns about the volume of discharge into the bay and what it will contain.”

Belfast Economic Development Director Thomas Kittredge agrees size and tree removal are inherent in the project. But Belfast has enough excess groundwater capacity to accommodate the project, he says. With regard to discharge, he's confident in the permitting process by federal and state regulatory agencies.

“My support is predicated on them being able to get all the needed permits,” Kittredge says.

Nordic's information sheet, issued before filing its wastewater discharge application with the Maine Department of Environmental Protection, says discharge, consisting of consists of residual nutrients from fish feed particles and fish feces and piped a kilometer offshore, will be treated using state-of-the-art technologies to meet or exceed water quality standards.

Bucksport residents are more agreeable, says Town Manager Susan Lessard. That's likely because Whole Oceans plans to operate on a site that's already industrial.

“It's a positive for us,” says Lessard. “The loss of 40% of our valuation, when the mill closed, was significant. And the loss of the jobs that went with that valuation was significant. This is the beginning of replacing some of that value and those jobs with a stable, environmentally friendly industrial valuation, in a community that understands that value.”

Site selection

Nordic, a wholly owned subsidiary of Nordic Aquafarms AS in Norway, searched for a site from Washington, D.C., to the Canadian border, in areas handy to copious clean, cold fresh and saltwater, before landing on 40 acres owned by the Belfast Water District. Nordic subsequently entered an agreement to buy an adjoining 14 acres from Belfast window manufacturer Mathews Brothers to buffer the site.

Pending federal, state and local permits, construction of the Phase I hatchery could begin in the summer of 2019, says Heim. The hatchery could be ready to receive eggs a few months later. Further construction will continue as the eggs grow, he says.

Phase I is expected to yield 16,500 metric tons of market-size fish. The timeline for full buildout is still in development. Ultimately, the project is expected to cost $450 million to $500 million and have an annual capacity of 33,000 metric tons.

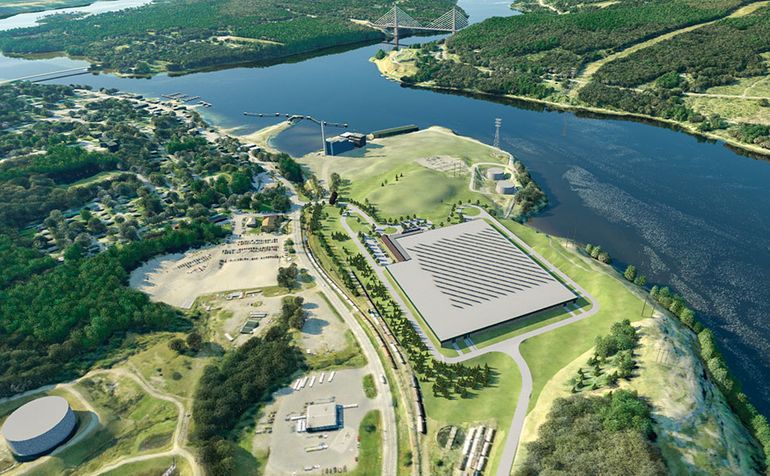

Whole Oceans found the Bucksport site attractive for numerous reasons, including substantial acreage and existing assets, says Willauer. The seller, Quebec metal recycler American Iron & Metal Development LLC, has been dismantling structures but will leave intact discharge pipes to the Penobscot River and intake pipes from Silver Lake that were formerly used by the mill and will now serve Whole Oceans.

Another plus, Willauer says, is the region's culture.

“This is a culture of people with a can-do attitude that is welcoming to folks who want to do something bold and is very open as a community to learning new industries,” Willauer says.

Whole Ocean's timeline calls for initial site preparation this year and phase one completion by late 2019. Initial permits allow it to grow 5,000 tons. Phase I costs $75 million. Full build-out is expected to cost $250 million as the company develops capacity in over the next 15 years to produce 25,000 metric tons per year.

Workforce development

Whole Oceans expects to have 60 jobs available within the coming year, and close to 100 total after that, says Willauer. A job link on its website, as of September, received 200 to 300 inquiries. Whole Oceans is planning partnerships with Maine's workforce development infrastructure, including Castine's Maine Maritime Academy where studies like biology and marine engineering are relevant to Whole Oceans; and other educational institutions as sources of training, Willauer says.

Nordic's Phase 1 is expected to create 60 to 65 positions, and 100 at total build-out.

“We're hoping to find Maine employees, but we're recruiting nationally and internationally, too,” says Heim. Nordic has been meeting with Maine education institutions, he says.

“It's an opportunity for universities to provide work opportunities for their students,” Heim says. The operation will also spin off ancillary jobs in outside companies, like packaging, trucking and plumbing.

Both companies expect demand for Atlantic salmon to grow.

“Seafood is considered the most energy-efficient and viable way of producing protein compared with other meats,” says Heim.

He adds: “This is simply a new segment of the industry that really, for a lot of reasons, is emerging and seems to be the wave of the future.”

Read more

Nordic Aquafarms’ $150M project faces key test in Belfast’s Tuesday elections

Comments