Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- October 20, 2025

- October 6, 2025

- September 22, 2025

- September 8, 2025

- August 25, 2025

- August 11, 2025

- + More

Special Editions

- Lists

- Viewpoints

- Our Events

- Calendar

- Biz Marketplace

Bill would extend tax-free options to companies helping workers with student loans

Collins photo Courtesy / MEDILL DC, FLICKR; King photo Courtesy / U.S. Naval War College, FLICKR

U.S. Sens. Susan Collins, R-Maine, and Angus King, I-Maine, have signed on as cosponsors of bipartisan legislation that supports employers assisting employees in paying off their student loan debt.

Collins photo Courtesy / MEDILL DC, FLICKR; King photo Courtesy / U.S. Naval War College, FLICKR

U.S. Sens. Susan Collins, R-Maine, and Angus King, I-Maine, have signed on as cosponsors of bipartisan legislation that supports employers assisting employees in paying off their student loan debt.

U.S. Sens. Susan Collins, R-Maine, and Angus King, I-Maine, have signed on as cosponsors of bipartisan legislation that supports employers assisting employees in paying off their student loan debt.

The Employer Participation in Repayment Act would allow employers to contribute up to $5,250 tax-free to their employees’ student loans — which the bill’s sponsors say offers much-need relief to employees while also giving employers a unique tool to attract and retain talented employees.

“Young people seeking higher education should be able to follow their dreams after graduation, but today the vast majority are shouldered with excessive and seemingly insurmountable debt,” King said in a joint news release with Collins. “A diploma should not be a certificate of anxiety, but one of hope for the future. That’s why we must look for innovative new ways to ease the burden of student loans and help the next generation join the workforce and succeed. This bipartisan legislation will support American students and help employers recruit and retain driven young people — a win-win.”

Alleviates 'financial strain'

According to the summary page of the legislation:

- Student debt in the U.S. reached $1.5 trillion in 2018, affecting one in four Americans still paying their student loans and outstripping credit cards and auto loans as the country’s leading source of non-housing debt.

- The legislation would update an existing federal program that allows employers to provide up to $5,250 per year in tax-free education assistance to employees enrolled in undergraduate or graduate courses. Although the existing program does not require recipients to be degree-seeking, they are required to be currently enrolled in courses. “This provision excludes students who have already accumulated student loan debt and offers them no relief,” the summary stated.

- Under the proposed legislation, employers also would be able to provide up to $5,250 per year in tax-free employer education assistance for student loan debt already incurred by their employees.

“Education plays a vital role in opening the doors of opportunity to all Americans, but the rising cost of a college education threatens to close those doors to many families across the country,” Collins said. “This bipartisan bill would help alleviate the financial strain of student loans by encouraging more employers to provide student loan repayment benefits to their employees.”

In addition to Collins and King, the legislation is supported by Sens. Mark Warner, D-Va.; John Thune, R-S.D.; Shelley Moore Capito, R-W.Va.; Ed Markey, D-Mass.; Pat Roberts, R-Kansas; Chris Murphy, D-Conn.; John Hoeven, R-N.D.; Doug Jones, D-Ala.; Mike Rounds, R-S.D.; Richard Blumenthal, D-Conn.; Jon Tester, D-Mont.; Roy Blunt, R-Mo.; Maggie Hassan, D-N.H.; Todd Young, R-Ind.; Jacky Rosen, D-Nev.; Cory Gardner, R-Colo.; and Kyrsten Sinema, D-Ariz.

In the U.S. House of Representatives, Reps. Chellie Pingree, D-Maine District 1, and Jared Golden, D-Maine District 2, have signed on as cosponsors of the legislation introduced by Reps. Scott Peters, D-Calif., and Rodney Davis, R-Ill., which has support from numerous educational organizations.

Th full text of the legislation can be found here.

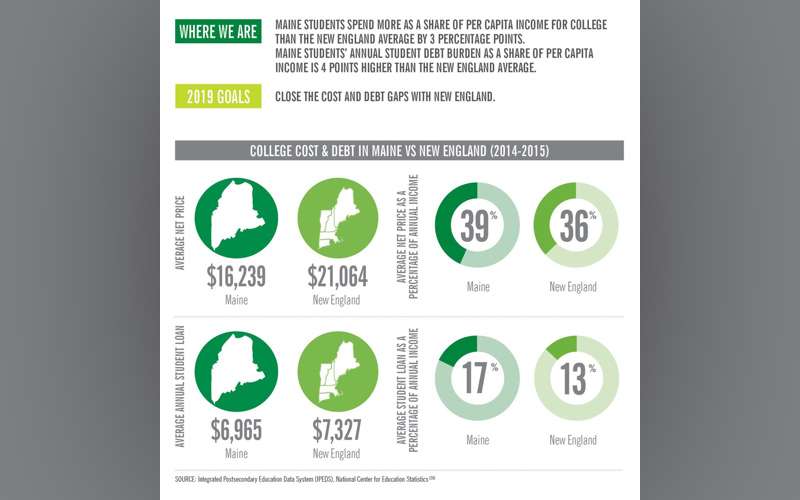

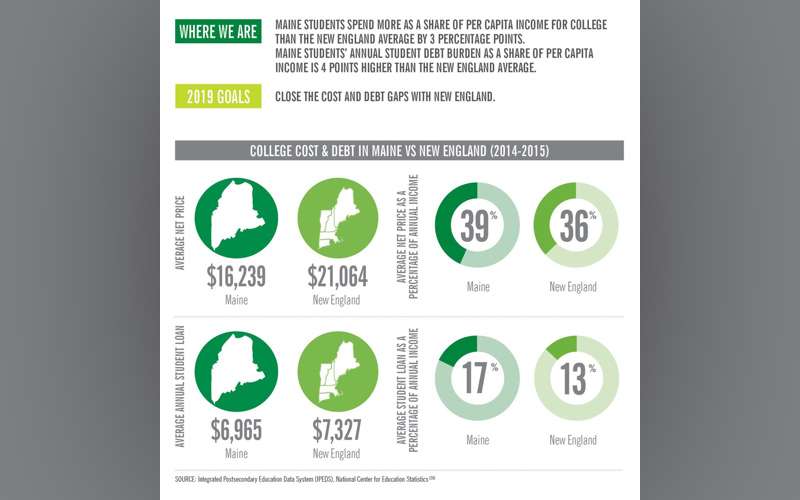

A poll released by the Maine Center for Economic Policy and the Center for Responsible Lending in December reported that graduates from Maine four-year institutions leave school owing an average of $31,364, the 10th worse in the nation, according to 2017 figures from the Institute for College Access and Success.

Mainebiz reported in December that some 56% of students at Maine four-year institutions graduate with debt, 28th in the U.S.

Mainebiz web partners

Related Content

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

0 Comments