Brexit opens new opportunities for Maine trade

Shifting sands in the European Union, including Britain's exit from the EU, known as Brexit, and federal elections in France, Britain and Germany, will create uncertainty in international trade and investment, experts say, but with that uncertainty comes opportunities for smart Maine companies.

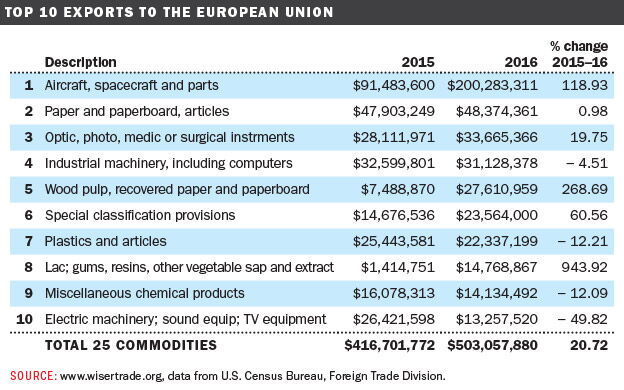

“Whatever else is happening with politics, business continues,” says Wade Merritt, vice president of the Maine International Trade Center in Portland. “Twenty percent of the global GDP is traded.” The EU accounts for four of Maine's top 10 overseas markets, according to the trade group, with the state exporting goods valued at $503 million to EU countries in 2016. The EU has the second-largest economy in the world, worth $16 trillion, second to the United States at $19.4 trillion, according to International Monetary Fund estimates.

The high trade numbers create a scenario similar to the “too big to fail” theory that asserts that institutions, or in this case countries, are so large and interconnected that their failure would be disastrous to the greater economic system, so international trade almost creates its own safety net.

“There's a lot of focus on Brexit,” says Matt Tripodi, general account director for Euromonitor International Inc., a Chicago research and consulting firm. “Is Brexit positive or negative? It all depends on who you are and how your business is positioned. The longer-term game plan for Maine has to be businesses staying involved in exporting.”

Tripodi is part of a panel to be chaired by Merritt on MITC's Trade Day 2017 on May 25 at Bangor's Cross Insurance Center. It is expected to draw 400 businesspeople. The focus is “Charting a Course in the Changing EU.” The other panelists are Harriet Cross, Britain's Consul General to New England, who is based in Boston; Jennifer Yoder, chair of the government department at Colby College in Waterville; and Mark O'Connell, CEO of OCO Global, an economic development and investment consultancy based in Belfast, Northern Ireland.

To Tripodi, international trade is the bigger player to watch than what is happening with trade in individual countries, even though they may shift trading partners or product sources going forward.

“The $15.5 trillion in worldwide trade is truly a massive number,” he says. “We've seen some retrenchment in value terms, but the volume is going up. And the value and volume will keep going up.”

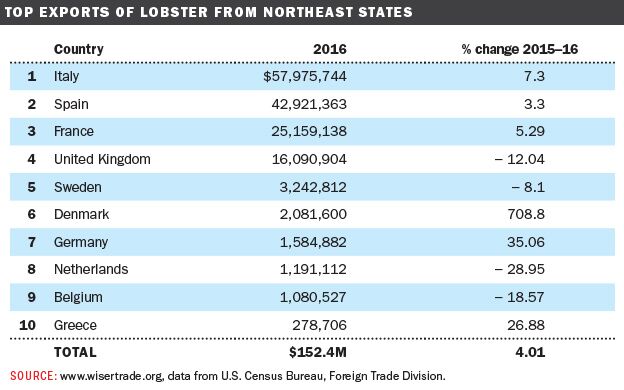

Even currency fluctuations didn't slow down trade of key commodities, like Maine lobster, he said. According to Tripodi, live lobster exports from Maine rose $140 million from $243 million in 2013 to $382 million in 2016.

Live lobsters, he explains, fit into the six-digit Harmonized System to classify physical goods for export. Putting the values into perspective, live lobsters composed 9.1% of all Maine exports in the six-digit HS category in 2013, rising to 13.3% in 2016. The rise came, he said, during a period when the dollar strengthened against other world currencies.

Maine trades in other HS categories, such as four-digit code civilian aircraft engines and parts, which more than doubled from $152 million in 2013 to be the top export in that category at $312 million in 2016. But the six-digit HS code category is the state's sweet spot, he says, noting that 68% of all of Maine's trade in value in 2016 is in 25 product categories with six-digit codes.

While Canada is Maine's top trading partner in overall exports, Germany is second and the UK third. But when it comes to six-digit code trade, Canada still is at the top and Germany second, but the UK is ninth.

“The impact to Maine for Brexit could be very little, especially in the six-digit category,” Tripodi says. “But Brexit also opens opportunities for Maine, for example, greater demand for civilian airplanes. Maine has strong products in paper, paperboard, seafood, civilian aircraft, vaccines for veterinary medicine, gas turbine parts, among others. The report card for Maine is evolving, and it's a positive one.”

Freer trade after Brexit?

Consul General Cross sees new potential once the UK is free from EU regulations, and says it could strike up its own favorable deals directly.

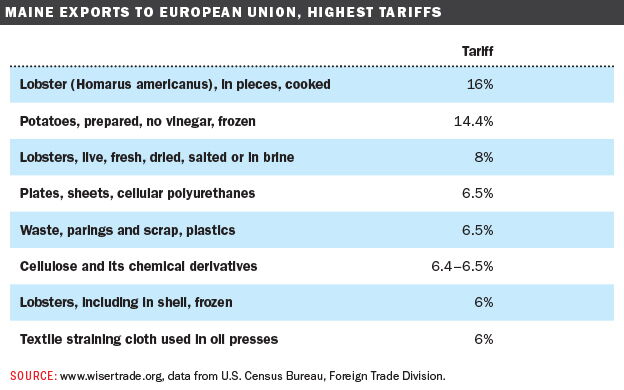

One example, she says, may be lobster trade. The New England, and especially Maine, lobster fisheries are concerned about a new trade deal under discussion called the Canada-European Union Comprehensive Economic and Trade Agreement, or CETA. The deal would eliminate tariffs on Canadian lobster exports to Europe, while U.S. tariffs would still range from 8% for live lobster to 20% on processed or cooked lobster.

“As soon as the UK is separate from EU regulations, we may be able to come to a better agreement with Maine on lobsters,” she says. “Maine is our fourth-largest export market [in the United States]. It is definitely a contender [for UK trade]. Maine is a desirable place to go on holiday, plus it has good food and drink.”

And for her, trade takes on a personal side as well. She and her husband, Phil Saltonstall (his ancestor, Sir Richard Saltonstall, led a group of English settlers to Massachusetts in 1630. Some of the Saltonstalls subsequently returned to the UK, but it is a well-known family name in Boston), have their own brewery in the north of England in Yorkshire. When they were in Portland, they got a taste of the local craft brew scene at Rising Tide.

“My husband Phil is exporting U.S. cask beer to the UK. We usually get only keg and bottled beer,” she says. “He started in Massachusetts and hopes to get into Maine. The East Coast of the United States is seen as a thriving craft beer scene that is at least five years ahead of the UK.”

One thing Cross wants to emphasize at Trade Day 2017 is that even though Brexit, which started March 29 and will continue for at least two years, may create uncertainty, the UK is stable and is the fifth-largest economy in the world.

Colby's Yoder says one reason UK Prime Minister Theresa May recently moved to have the UK national election sooner is to “make sure there's a strong sense of legitimacy with Brexit, a sense of continuity and stability. It's about shoring up support. It's a public relations issue.”

Cross says that while trade with EU countries may decline post-Brexit, she expects it to increase with the United States, and to increase the already robust trade with Maine.

“We'll direct more resources toward the United States and less toward the EU,” she says. “Maine in some ways is a hidden gem. In Boston you don't hear people talking about aerospace, but Maine exports $20 million in aerospace goods to the UK.”

Cross also expects the financial services industry to be a positive story post-Brexit. She points to figures from the British Embassy in Washington, D.C., finding that the UK is a major export market for Maine's goods and services, which in turn support 1,500 Maine jobs. UK-based firms are among the leading foreign investors in Maine. There were 23 UK subsidiaries in Maine in 2014 employing 2,100.

In 2016, $56 million worth of Maine goods and $138 million in services were exported to the UK. That compares to $53 million in goods and $123 million in services in 2014. Since 2009, goods exports grew 69% and services 48%. Maine goods exported to the UK include $20 million in aerospace and parts, $3.3 million in converted paper products, $3 million in miscellaneous manufactured commodities, $2.4 million in pharmaceuticals and medicines and $2.3 million in preserves and specialty foods.

Among services exports, travel tops the list at $55 million; followed by $14 million in miscellaneous financial services; $14 million in equipment installation, maintenance and repair; $13 million in management and consulting services; and $12 million in insurance services.

Campaign rhetoric and bluster

As for how trading partners and investors in Europe view the United States since the new administration took office, O'Connell of OCO Global says in an email to Mainebiz that after the initial election shock, “investors see that the campaign rhetoric was mostly bluster and he is pro business and trade … the pipeline of enquiries for U.S. investment is getting stronger, especially from the UK. So in short, the United States looks more attractive under new administration.”

There are some obstacles in trade between the EU and Maine, he writes, especially regulations on agriculture and food, which can be more problematic than import tariffs. The lack of direct air service and limited shipping lines is also a disadvantage. Strong sectors for trade are technology and business services.

Like Cross and Tripodi, he sees good opportunities for trade with Maine and the United States in general post-Brexit.

“The UK will likely experience significant economic damage as a result of Brexit and there will be capital flight. The government is pushing UK companies to explore other markets and United States is a top priority. Maine is attractive as a manageable and more affordable bridgehead to the Northeast and vast U.S. market,” O'Connell says.

He adds, “There are opportunities to establish an incubator for new-to-market UK firms, and we are discussing these initiatives with MITC. However, it will take many years for the UK to reach new trade agreements.”

Comments