Brightening skies

Revenue picture improving

- Budget surplus expected

- Pattern sparks optimism

After three quarters of the state's fiscal year, revenues are $35 million over estimates and Finance Commissioner Sawin Millett says his pessimism is fast being replaced with optimism. He expects the state will end the year June 30 with a revenue surplus.

“March was a good month, up $13.5 million over estimates,” said Millett. “It was driven by corporate taxes above estimates and sales taxes coming in above estimates.”

Millett said his optimism takes into account some corrected figures from January, when some revenues were misplaced in a holding account. Now that they have been properly assigned, there is a clear pattern of increased sales, income and corporate income taxes that started last fall.

“I am more optimistic than I have been in the last two or three months,” he said. “Things are looking better. We are in pretty good shape at the three-quarters mark.”

Millett declined to estimate the final size of the revenue surplus, saying the Revenue Forecasting Committee meets April 30 and once it has done its work he will have a clearer picture of revenues through the end of the budget year. April has always been a wild card.

Millett said he has seen years when the tax filing deadline has yielded good news with unexpected revenues, and he has seen years when the tax filings have been substantially below estimates. This year‘s filing deadline was April 17.

“I am always nervous until the filings are in and we have analyzed them,” he said.

Members of the Legislature's appropriations committee share his concern. Sen. Richard Rosen, R-Bucksport, co-chairman of the panel, has seen April surprises.

“We know from history that it is difficult sometimes to predict, and we have seen surprises in April, both positive and negative,” he said.

Rosen said he is pleased to see that revenues appear to be on the rebound, given the Legislature's remaining work.

“I am looking forward to what the Revenue Forecasting Committee does later this month,” he said. “We are going to be back in working on a 2013 Medicaid budget in May and it would be good if they had a better revenue forecast for us.”

Rosen said the panel is waiting for new usage projections from the Department of Health and Human Services to work on the Medicaid budget. He said the more-than 24,000 Mainers who were mistakenly counted as eligible for the program skewed projections and the committee needs accurate data. The program now is projected to have an $89 million shortfall in 2013.

“We do have our work cut out for us,” said Rep. Peggy Rotundo, D-Lewiston, the lead Democrat on the committee. She said the slow but constant increase in sales tax revenues is most encouraging.

“I have been watching the sales tax in particular because I think that is a good indication of how working families in Maine are doing,” she said.

Sales taxes are $11 million above estimates through the first nine months of the budget year.

LePage outlines tax goals in NYC

- Personal and corporate rates targeted

- Policy questions raised by Dems

Gov. Paul LePage told participants at the Bush Institute Conference on Taxes and Economic Growth in New York City when he wants to further overhaul Maine's tax policy by establishing a flat 4% personal income tax and lowering the corporate income tax rate.

“In the state of Maine, that is exactly what we are trying to do, to go down to a 4% flat tax with no exemptions for anyone,” he said. “The problem I see is this: Until we as Americans decide whether we want to continue down the path of welfare entitlement country, or we want to revive the American dream, we are not going to get there.”

LePage said at the conference that Maine started to reduce taxes in last year's budget and he wants to lower the top corporate income tax rate from nearly 8% to 4%.

“Hopefully, by the end of my first term, I would like to see it at four,” he said.

Former President George W. Bush convened the conference, which brought together four Republican governors and several conservative tax experts to discuss tax policy at the state and national level.

Rep. Seth Berry, D-Bowdoinham, the lead Democrat on the Legislature's Taxation Committee, said both of the governor's proposals would be bad policy that would likely increase overall taxes on middle-class Mainers while reducing taxes on upper-income taxpayers and out-of-state corporations, which pay the largest share of the corporate income tax.

“You are essentially taking money from the middle class and giving it to the top,” he said. “Because there is no other way to pay for it than to shift it on to local property taxes. You cut the schools, you cut the aid to towns and cities, and the middle class picks that up in higher property taxes.”

Berry said an analysis done recently by Maine Revenue Services indicates that with a 4% top tax rate, the average Mainer would see income taxes decrease by $241. He said the top 1% have the lowest overall tax burden, and their income taxes would decrease by $21,638.

The study is based on a top tax rate of 4% with current provisions allowing various exemptions, deductions and credits. LePage said he wants a flat tax.

The governor told participants at the conference that Maine's current top income tax rate affects nearly all taxpayers because it applies starting at $18,000 a year. He said his proposal would benefit all taxpayers by lowering the top tax rate to a flat rate.

Rep. Gary Knight, R-Livermore Falls, House co-chairman of the committee, said he was hearing about the governor's comments for the first time. He agrees with Berry's assessment that lowering the corporate tax would mostly benefit large out-of-state corporations.

“We should be lowering taxes for Mainers, not out-of-state corporations,” he said.

Knight disagreed with Berry on lowering the personal income tax to a flat 4%. He said that would provide a simpler tax structure and would stimulate economic growth.

“I really like the governor's previous statement where he said he would like to eliminate the [personal] income [tax] entirely,” he said. “That would really boost the economy.”

Knight said the only way to achieve tax reform is to balance income, sales and property taxes. He said he does not believe that income tax rates can be decreased significantly by growth in other state revenues alone. He said Maine ranks 43rd in the nation for sales taxes as a portion of the state's tax effort, so expanding the tax to cover more consumption items would be one way to find the cash to reduce the income tax rate.

Winglass: Fast track new IU fraud law

- Commish predicts more prosecutions

- AFL-CIO doubts scale of problem

Labor Commissioner Robert Winglass says his agency will put implementing a new unemployment fraud law on a fast track, adding he believes the fraud problem is worse than many believe.

“I think there are more [people abusing the system] than perhaps are being credited,” he said in an interview. “We will soon determine if that is true or not.”

Winglass said the Department of Labor has been working hard to identify those who may be cheating the state's unemployment insurance system; a measure recently signed by Gov. Paul LePage gives them additional tools to combat fraud.

“We are going to have more arrows in the quiver as the result of this legislation,” he said. “We haven't just been setting back and waiting, we have been on the march here, if you will, toward identifying individuals who have been violating the system big time.”

The legislation takes effect 90 days after the Legislature adjourns. One key provision spells out that the criminal offense of theft by deception applies to unemployment fraud by a worker or an employer. Winglass said the DOL has been prosecuting cases where it is clear a person intended to cheat the system.

“I think you are going to see more of those in the next few weeks,” he said.

LePage praised passage of the departmental bill because it is projected to result in some savings to the Unemployment Trust Fund, which pays unemployment benefits. It gets its cash from a tax on employers.

“Our limited resources must be used wisely,” LePage said. He said the state's management of the UI fund has been exemplary and pointed out that Maine was the only state in New England that did not have to borrow from the federal government to provide unemployment benefits in the recent recession.

“Maine's job creators need to use their resources to invest in growth and expansion to provide good-paying jobs for Mainers,” LePage said.

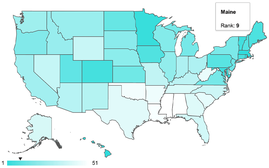

But Matt Schlobohm, executive director of the Maine AFL-CIO, said there simply is not a major problem with fraud in Maine's unemployment system. He said Maine is ranked fifth lowest in the country for UI fraud.

“Should we try to get rid of what little fraud we have? Of course we should,” he said in an interview. “But we should be focusing the major effort on how to find the 100,000 Mainers who want a job a job to go to every day. That should be the focus, not fraud that really is not a problem.”

Schlobohm said it is discouraging that LePage decided to focus efforts on the “non-problem” of fraud while not proposing legislation that will help create jobs and put more Mainers back to work.

“We have large-scale unemployment and underemployment and this administration has seen fit not to use the tools that it has to help those Mainers get a job,” he said. “That's where we need to focus, not on a fraud problem that is so small it's really hard to call it a problem.”

Sen. Chris Rector, R-Thomaston, the co-chair of the Labor, Commerce, Research and Economic Development Committee, sponsored the measure. He said the DOL has been doing a good job going after fraud and errors in the system.

“Our goal is to make sure that everyone who is entitled to benefits are receiving benefits and anyone who is not entitled to benefits are not receiving benefits,” he said. “Plain and simple.”

Rector said he wants to “root out” fraud because it drives up the cost of unemployment taxes for employers. He said many still do not realize that the entire cost of the system is paid by employers in Maine, unlike some other states.

Schlobohm said the rhetoric around unemployment fraud simply does not match the reality.

Comments