Contracted confusion | A new law and increased enforcement has independent contractors searching for answers

Charlie Huntington, owner of I&S Insulation in Wiscasset and president of the Maine Contractors and Builders Alliance, acknowledges the Legislature was well intentioned when it passed a law last year tightening the definition of what constitutes an independent contractor for workers’ compensation purposes. But he thinks the execution was abysmal.

The law, which took effect Jan. 1, presumes that any worker on a construction job site is an employee unless he or she can show proof of workers’ compensation insurance, or can meet the standards of a new 12-question form for the Workers’ Compensation Board that would predetermine them as an independent contractor. The predetermination application, which replaces an older and shorter one, needs to be filled out for every job that contractor works on. The workers’ comp board says the application is voluntary, but since it’s required by workers’ comp insurers such as MEMIC, for all intents and purposes, it’s mandatory.

Huntington’s “biggest beef” is that the predetermination application has to be filled out for every job, which for Huntington could mean he’s filling out the form 400 times — one for each of the 400 jobs he perfomed last year. “I’m appalled the state didn’t think through these details,” says Huntington, sitting in his office on a recent morning in February. “Did you really want this form 400 times? Did you really think the disappearing ink was going to come off and you were going to see something that wasn’t on the last form? How could you even think that was in the best interest of taxpayers?”

Huntington admits the issue of worker misclassification is real — he knows contractors who have several subcontractors working for them that should probably be considered employees — but accuses the state and Workers’ Compensation Board of creating unnecessary paperwork for businesses that are just able to keep their heads above water. The predetermination application has some in the construction industry, including Huntington, scratching their heads because it also asks for three years of tax returns and a client list, increasing the amount of paperwork. (As this issue of Mainebiz went to press, the Workers’ Compensation Board was working to streamline the predetermination application and the Legislature’s labor committee was considering emergency legislation to make it portable, meaning one form would apply for all projects in a given year. “We don’t want this to be any more burdensome on independent contractors than it needs to be,” says Steven Minkowsky, deputy director of the workers’ comp board.)

Worker misclassification — when an employer classifies an employee as an independent contractor, thereby avoiding payroll taxes and workers’ comp costs — is estimated to cost the state as much as $36 million per year in lost income tax revenues, according to a recent report from a task force looking at this issue. The report identifies other costs: to the taxpayers, who pick up the medical tab for workers hurt without workers’ comp; to companies that comply with unemployment laws who then compete against lower bids from companies that misclassify workers; and to the workers themselves who do not receive the workers’ comp coverage and other benefits they are entitled to as employees. Worker misclassification occurs across all industries, but is found to be most widespread in construction, home health and high tech. A 2005 study by the Construction Policy Research Center, the Labor and Worklife Program at Harvard Law School and the Harvard School of Public Health found that 45% of workers in Maine’s construction industry were misclassified annually between 1999 and 2002.

Worker misclassification is not an issue unique to Maine. Many states and the federal government are increasing scrutiny of the issue. The Obama administration plans to hire 100 more investigators and the IRS has begun auditing 6,000 companies suspected of misclassifying workers to dodge taxes — to yield at least $7 billion over 10 years, according to The New York Times.

Minkowsky puts the issue of the predetermination into perspective this way: “If we don’t have the predetermination application, the other option is keep the status quo, which no one wants, or make workers’ compensation insurance mandatory,” he says. “You need to come up with a menu of options, and I think this is a reasonable step to take.”

Inconsistent standards

The new law and enhanced predetermination application forms have also seemed to fuel confusion about worker misclassification in areas outside workers’ comp. The confusion stems from the fact that different areas of the state and federal government — the workers’ comp board, unemployment bureau, Maine Revenue Services, the IRS — have different standards to determine whether a worker should be an employee or a contractor. The lack of a consistent standard is not new, but seems to have fueled a new hysteria.

Janet Toth, Ellsworth’s community development coordinator, says accountants and insurance people in the area have told her they’ve seen “a revolving door” of contractor clients saying they’ve been audited because of worker misclassification. Patrick McGuire, owner of Dwight Brown Agency in Ellsworth, says he has five clients who have recently been audited on this issue. The word has spread and the prospect of being audited has struck fear into the hearts of contractors in the area, Toth says, some of whom have laid off subcontractors until they can understand the laws. She’s organized “contractor clarification workshops” to try and clear up some of the confusion.

One general contractor, who wished to remain anonymous because he’s facing two audits and doesn’t want to attract the ire of the state overseers, claims he was caught unawares because his subcontractors were always confirmed as independent contractors through the Workers’ Compensation Board. He says he thought if one state agency defined his workers as independent contractors, then the rest of the state agencies would as well.

The claim that contractors didn’t know about the separate standards used by the unemployment bureau is “disingenuous,” says Laura Fortman, commissioner of the Department of Labor. After all, the standard the unemployment bureau uses — known as the ABC test — has been around since 1935 and hasn’t undergone any changes due to the new law.

There’s a perception that the crackdown is a response to the state’s budget shortfall and its desperate need for revenue. But Fortman discounts that idea. She says while the state is increasing scrutiny through the Joint Task Force on Employee Misclassification and is trying to increase enforcement by sharing information among agencies, the Department of Labor has not increased the number of audits it performs every year, which has remained steady at 2% of all employers.

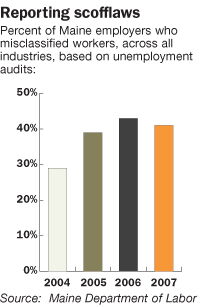

What has changed, Fortman says, is the number of employers the labor department has found in noncompliance with the employment laws. In 2004, misclassification of workers was found in 29% of employers audited across all industries. In 2007, it was 41%. “I think that as the economy becomes tighter, employers attempt to cut costs,” says Fortman. “It’s not that the laws have changed, but that the level of noncompliance has increased, which is a cause for serious concern.”

Part of the problem, she says, is what looks like a race to the bottom. As general contractors who classify workers correctly get underbid by contractors who misclassify workers, more are tempted to skirt the law, she says. For that reason, the task force is working to better publicize enforcement actions, including cases brought against chronic offenders.

And, while the labor department doesn’t have the resources to increase the number of audits, the task force has been busy “dismantling the silos that have traditionally existed between state agencies” to better share information that should lead to more efficient enforcement. For example, the Workers’ Compensation Board now shares a list of employers and workers requesting predetermination of independent contractor status with the Bureau of Unemployment Compensation. It has also set up a tip line to allow people to report cases of worker misclassification.

Fortman says the state is looking at how to address the recent confusion. The labor department has implemented a pilot project that has its unemployment auditors using the workers’ comp board’s predetermination application alongside the ABC test to compare the two. The purpose is to determine if creating one standard for all state agencies is viable, she says. “We’re exploring that.”

The bottom line is if your “contractors” show up for work every day, and you provide the equipment and tell them where, when and how to work, then they’re probably employees, says Fortman, and these changes could certainly affect you. But if you’re in the construction industry and hire legitimate contractors who have their own workers’ comp insurance or meet the standards set by the Workers’ Compensation Board and unemployment bureau, then none of this affects you, she says. “Nothing prohibits starting your own business and supporting that entrepreneurial spirit that Maine people do have,” Fortman says.

Whit Richardson, a writer based in Friendship, can be reached at editorial@mainebiz.biz.

Comments