Corridors of opportunity

Photo / Courtesy of Modula

One company staying put is Modula, a manufacturer of automated storage systems for factories and warehouses. Modula opened its own 102,000-square-foot factory in 2015 at Lewiston’s Turnpike Industrial Park. The next year, it leased 18,000 square feet of additional space nearby, and then replaced it with a larger leased facility in September 2017.

Photo / Courtesy of Modula

One company staying put is Modula, a manufacturer of automated storage systems for factories and warehouses. Modula opened its own 102,000-square-foot factory in 2015 at Lewiston’s Turnpike Industrial Park. The next year, it leased 18,000 square feet of additional space nearby, and then replaced it with a larger leased facility in September 2017.

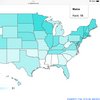

With vacancy rates for industrial real estate sinking to historic lows across the country, you might think sparsely developed Maine would attract warehouses and factories the way lobster rolls attract tourists.

But businesses are discovering the state is not immune to the epidemic shortage of industrial space.

Businesses searching for industrial space in southern Maine may need to adjust their expectations, according to Justin Lamontagne, a Portland-based broker with NAI The Dunham Group and an expert who is regularly called on to speak at the annual Maine Real Estate & Development Association.

“I don’t see any signs [of the shortage] changing there, at least in the foreseeable future,” he says. Businesses should try to be more flexible about the type and location of property they seek, and anticipate a window of at six to eight months before finding it … We need to be far more patient.”

The prognosis isn’t all bad, but you have to know where to look, and how.

Critical signs

Nationwide, the industrial vacancy rate fell to an all-time low of 5% during the last quarter of 2017, according to Chicago-based research firm JLL. That’s down from 5.2% in the previous quarter. In major markets like Los Angeles, rates were as low as 3%.

In southern Maine, available space is even scarcer. The Portland-Biddeford-Saco region is home to nearly 19 million square feet of industrial space, but only 1.25% of that total was vacant in December 2017, according to an annual survey by NAI The Dunham Group. The cities of Portland, South Portland and Westbrook each recorded a rate between 0.6% and 1.6%. In Gorham, there were no vacancies; 930,000 square feet of space was completely occupied.

Businesses fortunate enough to find an industrial property may be dismayed by its price tag. Lease costs in greater Portland soared to nearly $7 per square foot in 2017, the survey found, up $1 from the average rent in 2016. That’s the largest increase in industrial rents for the area in over 40 years, according to the survey analysis. Nationally, the average climbed slightly to $5.50, according to the JLL data.

Buying is no better. Sale prices jumped $5 a square foot, to $60, from 2016. Sales prices have increased 50% since 2011.

Some spaces are fetching as much as $80 per square foot. And while the higher pricing led to 200,000 square feet of new construction in 2017, most of it was quickly absorbed. In fact, by January, barely 10% of the new space was available.

The downside of demand

Depending on your perspective, the surging rents and sale prices can be a financial windfall or a drain on profitability. But they may have another impact that is potentially more sweeping — and dangerous.

“This is an economic development crisis,” says Lamontagne. “Without respite, southern Maine cannot compete for new business or support our own unless we can dramatically correct the scarcity of industrial real estate.”

A combination of causes account for the crisis. Municipal zoning makes new industrial properties “very rare or hard to find,” he says, and can limit the reuse of existing ones. Maine’s geography and transportation infrastructure limit prospects for development further. And increasingly numerous craft breweries and marijuana cultivators have swallowed up much of the available inventory.

However, Lamontagne points out that the demand from recreational marijuana producers has cooled a bit recently, as the legal status of the industry remains in limbo. “We’ve done virtually no transactions there in 18 months,” he says.

Just drive north or south. There are opportunities here and there, as long as you’re hugging the interstate.

Then there’s the red-hot market for residential real estate. More and more people want to live in southern Maine, creating pressure on all types of development. But without the industrial space to support business growth, where will the newcomers work?

“This is a perfect storm,” says Lamontagne. Compared to other markets, he believes the industrial space shortage in southern Maine is “pretty unique” in its complexity and severity.

“The shortage is very impactful and very real here,” Lamontagne says. “If you don’t have the physical space, as a business, you’re stuck.”

Businesses shut out from Portland may want to consider hitting the road in order to find new industrial space.

“Just drive north or south,” says Lamontagne. He recommends the corridor from Kennebunk to Lewiston as potential hunting grounds. “There are opportunities here and there, as long as you’re hugging the interstate.”

The next hot spot?

Among the opportunities he sees is a 500-acre parcel of land surrounding the Scarborough Downs harness-racing track, on U.S. Route 1 in Scarborough. The town’s Planning Board in April approved a master plan for mixed-use development of the property. While housing is the initial focus, the plan envisions the development of 50 acres along the property’s northern edge for potential industrial use.

“Scarborough Downs could be the next hot spot,” Lamontagne says. “It opens up a whole new swath.”

Another promising location is Brunswick Landing, on the former U.S. Navy base in Brunswick. The business campus there offers 1.6 million square feet of commercial space, much of it industrial, as well as Tech Place, a manufacturing incubator that is 75% occupied.

Farther north, the Bangor area boasts 7.4 million square feet of industrial space. Still, vacant space made up only 4.5% of the total in 2017, according to Bev Uhlenhake of Epstein Commercial Real Estate. Three years earlier, the vacancy rate was 10%.

Homegrown success

The industrial real estate market is also tightening in the Lewiston-Auburn area. But businesses seem to be getting by.

The expansion of local companies and spillover demand from greater Portland have absorbed most of the available inventory over the past year, according to Lincoln Jeffers, Lewiston’s economic and community development director. The area, with a dozen or so business parks, had an estimated vacancy rate of 3% of its industrial space in 2017.

Companies filling that space included Freeport-based L.L. Bean Inc., which in August 2017 moved a boot factory and warehouse from Lewiston’s Westminster Street to a Lexington Street property of 110,000 square feet, twice the size of the former plant. And Dielectric, a maker of broadcast antennas, expanded in December from its base in Raymond to a 33,000-square-foot manufacturing facility in Lewiston’s Gendron Business Park.

Despite the growth, Lewiston is “still accessible, still affordable, and still within reach,” says Jeffers.

The challenge for the area is to “keep local companies local” as they grow and look for new digs, he adds.

One company staying put is Modula, a manufacturer of automated storage systems for factories and warehouses. Modula opened its own 102,000- square-foot factory in 2015 at Lewiston’s Turnpike Industrial Park. The next year, it leased 18,000 square feet of additional space nearby, and then replaced it with a larger leased facility in September 2017.

Now the company is looking to add at least another 100,000 square feet to its footprint in Lewiston.

“We need to double our production floor,” says Rhonda Corson, Modula human resources manager and a spokesperson for the company. She expects the number of local full-time employees to increase from about 80 to 125. “The market for our products is still basically untapped, and we can’t keep up with demand.”

In June, it wasn’t yet clear whether the new space will be built or bought, according to Corson. But two things were certain. Modula would unveil plans for the expansion “well within six months,” she said. And that expansion would be somewhere in Lewiston.

Modula’s location offers easy access to the Maine Turnpike, to affordable housing stock and to central and northern parts of the state.

“There’s no talk of going anywhere else,” Corson said. “The company is comfortable here.”

0 Comments