Financial statement | Coastal Enterprises Inc. leads the pack in a rising lending sector

The federal government in November hosted a forum in the nation’s capital about how the Obama administration could help small businesses gain access to credit. The high-level meeting — attended by SBA Administrator Karen Mills, Treasury Secretary Timothy Geithner and FDIC Chairwoman Sheila Bair — included panelists from, predictably, the banking industry and the business community. But a third, less well-known sector also made the cut, one that might not have even one year ago: community development financial institutions. And a man from Maine, Ron Phillips of Coastal Enterprises Inc., was invited to help make their case.

The nation’s more than 800 CDFIs, financing organizations dedicated to serving low-income areas, are nothing new. Their roots date back to the Civil Rights era, when they arose as a way to circumvent segregationist state governments that refused to fairly distribute federal money. CEI, which Phillips founded in 1977, was among the first. But now, in the wake of the nation’s banking collapse, CDFIs’ services are more in demand than ever, and they’re gaining national prominence as a reliable delivery system for federal stimulus funds.

A provision in the stimulus bill more than doubled funding for CDFIs and, in light of the recession, waived requirements that they raise private capital to match federal dollars. Federal Reserve Chairman Ben Bernanke singled out the industry at a June global financial literacy summit in Washington. Goldman Sachs just announced it will invest $300 million in CDFIs as part of its new $500 million small business initiative.

And the nonprofit CEI, recognized as a pioneer in the industry, is bringing some of that love back home to Maine. Much of it comes by way of the New Markets Tax Credit program, an initiative Phillips helped draft that provides incentives for investments in underserved communities. Of the $5 billion awarded through the New Markets program this year, CEI netted $125 million, the largest single allotment. That’s no small feat, particularly considering the government awarded only 20% of the $22.5 billion requested and CEI was up against multinational banks including Chase and Bank of America. The Wiscasset organization won the highest allotment in 2008, too.

While Phillips does get face time with White House bigwigs, it takes more than political connections to have such success with New Markets financing, according to Julia Sass Rubin, a Rutgers professor who has researched the government program. “[Phillips] understands the program and what its purpose is, and he is an innovator who’s been on the cutting edge of this field of community development over the last 30 years,” she says.

The opportunities borne of the banking crisis are not lost on Phillips. “We’re in the right place at the right time. That’s what it comes down to,” he says. Having for decades cobbled together resources for communities most in need, CEI and its fellow organizations have earned the White House’s attention, Phillips adds. “We’ve been advocating busily for years.”

The sector

The network of CDFIs in America has grown to a roughly $30 billion industry, from just $1 billion in the early 1990s. With at least one in every state, including five based in Maine, CDFIs are private financial intermediaries dedicated to serving rural and urban low-income communities and Native American populations. Many are loan funds, but the category also includes banks, credit unions and venture capital funds. In addition to federal money, CDFIs also get capital from religious organizations, charities and foundations.

What makes CDFIs unique — and now of greater interest to the federal government and big banks — are their ties to the areas they serve and their experience managing risk. To be eligible for federal funds, CDFIs must have a primary mission of sustained community development and offer technical assistance. Because they’ve long served areas often overlooked by traditional financial institutions, comfort with risk is part of their DNA.

Mark Pinsky, president of Opportunity Finance Network, a coalition of more than 170 CDFIs, offers an analogy originally coined by popular author and business consultant Jim Collins. Say you’re at base camp on Mount Everest and a storm comes up. Even if you’re not well prepared, you’ll probably survive. But if you’re standing near the summit at 27,000 feet unprepared, you’ll never make it. “CDFIs live at 27,000 feet,” he says. “They live with distress.”

Managing more than $25 billion in assets, the nation’s CDFIs continue to see increased demand for their services. The Treasury Department recently estimated that it attracts $15 in non-federal investments for every dollar it invests in CDFIs.

A complement to traditional financing institutions, CDFIs capitalize on opportunities others often miss, according to Pinsky, in part because of the kind of equity investments they can access. Other federal community development programs are project based. An investor wants to support construction of a community center, so it asks the government to help fund it. But CDFIs receive unrestricted equity investments from a federal fund, which they can manage with more flexibility. “It’s a unique and special source of funding,” Pinsky says.

In the case of CEI, a member of the network, that funding has been used in particularly innovative ways, he says. “They’re clearly respected on a number of fronts.” The nonprofit’s investments range from affordable housing to natural resources development to medical and day care facilities. CEI maintains special expertise in rural projects, the New Markets Tax Credit program and linking environmental protection to financing efforts, he says. Phillips personally has earned a reputation for his policy work, according to Pinsky.

He would know. It was in the advocacy realm that Pinksy met Phillips in the early 1990s. The men were members of a group that successfully worked to establish the CDFI Fund, a Treasury Department fund that administers the New Markets program, among others. Phillips also served on the Opportunity board for nine years. More recently, Phillips and CEI pushed for stronger state foreclosure laws and tighter regulation of predatory mortgage practices employed by national lenders like Countrywide and Ameriquest.

CEI traces its roots, strangely enough, to church basements in Chicago, Phillips says. There, in the late 1970s, organizers were struggling with the deterioration of local neighborhoods wrought by the banks’ infamous “red lining” tactics of deeming entire neighborhoods off limits for loans. Local advocacy led to the Community Reinvestment Act of 1977, which required banks to end discriminatory lending practices if they sought to grow or participate in mergers and acquisitions. Cash flow in distressed communities turned out to be significant, Phillips says. “Much more economic opportunity existed than the red liners admitted.”

Out of that change in landscape rose community development corporations, and later the CDFIs that fund them. CEI is both a CDC and a CDFI, and also provides venture capital.

Faith-based organizations served as early funders of the organizations, and their influence echoes in Phillips’ professional history. He earned a master’s of divinity from Union Theological Seminary in New York before graduating from Harvard Business School’s Advanced Management Program. The theme of social and environmental responsibility runs through his organization, which uses a triple bottom line approach to its return on investments: economy, equity and ecology. A portion of all new jobs at its projects must be held by low-income workers, and its technical assistance serves refugees starting their own businesses, as well as working waterfronts and farms. “CEI at its core is financing with flexible, patient capital that we raise from a number of sources,” Phillips says.

Mining opportunity

The largest source of capital for CEI, by dollar volume, is far and away the New Markets Tax Credit program. CEI has won $606 million through the program over the last several years, funding 33 projects mostly in Maine, New Hampshire, Vermont, Massachusetts and New York.

Established by Congress in 2000, the program was designed to encourage development in underserved communities by giving investors a federal income tax credit totaling 39% of the cost of the investment. Interest in the program has skyrocketed, in part because of its flexibility. Capital can flow to companies as debt, equity or a mix of both, and the credits can be used to provide borrowers better rates and terms, or repay equity investors in the place of actual cash.

“The demand for credits has increased almost since the beginning,” says Charles Spies, managing director of the CEI subsidiary that handles the New Markets program.

With all those options come complications, however. Spies has admirably flow charted CEI’s New Markets investment models in a PowerPoint presentation he shows to potential investors. The various acronyms, dotted lines and percentages don’t become comprehensible, lacking Spies’ narration, until about the fourth or fifth look.

More than one third of CEI’s total New Markets allocation has been used in Maine, and nearly 70% has financed projects in rural areas. Only it and CEI’s venture capital efforts reach beyond the state. As Phillips figures, casting a wider net attracts more investors to Maine. “We draw money in by going outside,” he says.

The nonprofit’s success with the New Markets program results from its broad network of lenders and tax credit buyers, and its track record placing deals in rural areas, Spies says. CEI also has built-in incentives to monitor and support its New Markets projects over the long term, since the credit unfolds over seven years.

One of CEI’s most notable New Markets projects in Maine was an innovative land-for-debt deal in Millinocket in 2004. More than $32 million was used to finance the purchase of 300,000 acres of forestland by Brascan Corp., the new owner of Great Northern Paper. The Nature Conservancy provided back-up financing and conserved more than 200,000 acres. Of its 33 New Markets projects, only one is considered non-performing, according to Spies.

The fees CEI collects through the program are funneled to serve its overall mission, furthering its microlending, small business support and various other efforts. “New Markets has enabled us to grow that dramatically because of the scale of the program,” says Spies.

CEI has also been a leader in partnering with smaller CDFIs to help them access the complex New Markets program, according to Rutgers professor Rubin. CEI’s success obtaining New Markets financing is particularly noteworthy because the nonprofit can’t self-finance like its for-profit competitors, she says. “A lot of the entities that are getting the tax credit have no incentive to use it the right way,” says Rubin.

A January 2007 General Accounting Office report found that the program appeared to increase investment in low-income communities, but Rubin says whether for-profit entities would have invested those dollars anyway can’t be determined. And a June GAO study found that minority entities are less successful at obtaining New Market allocations than their non-minority counterparts. However, Rubin says, “Is the program providing ways for mission-driven organizations to do more? The answer is yes.”

The CDFI industry overall faces its own challenges. While it makes up only a small portion of the overall capital and credit market, the sector is not immune to the same challenges facing the banking industry. As Bernanke noted in his June speech, “Even as the capacity of CDFIs has become more constrained, economic conditions and pullbacks by mainstream lenders have increased the demands being placed on these organizations to provide credit and services.” According to a third quarter market conditions report by Opportunity Finance Network, delinquency rates continue to climb along with demand, and liquidity constraints persist. CEI’s charge-off rate in the calendar third quarter was 1.6% compared to 0.8% in the OFN survey.

But managing a challenging portfolio is what CEI has done for more than 30 years. According to Treasury Department spokesman Bill Luecht, CEI’s at the top of the list if Geithner ends up paying a visit to just one CDFI in all of New England. “They are known to be one of the best in the country,” he says.

Jackie Farwell, Mainebiz staff reporter, can be reached at jfarwell@mainebiz.biz.

Coastal Enterprises Inc.

36 Water St., Wiscasset

President and CEO: Ron Phillips

Services: Financing and technical assistance for community development

Founded: 1977

Employees: 78

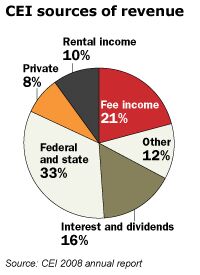

Annual revenues, 2008: $9.3 million

Contact: 882-7552

www.ceimaine.org

Comments