King backs bill to give cannabis firms access to banking services

For now, cannabis businesses are denied access to the banking system because they can be prosecuted under federal banking law, but this could all change.

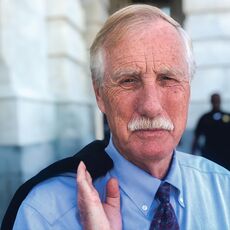

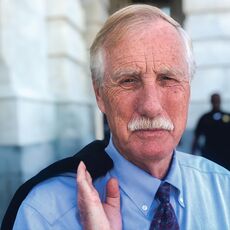

U.S. Sen. Angus King, I-Maine, has cosponsored bipartisan, bicameral legislation that would ensure Maine’s legal cannabis businesses could access the same banking services used by other businesses.

The SAFE Banking Act would resolve a key logistical and public safety problem for states that have legalized medicinal or recreational cannabis.

The Maine cannabis industry has no access to bank accounts. It cannot accept credit cards or accept or write checks. Businesses must operate using large amounts of cash, which creates safety risks for the businesses, employees and customers, lawmakers argue. It also makes it difficult for state governments to collect taxes.

“A business that follows all state laws should be able to access the banking system — that’s pretty common sense,” said King. “As Maine’s cannabis industry has grown in recent years, it has been forced to operate on a cash-only basis. This presents a number of safety, logistical, and legal concerns. The SAFE Banking Act addresses this unnecessary challenge and ensures that all our legal Maine businesses can access the banking system. It’ll bring more customers to local banks, improve public safety, and support the success of Maine’s many small business entrepreneurs.”

The SAFE Act would prohibit federal banking regulators from penalizing a bank or credit union for providing banking services to state-legal cannabis-related businesses. That would eliminate the cash-only aspect of the industry and allow cannabis businesses access to loans, affordable insurance and credit and debit cards.

King was joined by nearly 40 other senators in supporting the bill.

According to the release, the bill will also create a safe harbor from criminal prosecution and liability and asset forfeiture for banks, officers and employees who provide financial services to legitimate, state-sanctioned cannabis businesses while maintaining the banks’ right to choose not to offer those services.

It would also require banks to comply with current Financial Crimes Enforcement Network (FinCEN) guidance while allowing FinCEN guidance to be streamlined over time as states and the federal government adapt to legalized medicinal and recreational cannabis policies.

“The SAFE Banking Act will help ease bureaucratic and safety concerns for cannabis operations in Maine,” said Jim Roche, president Maine Bankers Association. “Right now, cannabis enterprises are forced to do business in cash, which often creates potentially dangerous circumstances for them. With passage of this bill in Congress, more small businesses will have access to capital through the safe and established banking system throughout the state. “

0 Comments