Legal woes | Bad times bring more lawsuits and insurance to protect against them

Sitting at an expansive conference table in his insurance office’s meeting room, Ken Ross recalls how he had just that morning asked a client whether he wanted to buy employment practices liability insurance — the insurance that covers your business if an employee sues.

“He said, ‘no thank you’,” recalls Ross, vice president and treasurer of Clark Insurance in Portland. “He has 11 employees.”

A polite dismissal by a small business owner for a fairly obscure insurance product is not surprising. But just a couple of years ago, that conversation would never have happened.

Employment practices liability insurance has, just within the last two years, become much more common in Maine. (Another Maine insurance company offered the product a decade ago but discontinued it three years later because it didn’t sell, Ross says.) Now, however, roughly 10% of Clark’s 4,500 or so business clients own employment insurance, twice as many as a year ago. “Insurance companies are stumbling over one another to offer this product,” Ross says.

More businesses are purchasing the insurance — which covers discrimination or harassment cases, for example — as their awareness about it increases, he says. Portland insurance company MEMIC began selling an employment policy designed for Maine’s small businesses in April 2008. Since then, about 8,000 of its roughly 20,000 clients in Maine have bought the insurance, according to Michael Bourque, a MEMIC spokesman.

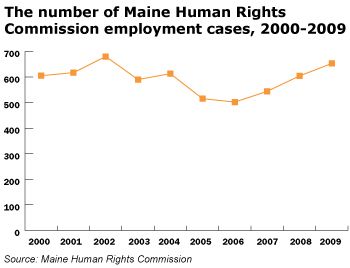

The interest has sprung from tough economic times, which can lead to tough legal times for businesses. Companies laying off workers can trigger discrimination suits. Bankruptcy filings rise. Firms break contracts. Employment complaints filed with the Maine Human Rights Commission have, for instance, increased in the last two years.

A Texas-based law firm, Fulbright and Jaworski L.L.P, reported in its sixth annual Litigation Trends Survey that many U.S. companies are anticipating a swell of litigation in the coming year, based on information supplied by corporate attorneys. The report claims that more than half of the surveyed attorneys predicted lawsuits would at least remain stable in the coming year while 42%, compared to 34% in 2008, are bracing for more cases.

The survey reports that the most common pending litigation types against U.S. companies have to do with labor/employment and contracts.

“Generally, litigation rises in an economic downturn as regulators tend to step up enforcement, laid-off workers head to court and companies need to file more suits in order to collect on money owed,” says Stephen Dillard, head of Fulbright’s global litigation practice, in a company release.

But people should not panic. The number of new lawsuits reported against U.S companies did not significantly increase in 2009, according to the same litigation survey. It’s possible that at the same time the recession is giving corporate counsel the jitters, it is also, ironically, engendering a lull as cash-strapped businesses and people try to avoid legal fees.

An informal look at civil litigation in Maine’s courts reveals a rising number of cases, but it is difficult to winnow out ones involving businesses. Overall, civil cases in Maine courts have jumped from 12,887 in 2005 to 20,254 in 2009. Specifically, contract cases — the most likely to involve businesses — have increased from 6,143 to 10,788 over the same period. (This category generally does not include labor contracts and is not covered by employment insurance.)

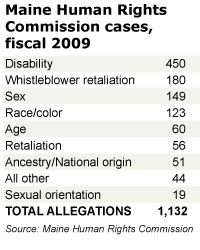

The Maine Human Rights Commission offers a better way to track employment-related suits. New cases filed with the commission increased about 4% over last year to 849, and nearly 77% of those cases alleged discrimination in employment. In 2007, 544 employment charges were filed, which increased to 604 cases in 2008, and 653 in 2009. (See charts on page 21.)

On the employees’ side

Jeffrey Young, a partner at the Topsham law firm McTeague Higbee, which specializes in employment law and exclusively represents employees, says his firm is very busy. “We have had a lot more calls [recently] than in the 20 years I’ve been practicing,” he says.

His firm fielded 35% more labor-related intakes in the first quarter of 2009 over the same quarter in 2008, and 46% more in the second quarter of 2009 than in 2008. Now, in the third quarter, those numbers are beginning to decline, Young says.

The calls are coming from workers with complaints about layoffs, discrimination, unpaid severance claims and wage violations.

“I probably have a half dozen wage-and-hour cases where lower-income workers claim they are not being paid consistent with state and federal hour laws,” Young says. He adds that the discrimination and layoff cases are directly linked to the recession, but he’s not sure whether the same can be said for wage disputes.

“In the old days, when employers reduced their work forces, and there was a more unionized economy, there was an orderly process, and junior employees were let go and senior employees retained,” Young says. But these days, employees are often terminated without a set procedure. “Employees begin to question, ‘Why was I selected and someone junior to me and 20 years younger than me was retained?’”

Young is also representing workers who say they were let go without proper warning, violating the Worker Adjustment and Retraining Notification, or WARN, Act, which requires 60 days advance notice of layoffs. He is heading a class-action suit on behalf of five former workers and Local 1996, a carpenters’ union, against Roark Capital Group, the Atlanta-based parent company of Wood Structures Inc. Wood Structures, which made wooden trusses, suddenly closed its headquarters in Biddeford and its factory in Saco last spring, laying off around 180 workers, according to the Portland Press Herald. Young claims the company also did not pay severance to the laid-off workers.

Roark Capital has responded with a motion to dismiss the case, arguing that it, as the parent company, is not accountable for the timing of layoffs, and that it does not have to pay severance because of Wood Structure’s bankruptcy status. Calls to Roark’s Portland-based lawyer were not returned.

Along with workers seeking legal help for some bad fortune, a fair number of top-level managers are also finding themselves in trouble, Young says. “With the downturn in the economy, it’s not just line workers who have been losing their jobs,” Young points out. “Employers have reduced executives as well, and they often want good legal representation.”

Advice and reassurance

Traditionally, business owners have accepted employment-related risks and not bothered to protect themselves. But some employers are rethinking this tactic as employment insurance becomes more common and relatively inexpensive.

Employment practices liability insurance covers areas such as discrimination based on age, sex, race and disability; wrongful termination of employment; harassment; emotional distress; privacy claims; and defamation. The most common employment policy Clark Insurance offers — through MEMIC — has annual premiums between $32 and $35 per employee and a $100,000 coverage limit.

Ross says business insurance needs vary, based on how big the companies are and what types of risks are associated with them. His company typically sells its business clients a blanket policy that includes fire, crime, automobile, general liability (which covers bodily injury and property damage) and workers’ compensation. He recommends at least $1 million of coverage to start. In Maine, “statistically speaking, $1 million to $2 million is adequate,” Ross says.

But Clark Insurance, which earns about $75 million annually, has seen Maine businesses cut back on their policies to “carve out savings,” as Ross puts it, during this recession. They’re lowering their coverage ceiling, dropping collision insurance on their trucks or increasing their deductibles. He repeats a story he has often heard: “I understand this decision might not be a wise one, but I have to make sure my company’s in business next year. That’s more of a risk than not buying insurance.”

One policy companies are not dropping, however, is employment insurance, Ross says. Young, who advocates for workers, has some advice for employers to avoid legal problems with disgruntled employees. He suggests they use aggressive discipline before firing an employee, and diligently documenting all performance issues prior to termination. They should also have a process in place where more than one person, for instance a supervisor or human resource director, evaluates the case.

When a business has to reduce its work force, it should be careful not to single out employees who have characteristics protected by law, such as those related to age, race, disability or gender. “Every employer would be well served to have an employee handbook with policies well understood by employees and managers,” Young counsels.

Rebecca Goldfine, a writer based in Dresden, can be reached at editorial@mainebiz.biz.

Comments