Maine has 4th-highest taxes in US, and ranks No. 1 for property tax burden

File Photo / Courtesy, Pixabay.com

Maine's overall tax burden ranks as the fourth-most expensive in the U.S., according to an analysis by finance website WalletHub.

File Photo / Courtesy, Pixabay.com

Maine's overall tax burden ranks as the fourth-most expensive in the U.S., according to an analysis by finance website WalletHub.

If your tax bills add up to a heavy load, there's good reason.

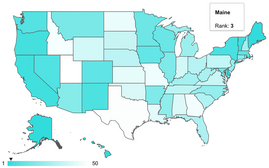

Maine ranks No. 4 among U.S. states with the largest shares of personal income going to the government, according to an analysis released last week. And when it comes to property taxes, Maine is the most expensive state in the country.

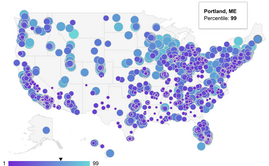

The analysis by finance website WalletHub looked at average property tax, individual income tax, sales tax and excise tax payments as a percentage of income. Using data obtained last month from the nonpartisan, nonprofit Tax Policy Center, WalletHub then compared and ranked the states.

Maine's overall tax burden amounts to 10.74% of personal income. That percentage places the state behind New York, which is No. 1 with a tax burden of 12.02%; Hawaii, No. 2, 11.8%; and Vermont, No. 3, 11.12%.

California ranks No. 5, with 10.4% of its residents' income going to taxes.

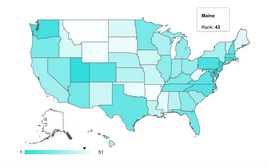

In a separate ranking of property tax burdens, Maine holds the dubious distinction of being No. 1, with homeowners paying an average of 4.86% of their income for their properties. Unlike the other, state-levied taxes compared by WalletHub, property taxes are collected by municipalities.

Maine's property tax percentage edges out the burden in Vermont, which ranks No. 2 at 4.85%.

New Jersey ranks No. 3, at 4.59%, and New Hampshire is No. 4, at 4.51%. But because income, sales and excise taxes are negligible in the Live Free or Die State, it ranks No. 49 in the overall ranking of tax burdens — meaning New Hampshirites pay the second-smallest share of their income, 5.63%, to state and local coffers.

Only residents of Alaska pay a smaller share, 4.93%.

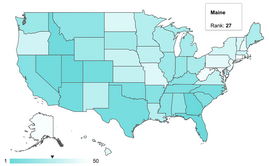

In the ranking of individual income tax burdens, Maine is middle-of-the-pack: No. 21 at 2.59%. The state holds a similar spot, No. 24, for the sales and excise tax burden, 3.29%.

The complete rankings and more information can be found here.

0 Comments