Middle market firms enter foreign markets cautiously, strategically: study

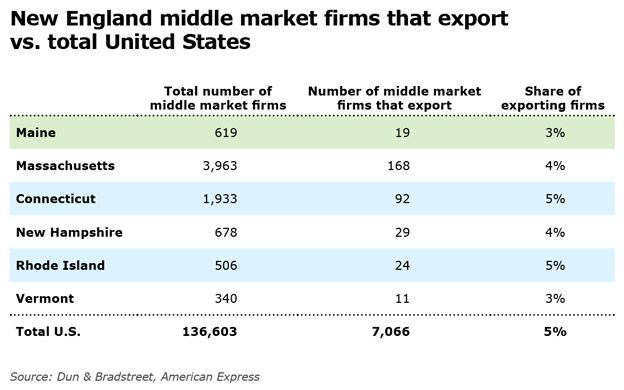

Of the 619 middle market firms in Maine, only 19 are involved in exporting, according to a new study.

That 3% is on par with Vermont, but lower than other New England states, with 4% involved in exporting in Massachusetts and New Hampshire and the 5% in Connecticut and Rhode Island. The U.S. total is 5%, according to a new study called the “Middle Market Power Index: Taking the Global Stage” from American Express and Dun & Bradstreet.

Middle market companies, which generate from $10 million to $1 billion in revenues, tend to export more as their revenues grow and they remain in business longer, according to the report, but they do so strategically and cautiously.

“These are the most dynamic firms in the U.S. economy. They account for almost all of the net new jobs,” report author Julie Weeks told Mainebiz. She said states should look at how to help these companies grow from $1 million to more than $10 million in revenue.

“This report tees us up for a discussion of what can be done,” she said. “A lot of business are probably ready to export, but don’t know how.”

Trade missions

Weeks said states can help both companies and industries like blueberries, lobsters and forestry by getting their products known in other countries that might want to buy them. State-run trade missions are one vehicle to do that, she said.

Gov. Paul LePage will lead a delegation of Maine businesses and educational institutions in a trade mission to Japan and China this October that is organized by the Maine International Trade Center and the U.S. Commercial Service.

“Mid-sized companies are driving job growth domestically, and many could benefit from overseas expansion earlier in their lifecycles,” Susan Sobbott, president of global corporate payments at American Express, said in a prepared statement.

Jeff Stibel, vice chairman of Dun & Bradstreet, added that there is a high likelihood for increased domestic job growth as middle-market companies increase exports.

The report cited U.S. Census figures noting that less than 1% of all U.S. businesses are middle market companies. They account for 29% of all U.S. business revenues and 18% of the firms that export goods and services. Additionally, middle market companies account for only 9% of the value of U.S. exports, lagging larger firms, according to the International Trade Administration.

The report is based on an analysis of all firms in Dun & Bradstreet’s commercial databases of nearly 19 million businesses between 2008 and 2014.

Comments